By Gary A. Johnson – Black Men In America.com

Updated September 12, 2022 (Originally posted on November 5, 2010).

How black people spend their money has been a hotly debated topic in offices, at social events, and in beauty and barber shops across America. This article, “How Do Black People Spend Their Money?,” has been the most read and commented article for 12 years running. Once I learned that this was the most popular and discussed article on the website, I decided to do some research and share this information with others. Over the years I found the process of gathering data and updating the site to be exhausting. It’s a lot to read. I update the site 1-2 times per year. This year I decided to update the article via video in the form of a pictorial slideshow. This way the reader has options. You can watch a 9-minute video which is the equivalent of having a summary video or a “Cliff Notes” version of how Black people spend their money, which includes a new component. I developed, “Gary’s 10 Tips To Prosperity and Emotional Fulfillment,” as part of the 2022 update. Or, you can read and review the exhaustive data and charts/graphs.

Here’s something to think about. Blogger Matthew Corbin lists 5 Reasons Why Black People Are Still Broke.

Here are Corbin’s 5 reasons:

- Black people spend more money than they make

- Black people don’t support black businesses

- Black people don’t save their money

- Black people don’t know how to invest

- Black people aren’t working towards getting out of poverty

Click here to read Corbin’s explanation for each reason.

![]()

There is an article on Mater Meta.com, by Kimberly Anderson-Mutch, about how to build generational wealth. Kimberly outlines the following 5 things that Black families can do to build generational wealth.

- Talk to your children about wealth.

- Buy a home or invest in real estate to create generational wealth.

- Start a business.

- Invest in stocks.

- Establish an estate plan.

![]()

A recently released study by Merrill Lynch explored the ways wealthy Black people in the US spend their money.

What they found is that many well-to-do Black Americans:

- Take care of their family members, invest in their friends’ businesses, and eliminate debt

- Spend their earnings preparing for the future and retirement

The study, entitled “Diverse Viewpoints: Exploring Wealth in the Black/African American Community,” surveyed 455 affluent Black people –– defined as a household with annual income of $125,000 or more. The study’s findings indicate that this group of the US population is actually growing in size and has been since 2015.

The study participants reported working harder than other people in the affluent income category and charter their own career pathways. Affluent Black in the US are five times more likely to financially support their parents than other affluent people and four times more likely to plan to start their own business.

Another great source of information is “How Black/African Americans Pursue—and Define—Success,“ by Diallo Hall, a longtime content strategist and editor whose experience includes serving as Director of Thought Leadership at Fortune and Senior Editor at the Economist Intelligence Unit. In that article you will read about the “Black Rules for Success,“ from other successful Black/African American survey respondents.

![]()

Part 1: The Narrative

Warning: The following is a link to a long article with a lot of details, numbers, observations and opinions covering over two decades of information and data. A large portion of the data was gathered before COVID-19.

Click Here To Read The Entire Updated “How Do Black People Spend Their Money?”

![]() How black people spend their money has been a hotly debated topic not only on this site, but in our office, at social events and in beauty and barber shops across America. This article has been the most read and commented article for 12 years running. Once I learned that this was the most popular and discussed article on the website, I decided to do some research and share this information with others.

How black people spend their money has been a hotly debated topic not only on this site, but in our office, at social events and in beauty and barber shops across America. This article has been the most read and commented article for 12 years running. Once I learned that this was the most popular and discussed article on the website, I decided to do some research and share this information with others.

Click Here To Read The Entire Updated “How Do Black People Spend Their Money?”

Here are the facts:

- 96.1 percent of the 1.2 million households in the top one percent by income were white.

- America’s 100 richest people control more wealth than the entire Black population.

- The 5 largest white landowners own more land than all Black people combined.

- The average Black family would need 228 years to build the wealth of a white family today.

I predict that even after reading this article there are a significant number of Black people who will NOT change their habits and work toward changing their situation. Over time, when things go unchallenged, they seem normal.

I predict that even after reading this article there are a significant number of Black people who will NOT change their habits and work toward changing their situation. Over time, when things go unchallenged, they seem normal.

After centuries of slavery, black people must realize that they need to work toward building generational wealth and learn to invest their money and establish Trust funds for their wealth that can be passed down to future generations.

So what does this really mean? According to The Nielson Company research, Black consumers are speaking directly to brands in unprecedented ways and achieving headline-making results. Through social media, Black consumers have brokered a seat at the table and are demanding that brands and marketers speak to them in ways that resonate culturally and experimentally—if these brands want their business. And with African Americans spending $1.2 trillion annually, brands have a lot to lose.

“Our research shows that Black consumer choices have a ‘cool factor’ that has created a halo effect, influencing not just consumers of color but the mainstream as well,” said Cheryl Grace, Senior Vice President of U.S. Strategic Community Alliances and Consumer Engagement, Nielsen. “These figures show that investment by multinational conglomerates in R&D to develop products and marketing that appeal to diverse consumers is, indeed, paying off handsomely.”

Generally speaking, Black people are still living for the moment with a “to hell with the future” mindset when it comes to money. Too many Black folks tend to only worry about themselves and the money that they have NOW. That way of thinking is crippling and must STOP now!

A common scenario for many Black folks when they get a “huge” chunk of money or their tax refund deposit is to run to the nearest appliance store, high-end mall or car dealer–(we just love those shiny new rims). According to The State of Working America, Black people spend 4 percent more money annually than any other race despite the fact that they are the least represented race and the race that lives in poverty at the highest rate.

If current economic trends continue, the average Black household will need 228 years to accumulate as much wealth as their white counterparts hold today. For the average Latino family, it will take 84 years. Absent significant policy interventions, or a seismic change in the American economy, people of color will never close the gap. (Institute for Policy Studies (IPS) and the Corporation For Economic Development).

Dr. Boyce Watkins shares the secret to money that most rich people understand. Check out this short video.

Dr. Boyce Watkins shares the secret to money that most rich people understand. Check out this short video.

Faced with that reality, I wanted to know: How long does money stay in the various communities?

A dollar circulates:

- 6 hours in the Black community

- 17 days in the White community

- 20 days in the Jewish community

- 30 days in the Asian community

How Did This Happen?

According to Brian Thompson, a contributor to Forbes.com, the term “systemic racism”ruffles a lot of feathers. It often triggers emotional arguments about how people feel about racism and its effects. Yet concrete data over long periods of time shows very clearly that systemic racism exists.

Blacks were historically prevented from building wealth by slavery and Jim Crow Laws (laws that enforced segregation in the south until the Civil Rights act of 1964). Government policies including The Homestead Act, The Chinese Exclusion Act and even the Social Security Act, were often designed to exclude people of color.

Last year, Janelle Jones wrote and article for the Economic Policy Institute titled “The Racial Wealth Gap: How African-Americans Have Been Shortchanged Out Of The Materials To Build Wealth.”

In her article Jones writes, “Wealth is a crucially important measure of economic health. Wealth allows families to transfer income earned in the past to meet spending demands in the future, such as by building up savings to finance a child’s college education. Wealth also provides a buffer of economic security against periods of unemployment, or risk-taking, like starting a business. And wealth is needed to finance a comfortable retirement or provide an inheritance to children. In order to construct wealth, a number of building blocks are required. Steady well-paid employment during one’s working life is important, as it allows for a decent standard of living plus the ability to save. Also, access to well-functioning financial markets that provide a healthy rate of return on savings without undue risks is crucial.”

The gaps in wealth and income between white and black Americans are stark – and haven’t narrowed significantly in 50 years. Credit Suisse and Brandeis University’s Institute on Assets and Social Policy took a closer look at disparities between whites and Blacks. There are some notable differences in how each group approaches their money. Here are a few:

- The wealthiest 5% of Black Americans are slightly less likely to hold financial assets (stocks, bonds, and so on) in their asset mix. Of the financial assets they do invest in, wealthy Blacks are more likely than wealthy whites to invest in safer assets, preferring CDs, savings bonds, and life insurance to higher risk (and higher reward) assets.

- Wealthy Black Americans have more money in real estate holdings than equally wealthy white Americans. The former hold 41% of their non-financial assets in (non-primary residence) real estate, while the figure for the latter is just about 22%. Adding in primary residences brings those numbers to 57% and 34%, respectively. Even after the housing bust, real estate is considered a lower-risk investment.

- Wealthy Black Americans are less likely to hold equity in business assets. Looking at this group’s non-financial assets, 9% are equity in business assets. That figure is 37% for comparably wealthy Whites. The numbers are similarly stark if you look at this as a percentage of total assets: 21% of the wealthy Whites’ total assets are invested in their own businesses, versus just 6% for wealthy Blacks. Because both groups are equally likely to run their own companies – 23% in both cases – the researchers calculate that this means white business owners are investing in their businesses at a rate 7 times higher than Black business owners. In raw dollar terms, it means that Black business owners have about $68k in their businesses, while White business owners have roughly $468k.

“The American Dream remains out of reach for many African-American and Hispanic families,” said Signe-Mary McKernan, co-director of the Opportunity and Ownership Initiative at the Urban Institute. “Families of color, who will be the future majority population of this country, are not on a firm wealth-building path.”

There are three main reasons for the widening gap, according to McKernan. Blacks and Hispanics are less likely to be homeowners or participate in retirement accounts, which build wealth.

Federal government programs aimed at helping Americans buy homes and save for retirement rely on tax breaks and aren’t as available to Blacks and Hispanics, who typically have lower incomes. The bottom 20% of taxpayers, in terms of income, received less than 1% of federal subsidies for home ownership or retirement.

And the earnings gap between the races makes it harder for Blacks and Hispanics to save.

Blacks and Hispanics have also socked away a lot less for retirement in 401(k)s and IRAs. And as these voluntary retirement plans replace pensions, black and Hispanic families are left on shakier ground in what should be their Golden Years.

According to the Curators of Dopeness blog, Black people love to spend money on fashion. Black people get made fun of for not having on the newest Jordan’s or a brand name shirt that’s “in style”. Expensive purses and high heels are a must if you’re ever stepping out. Your hair needs to be flawless at all times. So in order to compensate for lack of confidence or trying the whole “look good, feel good” approach, Black people spend their dollars on looking good. This is some dumb shit that needs to be taken out of this culture because you need to crawl before you walk. First handle the foundation then move up to Jordan Brand products and red bottom shoes..

Check out this 1954 film made to educate white merchants on the spending habits of Black Americans.

The Secret of Selling the Negro Market is a 1954 film financed by Johnson Publishing Company, the publisher of Ebony magazine, to encourage advertisers to promote their products and services in the African-American media. The film showed African-American professionals, housewives and students as participants in the American consumer society, and it emphasized the economic power of this demographic community. The film, which was shot in Kodachrome Color, featured appearances by Sinclair Weeks, Secretary of the U.S. Department of Commerce, and radio announcer Robert Trout. The film had its premiere in July 1954 at the Joseph Schlitz Brewing Company in Milwaukee, Wisconsin, and was shown on a non-theatrical basis.

Watch this film and measure how far we’ve come over the last 60+ years.

White people love to spend money on fashion too. White people love to buy expensive cuff-lings, designer purses, custom suits. Their efforts are more to make sure they look presentable to potential employers. They really don’t care about being made fun off on a day off. That’s why you see white people with sandals on or those really high shorts. White people tend to over do it on the suits but they tend to last them a very long time so they treat them more like investments than clothes.

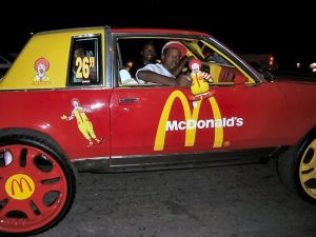

Black people love to spend money on cars. Chrysler 300’s, Dodge Chargers and the new model mustangs are a favorite. Black people also customize cars and don’t really bother with leasing. The car becomes an investment instead of just something to drive.

White people love to spend money on cars too. They lease new cars. Most of the BMW’s and Benz’s that you see are leased. They have a more economic car and then a leased car. They figure it’s just a car and pretty soon I’ll need another one so I’ll just rent the newest one out. Leasing a car is throwing away money that could be used somewhere else. More on cars later in this article.

According to Tingba Muhammad of the Nation of Islam Research Organization (NOIRG) wasteful Black spending is rooted in slavery. Earlier this year, Minister Louis Farrakhan gave speech on the root of black spending behaviors and what black people need to do to correct some of these bad habits. According to the research 42 million Blacks have a spending power amounting to $1.1 trillion, which gives each man, woman, and child an annual spending power of $26,200 dollars. Black spend their money overwhelmingly with white businesses on the following products and services.

- tobacco $3.3 billion

- whiskey, wine, and beer $3 billion

- non-alcoholic $2.8 billion

- leisure time spending $3.1 billion

- toys, games, and pets $3.5 billion

- telephone services $18.6 billion

- gifts $10 billion

- charitable contributions $17.3 billion

- healthcare $23.6 billion

The NOIRG theorizes that when most Blacks emerged from slavery, it frightened the hell out of White people. They knew that money and knowledge in Black hands meant that Blacks would have the power to determine their own destiny apart from White domination and control. The first impulse Blacks had after slavery was to get as far away from whites as possible. They even set up over 60 all-Black towns, in which they managed free of white authority. This trend had to be stopped because with Black independence came the total loss of the labor that whites totally depended on. This created a tremendous amount of oppression. Blacks responded to this oppression by becoming fast spenders.

So, today, many Blacks don’t trust banks, or the courts—Blacks “trust” only that which they can hold in their hands at that very moment. As destructive as that behavior is to Black progress is exactly how profitable that behavior is to whites—who will do anything to keep Blacks on that thinking track.

Hmmmmm! Something to think about.

Another school of thought is shared by blogger Matthew Corbin who wrote 5 Reasons Why Black People Are Still Broke. Here are Corbin’s 5 reasons:

- Black people spend more money than the make

- Black people don’t support black businesses

- Black people don’t save their money

- Black people don’t know how to invest

- Black people aren’t working towards getting out of poverty

Click here to read Corbin’s explanation for each reason.

Donald J. Trump is the disgraced and twice impeached 45th President of the United States. He’s also a HORRIBLE HUMAN BEING. Some say life under a Trump administration wasn’t that bad from a personal economic factor. The thinking back then, was that Donald Trump may do more for Blacks than the last several presidents before him. You be the Judge. Trump says he was great for blacks. Click here to read Donald Trump’s plan for the black community.

The following information comes from the website Racism In America.com. As the largest racial minority in the United States, blacks make up approximately 13.2% of the population, but have a spending power of over one-trillion dollars. So why is it that Blacks have the lowest net worth of all racial classes?

During the Civil War, small banks were established throughout the country to be financially responsible for freed and runaway slaves’ deposits. However, many of those individuals lost their money because the banks “lost” their deposits. And after the Civil War, Blacks had practically no economic resources, access to capital, or entrepreneurial abilities, making it almost impossible to build, accrue, and pass on wealth. But in an attempt to financially assist soldiers and emancipated slaves with transitioning into “freedom,” Congress established the Freedman’s Saving and Trust Company–a financial institution for Blacks. The bank’s objective was to help Blacks “increase their financial strength.”

In the 21st century, many Blacks still don’t possess bank accounts, but instead rely on check cashing services, prepaid debit cards, and cash apps on their cell phones. Living an “all cash” lifestyle allows for more spending and less saving. However, because of the history of being financially defrauded, Blacks have grown to rely on tangible items to justify their finances. In other words, many of them feel more secure being able to see and spend their money instead of trusting a financial institution. Consequently, the more items bought and the more expensive items may be, signifies many Blacks’ interpretation of their net worth and status as opposed to what a savings account may reflect or indicate.

Studies have shown that managing: household expenses and budget, money and debt, investments, and to save for college education are areas that many Blacks aren’t financially literate.

In a 2013 survey, Prudential Research reported that 40% of Blacks considered themselves to be spenders, 51% savers, and only 9% that actually invest. To this date, Blacks only possess 5% of America’s wealth, oppose to Whites that own 61%, Asians 28%, and Hispanics 6%.

Therefore, the real reason why Blacks spend their money and don’t save is because systematic racism prevented them from safely investing in banks, and is currently impacting their ability to own property, land, or businesses, thus leaving them with nothing to pass down to future generations. They were forced into a mindset of poverty–spend now before it’s gone, impacting them generationally. Historical experiences blinded Blacks from recognizing the importance of financial literacy and because of their monetary ignorance, blacks possess the least amount of wealth in America.

I decided to post this article as a clear example of how, in this case, this Black person spends his money. Why do many Black folks feel the need to flaunt their money? In many cases, what’s “money” to them, is “small change” to people in other ethnic groups. I’m not a psychologist, but it is an interesting question to ponder. The previous 1954 video on Black consumers shopping and spending habits may shed some answers.

A recent report from Nielsen, “The Increasingly Affluent, Educated and Diverse,” explores the “untold story” of Black consumers, particularly Black households earning $75,000 or more per year. According to the report, Black people in this segment are growing faster in size and influence than whites in all income groups above $60,000. And as Black incomes increase, their spending surpasses that of the total population in areas such as insurance policies, pensions and retirement savings.

According to Nielsen, “African-American households spend more on basic food ingredients and beverages and tend to value the food preparation process, spending more time than average preparing meals. Other popular buying categories include fragrances, personal health and beauty products, as well as family planning, household care and cleaning products.”

The authors of this report emphasize that as the social and cultural clout of the Black consumer is on the ascendancy, it is incumbent upon advertisers and marketers of consumer brands to develop a long-tern game with the Black community.

As The Atlantic notes, Black buying power is expected to reach $1.2 trillion this year, and $1.4 trillion by 2020, according to the University of Georgia’s Selig Center for Economic Growth.

LetsBuyBlack365 is a national grassroots movement that utilizes the online community and local networking to harness Black buying power, with a goal to create jobs and resources to help Black people.

A few years ago we updated our original post with some information from an article written in September 2013, by Stacy M. Brown posted on the Washington Informer.com website titled, “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars.” In that article, Ms. Brown writes, “If black America counted as an independent country, its wealth would rank 11th in the world. However, African Americans continue to squander their vast spending power, relegating blacks to economic slavery instead of financial freedom, according to several consumer reports detailing the use of cash in the black community.”

We also incorporated 2014 data from the Nielsen Company. If history is any indication of future behavior, this updated article will be hotly debated in 2018. Let’s hope that we can make some progress in this area and close the wealth gap.

Compared to all consumers, Black people as a group spend 30 percent more of their total income — even though we make $20,000 less than the average household. A whopping 87 percent of annual retail spending consists of Black consumers. But where does our money go? Hudson Valley Press Online gives us the scoop via an article from Nielsen’s SVP of public affairs and government relations, Cheryl Pearson-McNeil.

When it comes to shopping at the mall, we make eight more annual trips than any other group pulling in an average of 154 visits. Blacks also patronize dollar stores the most; we make seven more trips than the average group making a total of 20 trips. Lastly, Black Americans made more visits to convenience/gas stores by a small margin: making a total of 15 annual visits.

However, Black trips to grocery stores and warehouse clubs (like Costco) are a bit more scarce. “Less time is spent at grocery stores, with three fewer trips. The exception to grocery store shopping, though, is with Blacks who earn upwards of $100K annually. We also make three fewer trips to warehouse stores and two fewer trips to mass merchandisers than the total market. However, more upper-income Blacks (73%) shop at warehouse clubs than non-Blacks annually,” Pearson-McNeil said.

It could be that the lack of grocery stores and other healthy establishments in Black neighborhoods that contribute to this trend. This is why it’s not at all surprising that Black people frequent McDonald’s and Burger King more than other U.S. household.

What you probably won’t see in our carts are diary products such as milk and yogurt. “[T]his could be because many of us are lactose-intolerant,” Pearson-McNeil adds.

But probably the largest retail disparity between Blacks and other groups rests in the hair and beauty industry. We spend about nine times more on hair care and beauty products in comparison to other demographics. “In fact, 46% of Black households shop at Beauty Supply Stores and have an average annual total spend of $94 on products at these stores,” Pearson-McNeil says.

All the aforementioned figures were pulled from Resilient, Receptive, and Relevant: The African-American Consumer 2013 Report. With African Americans approaching $1 trillion buying power, one must wonder why aren’t marketers paying more attention to Black consumer trends.

** The average Black household contains 2.57 persons. In addition, Black households averaged 1.25 owned vehicles. Most of these households were renters, living in apartments or flats.8 Their dwellings averaged 5.45 rooms (including finished living areas and excluding all baths) and 1.49 bathrooms. Black households’ annual expenditures averaged $36,149, which was 79.8 percent of their average income before taxes. The amount spent on housing ($13,530) consumed the biggest portion of annual expenditures, accounting for more than one-third of the total. This was followed by transportation ($5,946) and food ($5,825). The remaining expenditures made up roughly 30 percent of total spending: personal insurance and pensions, healthcare, entertainment, cash contributions, apparel, and education, in addition to personal care, tobacco, alcohol, reading, and miscellaneous expenditures.

Black Americans are just 13 percent of the U.S. population, and yet, we’re on trend to have a buying power of $1.4 trillion by 2019. A new Nielsen study hints that marketers may want to start developing a better consumer-producer relationship with African Americans if they want to make big bucks.

Titled “The Multicultural Edge: Rising Super Consumers,” the report finds that the Black American sweet spot, in terms of buying power, lies in ethnic hair and beauty aids (surprise, surprise). Black American dollars make up a whopping 85.8 percent of the industry.

**Here are highlights of the spending patterns of low-income versus high-income Black households:

- On average, low-income Black households spent $16,627 in total annual expenditures, compared with high-income Black households who spent approximately $50,000 more.

- Housing was the biggest expenditure for both types of households. For the high-income Black households, housing was 34.2 percent of the total annual expenditure. For the low-income Black households, it was nearly half of the total annual expenditure, at 45.5 percent.

- Food was another large spending category for both types of households. However, it made up only 12.7 percent of total expenditures for high-income Black households, compared with 23.5 percent for low-income Black households.

- Transportation and personal insurance and pensions made up only 11.5 percent and 1.9 percent, respectively, of total expenditure for the low-income Black households. However, for the high-income Black households, these shares were 17.1 percent and 15.0 percent, respectively.

- Cash contributions, such as charitable donations, was a smaller expenditure category in which low and high-income Black households differed. Cash contributions were 2.1 percent for the low-income Black households and 4.6 percent for the high-income Black households.

- Among the remaining expenditure categories, alcoholic beverages, apparel and services, healthcare, entertainment, personal care, reading, education, and miscellaneous expenditures, low-income and high-income Black households had similar expenditure shares.

- Tobacco and smoking supplies was the only expenditure category in which low-income Black households spent both a higher share and a higher actual dollar outlay than their high-income counterparts. For low-income Black households, tobacco and smoking supplies was 1.5 percent ($248) of their total expenditure but made up only 0.3 percent ($218) of total expenditure for high-income Black households.13

Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), http://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

According to Nielsen:

- Blacks are more aggressive consumers of media and they shop more frequently.

- Blacks watch more television (37%), make more shopping trips (eight), purchase more ethnic beauty and grooming products (nine times more), read more financial magazines (28%) and spend more than twice the time at personal hosted websites than any other group.

- Blacks make an average of 156 shopping trips per year, compared with 146 for the total market. Favoring smaller retail outlets, blacks shop more frequently at drug stores, convenience stores, and Dollar stores.

- Beauty supply stores are also popular within the black community, as they typically carry an abundance of ethnic hair and beauty aids reside that cater specifically to the unique needs of black hair textures.

While the numbers indicate that Black folks are an important part of the buying public, companies spend just three-percent (3%) of their advertising budgets marketing to black consumers. According to Cheryl Pearson McNeil, a Vice President at Nielsen, “The Black population is young, hip and highly influential. We are growing 64 percent faster than the general market,” she explains.

However, Noel King, a reporter for NPR’s Marketplace, cautions companies against trying to reach Black consumers without knowing our needs. “If you want to market to those groups, then you should know what particular group buys your stuff,” says King. “Blacks tend to spend more on electronics, utilities, groceries, footwear. They spend a lot less on new cars, alcohol, entertainment, health care, and pensions.”

Despite our collective buying power, statistical data reflects that much of that money is spent outside of the Black community and not with Black-owned businesses.

Compare these numbers about “dollar circulation” reported by the NAACP:

“Currently, a dollar circulates in Asian communities for a month, in Jewish communities approximately 20 days and white communities 17 days. How long does a dollar circulate in the Black community? 6 hours! Black American buying power is at 1.1 Trillion; and yet only 2 cents of every dollar blacks spend in this country goes to black owned businesses.”

If the “dollar circulation” data does not get your attention, consider the following information from an article written by financial expert Ryan Mack:

55 percent of Black Americans are unbanked or under-banked meaning they do not have a bank account or the appropriate bank account (Federal Deposit Corporation Survey)

- “About a quarter of all Hispanic (24 percent) and Black (24 percent) households in 2009 had no assets other than a vehicle, compared with just 6 percent of white households. These percentages are little changed from 2005.” (Pew Research)

- “The median amount Black households reported saving on a monthly basis is $189, compared to $367 among White households…. [This is] the first time in a decade that Black households have reported saving less than $200 per month.” (Ariel Investments 2010 Black Investor Survey)

- “Blacks on the average are six times more likely than Whites to buy a Mercedes, and the average income of a Black who buys a Jaguar is about one-third less than that of a White purchaser of the luxury vehicle.” Earl Graves, Black Enterprise Magazine

- Although Blacks make up 13-percent of the U.S. population, just seven-percent (7%) of small business are owned by Blacks. Access to capital, clientele, and other resources hinder many Black folks from starting business, despite a long history of entrepreneurship.

Highlights from “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars”:

Highlights from “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars”:

- Blacks consistently outpace the total market population in overall growth, smart phone ownership, television viewing and annual shopping trips according to the new study, “Resilient, Receptive and Relevant: The African-American Consumer 2013 Report,” a collaborative effort by the Nielsen Company in New York and the National Newspaper Publishers Association (NNPA), located in Northwest Washington, D.C.

- Black buying power continues to increase, rising from its current $1.1 trillion level to a forecasted $1.3 trillion by 2017.

- Despite the strong economic outlook, Blacks continue to spend most of their money outside of the Black community and, according to Nielsen and NNPA, advertisers have repeatedly slighted the black media, spending only three percent, or $2.24 billion, of the $75 billion spent with all media last year.

- Each year, Blacks spend more than $47 billion on Lincoln automobiles, $3.7 billion on alcohol, $2.5 billion on Toyotas, $2 billion on athletic shoes, and $600 million each year on McDonald’s and other fast foods, according to Target Market News Inc., a Chicago-based marketing research group.

- Blacks also spend wildly to keep up their appearances. The black hair care and cosmetics industry counts as a $9 billion a year business, but while African Americans are spending the most, they are profiting the least, said officials from the Black Owned Beauty Supply Association (BOBSA) in Palo Alto, Calif. Beauty product lines designed for African Americans were once 100 percent owned and operated by blacks, today other ethnic groups control more than 70 percent of the market.

- The current homeownership rate reveals that 73.5 percent of whites own homes while approximately 43.9 percent of Blacks are homeowners, according to the Harvard Joint Center for Housing Studies State of the Nation report for 2013.

- Sixty percent of Blacks have less than $50,000 saved in company retirement plans and only 23 percent have more than $100,000.

In June 2021, the shopping app Miiriya was introduced. shopping app that makes it easy for consumers spend their money exclusively with black-owned businesses and brands. Miiriya provides a platform for black-owned brands and businesses to more easily sell the products and services to consumers. The app lets vendors sign up without transaction or listing fees. The vendors receive 100 percent of their earnings; so when you shop, the money is going straight to these small businesses. Loco pays the vendors credit card and PayPal fees out of pocket as well so they get 100% of their earnings.

The loyalty Blacks have to their church also has proven costly, said officials at Faith Communities Today, a nonprofit based in Hartford, Conn. A 2013 study revealed that Black churches have collected more than $420 billion in tithes and donations nationwide since 1980, an average of $252 million a week.

The loyalty Blacks have to their church also has proven costly, said officials at Faith Communities Today, a nonprofit based in Hartford, Conn. A 2013 study revealed that Black churches have collected more than $420 billion in tithes and donations nationwide since 1980, an average of $252 million a week.

“What people fail to see and understand is that, the church pastors aren’t waiting for miracles to fund their lifestyles, they don’t have to pray, day in and day out, to make their ends meet,” said Northwest resident and author, Byron Woulard. They are getting rich off God, not from God,” he said. Woulard, whose books include, the 2011, “Pawn Queen,” noted that the money spent tithing could buy as many as 93,333 homes valued at $150,000; pay for tuition up to $15,000 a year for 933,333 college students, and feed every homeless American for a year. “It’s the best hustle on the planet. If you don’t get it here on earth, you’ll get it when you die and go to heaven,” Woulard said. “And, it just so happens that not one person in the history of this planet has died, went to heaven, and come back to tell everyone that it’s true.”

Rich Blacks vs. Poor Blacks: Income and Spending Patterns

Data from the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey provide information on annual household spending. Looking at demographic subgroups of the population can provide a deeper understanding of consumption preferences and spending behavior for a particular group. Using data from the CE Survey, the following charts compares and contrasts the spending patterns of low-income Black households to their high-income counterparts.

Data from the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey provide information on annual household spending. Looking at demographic subgroups of the population can provide a deeper understanding of consumption preferences and spending behavior for a particular group. Using data from the CE Survey, the following charts compares and contrasts the spending patterns of low-income Black households to their high-income counterparts.

| Category | All Black

households |

High-income Black

households |

Low-income Black

households |

|---|---|---|---|

| Total average annual expenditures | $36,148.98 | $67,114.17 | $16,627.29 |

| Tobacco and smoking supplies | $239.06 | $218.26 | $248.34 |

| Housing | $13,529.96 | $22,956.40 | $7,569.19 |

| Total food | $5,825.34 | $8,514.41 | $3,910.12 |

| Transportation | $5,945.94 | $11,469.17 | $1,915.35 |

| Personal insurance and pensions | $3,678.55 | $10,043.75 | $315.33 |

| Cash contributions | $1,347.50 | $3,081.13 | $349.31 |

| Healthcare | $1,794.27 | $3,240.21 | $689.57 |

| Apparel and services | $1,000.48 | $1,907.43 | $474.05 |

| Education | $503.25 | $1,354.23 | $190.31 |

| Entertainment | $1,362.24 | $2,485.95 | $635.57 |

| Personal care | $318.71 | $645.89 | $117.30 |

| Reading | $45.22 | $97.22 | $12.86 |

| Alcoholic beverages | $168.09 | $329.53 | $95.40 |

| Miscellaneous expenditure | $390.37 | $770.58 | $104.60 |

The only category which low-income Black households were not outspent was tobacco and smoking supplies. This particular statistic supports the phenomenon that tobacco tends to be a higher share of total expenditures for those with lower income as compared to those with higher income.

Source: Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), https://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

Click Here To Change Your Life and Purchase This DVD “Generation One: The Search For Black Wealth” Now!

Stacy M. Brown’s article posted on the Washington Informer.com website concludes with what is described as an inescapable fact: When black folks make money, they are quick to spend it!

According to Dr. Boyce Watkins, a Scholar in Residence in Entrepreneurship and Innovation at Syracuse University in New York, also known as “the people’s scholar,” “We don’t use money to invest or produce,” said Watkins, 42.” When we get our tax refund, we go straight to the store.”

The 17th annual report on “The Buying Power of Black America” also includes a dollar-by-dollar breakdown of the Black economy.

Copies of “The Buying Power of Black America” can be purchased from Target Market News for $99.00 for the hard copy version and $65.00 for the digital version. For more information call 312-408-1881, or click here to purchase online.

Below is our original article posted in November 2010. Have their been any improvements? You be the judge.

“How Do Black People in America Spend $507 Billion Dollars Annually?”

With $836 Billion in Total Earning Power, only $321 Million Spent on Books while $7.4 Billion Spent on Hair and Personal Care Products and Services

New ‘Buying Power’ report shows black consumers spend as economy improves

New 16th edition shows expenditures rise to $507 billion

(November 1, 2010) African Americans consumers are cautiously increasing their spending in some key product categories, even as they continue to make adjustments in a slowly growing economy. The finding comes from the soon to be issued 16th annual edition of “The Buying Power of Black America” report.

In 2009, Black households spent an estimated $507 billion in 27 product and services categories. That’s an increase of 16.6% over the $435 billion spent in 2008. African-Americans’ total earned income for 2009 is estimated at $836 billion.

The report, which is published annually by Target Market News, also contains data that reflect the economic hardships all consumers are facing. There were significant declines in categories — like food and apparel — that have routinely shown growth in black consumers’ spending from year-to-year.

“These latest shifts in spending habits are vital for marketers to understand,” said Ken Smikle, president of Target Market News and editor of the report, “because they represent both opportunities and challenges in the competition for the billions of dollars spent by African-American households. Expenditures between 2007 and 2008 were statistically flat, so black consumers are now making purchases they have long delayed. At the same time, they re-prioritizing their budgets, and spending more on things that add value to their homes and add to the quality of life.”

The median household income for Blacks dropped by 1.4% in 2009, but because of students going out on their own, and couples that started their lives together, the number of black households grew 4.2%. This increase meant that many household items showed big gains. For example, purchases of appliances rose by 33%, consumer electronics increased 33%, household furnishings climbed 28%, and housewares went up by 37%.

Estimated Expenditures by Black Households – 2009

| Apparel Products and Services | $29.3 billion |

| Appliances | 2.0 billion |

| Beverages (Alcoholic) | 3.0 billion |

| Beverages (Non-Alcoholic) | 2.8 billion |

| Books | 321 million |

| Cars and Trucks – New & Used | 29.1 billion |

| Computers | 3.6 billion |

| Consumer Electronics | 6.1 billion |

| Contributions | 17.3 billion |

| Education | 7.5 billion |

| Entertainment and Leisure | 3.1 billion |

| Food | 65.2 billion |

| Gifts | 9.6 billion |

| Health Care | 23.6 billion |

| Households Furnishings & Equipment | 16.5 billion |

| Housewares | 1.1 billion |

| Housing and Related Charges | 203.8 billion |

| Insurance | 21.3 billion |

| Media | 8.8 billion |

| Miscellaneous | 8.3 billion |

| Personal and Professional Services | 4.1 billion |

| Personal Care Products and Services | 7.4 billion |

| Sports and Recreational Equipment | 995 million |

| Telephone Services | 18.6 billion |

| Tobacco Products | 3.3 billion |

| Toys, Games and Pets | 3.5 billion |

| Travel, Transportation and Lodging | 6.0 billion |

Source: Target Market News,

“The Buying Power of Black American – 2010”

“The Buying Power of Black America” is one of the nation’s most quoted sources of information on African-American consumer spending. It is used by hundreds of Fortune 1000 corporations, leading advertising agencies, major media companies and research firms.

The report is an analysis of consumer expenditure (CE) data compiled annually by the U.S. Department of Commerce. The CE data is compiled from more than 3,000 Black households nationally through dairies and interviews. This information is also used for, among things, computing the Consumer Price Index.

The report provides updated information in five sections:

– Black Income Data

– Purchases in the Top 30 Black Cities

– Expenditure Trends in 26 Product & Services Categories

– The 100-Plus Index of Black vs. White Expenditures

– Demographic Data on the Black Population

According to Forbes magazine, Floyd Mayweather, Jr., made more than $420 million in 2015. He is the highest paid athlete in the world.

Click here to read how Floyd Mayweather, Jr. spends his money.

Portions of this article came from Clutch Mag online.

Here’s a great resource to Black wealth:

Black Wealth 2020, a movement, aims to unite some of the most historic national economic, civic and civil rights organizations with a goal to impact economic outcomes in Black America through the year 2020. The group’s three-pronged strategy is to significantly increase the number of Black homeowners, strong Black-owned businesses and deposits in Black banks.

If you want to educate yourself and others about how to earn and spend your money responsibly, read the book, Black Dollars Matter: Teach Your Dollars How to Make More Sense, by James Clingman. Clingman is a friend to this site. He’s also the founder of the Greater Cincinnati African American Chamber of Commerce and the nation’s most prolific writer on economic empowerment for Black people. He can be reached through his website, www.blackonomics.com. Black Dollars Matter: Teach Your Dollars How to Make More Sense is available through the website www.professionalpublishinghouse.com and Amazon Kindle e-Books.

There is a great organization called World of Money. Founded in 2005, the World of Money is a New York City based 501(c)(3) non-profit organization whose mission is to empower youth through the engaged, local delivery of professional quality financial education. World of Money Founder and CEO, Sabrina Lamb, while attending a financial planning seminar, was inspired by a compelling question. Are children, in the course of their education and upbringing, getting this information on how to manage their financial life? After conducting some research on the subject, Ms. Lamb found that the answer to her question was a resounding “no”. So, after affirming the detrimental effects of this knowledge gap, she set forth to leverage her experience as an entrepreneur and love of working with children to create World of Money. Click here to visit their website and learn more.

There are already over 35 Black owned banks and credit unions in the United States where you can put your money if you find these type of efforts for financial stability and reinvestment in the black community important.

Check out the list below!

- Omega Psi Phi Credit Union – Lawrenceville, Georgia

- Phi Beta Sigma Federal Credit Union – Washington, DC

- One United Bank – Los Angeles,California

- FAMU Federal Credit Union – Tallahassee, Florida

- Credit Union of Atlanta – Atlanta, Georgia

- North Milwaukee State Bank – Milwaukee, Wisconsin

- Seaway Bank – Chicago, Illinois

- The Harbor Bank- Baltimore, Maryland

- Liberty Bank – New Orleans, Louisiana

- United Bank of Philidelphia – Philidelphia, Penn

- Alamerica Bank – Birmingham, Alabama

- Broadway Federal Bank – Los Angeles, California

- Carver State Bank – Savannah, Georgia

- Capital City Bank – Atlanta, Georgia

- Citizens Trust Bank – Atlanta, Georgia

- City National Bank – Newark, New Jersey

- Commonwealth National Bank – Mobile, Alabama

- Industrial Bank – Washington D.C.

- First Tuskegee Bank – Tuskegee, Alabama

- Mechanics & Farmers Bank – Durham, North Carolina

- First Independence Bank – Detroit, Michigan

- First State Bank – Danville, Virginia

- Illinois Service Federal – Chicago, Illinois

- Unity National Bank – Houston, Texas

- Carver Federal Savings Bank – New York, New York

- OneUnited Bank – Miami, Florida

- OneUnited Bank – Boston, Massachusetts

- Tri-State Bank – Memphis, Tennesse

- Citizens Bank – Nashville, Tennessee

- South Carolina Community Bank – Columbia, South Carolina

- Columbia Savings and Loan – Milwaukee, Wisconsin

- Liberty Bank – Baton Rouge, Louisiana

- Liberty Bank – Kansas City, Missouri

- Citizen Trust Bank – Birmingham, Alabama

- Liberty Bank – Chicago, Illinois

- Liberty Bank – Jackson, Mississippi

- Toledo Urban Credit Union – Toledo, Ohio

- Hill District Credit Union – Pittsburgh, Pennsylvania

Are you currently putting money in a Black owned bank? Leave any testimonials you have below!

Photo credit: Couple counting money — Image by © Jose Luis Pelaez Inc/Blend Image/Blend Images/Corbis

** Sources: U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey, http://racisminamerica.org/the-real-reason-why-blacks-spend-their-money-and-dont-save/, CNN, Harvard Business Review, http://curatorsofdopenessblog.tumblr.com/post/72870270050/black-money-white-money

Here’s another related and informative article on black spending.

How Blacks’ Dollars Can Achieve Black Power by William Reed

By William Reed (Posted June 12, 2017)

What is your view of black economic development? Most blacks say they are tired of being slighted and disrespected; yet the majority of us ignore tried and true capitalistic practices that would improve the race’s poor economics. It’s too bad there’s no accumulation of Blacks oriented toward race-based economic empowerment and wealth building. Black people collectively pooling economic resources aren’t the “wishful thinking” that many suggest. The thing we need to recognize is “to do for self‘”. When blacks across the nation make economic growth and development functioning realities collectively practicing means and methods that create jobs and opportunities we will be well on our way to respect and admiration.

It is generally accepted that there’s been progress for black Americans over the last 60 years, yet our overall status is bleak. Too many blacks are focused to rid the country of “white supremacy”. Black politicians and civil rights “leaders” boast that they’ve gotten blacks to 72 percent parity with whites. Truth is whites have “superior” understandings and adaptations of capitalistic procedures. Blacks must “stay awake” to more than partisan politics. Even as our poverty and unemployment rates continue to be higher than whites’, it’s a challenge to get most blacks to see benefits that can accrue if we come together and do more financially for betterment of our communities.

Black buying power is currently $1.3 trillion according to a Nielsen and National Newspaper Publishers Association Report.” With such money and buying power blacks should be utilizing methods and practices that circulate those dollars to Black owned initiatives. Each of us should look at our own actions and practices that keep us from spending substantial portions of money we get with Black-owned businesses. Why do we not deposit in Black-owned banks when doing this enables black financial institutions to fund our projects, goods and services.

To “be equal” in American society, blacks must learn how to build business/investments, hold onto it and pass it on. Some skeptical blacks must see the value in spending their money with our businesses. More blacks must “do more for self” to bring about Black Economic Power.” The prevailing “Black Leadership” has its focus on partisan politics and elusive “’racial harmony”. When will blacks learn that it’s imperative for concerned individuals, groups, organizations, churches and businesses push vital black financial and entrepreneurial cooperation to turn around disproportionate negative conditions that continue in Black communities?

Opportunities exist across the nation for black individuals, their organizations, churches, lodges, frats and entrepreneurs to provide educational programs, workshops and business conferences that teach and show people how and why to do for self. America needs local black leadership demonstrating the power of the black dollar and increase community awareness to recycle dollars within our community, by banking with black-owned banks and buying from black businesses. The solution to the high unemployment and income inequality black communities must come from us. It includes development of black businesses. Local or national groups, be them small or large: the thing is to do for self. If we are serious about tackling unemployment in our community, the quickest fix is to start financially supporting Black-owned businesses. Too many blacks rely on getting whites to remedy their financial problems. Data suggests that if African-Americans invested more money in Black-owned businesses, these businesses would be sources of employment for more of us.

The stand we suggest all blacks adopt is empowering the black community toward taking control and redirecting its wealth and investments. Blacks need more education on consuming and capitalism. More blacks must establish locations where people come and learn economic and financial principles on how to create and sustain Black businesses where they live. Let’s more of us hold power networking conferences for training and networking to bolster and educate Blacks. We all have to engage what we know and have toward operational unity. Enterprising individuals and organizations can sponsor regular business networking socials and gatherings. Do them at Black-owned establishments. Be sure to invite blacks in banking. Those provide opportunities for entrepreneurial blacks to meet one another, exchange ideas and partner.

William Reed is publisher of “Who’s Who in Black Corporate America” and available for projects via Busxchng@his.com

Gary A. Johnson

Gary is the Founder and Publisher of Black Men In America.com, an online news and magazine and several other online sites. Gary is also the author of the book “25 Things That Really Matter In Life,”: A Quick and Comprehensive Guide To Making Your Life Better—Today! and “The Black Father Perspective: What We Want America To Know,” and “In Search of Fatherhood – Transcending Boundaries: International Conversations on Fatherhood.“

In 2019, Gary developed a line of spices under the name of “MasterChef Gary’s Premium Organic Seasoning.”

Scroll down and leave a comment. Tell us what you think.

“When we’re faced with someone else’s success, it makes us think about why we can’t do it instead of how the other person did do it.”

–Author Chris Hogan

“Everyday Millionaires”

There have been three great books on the subject of wealth that I have been blessed to read over the years. The first one: “Think and Grow Rich” by Napoleon Hill. The second: “Think and Grow Rich: A Black Choice” by Dennis Kimbro, Ph.D. The third one is the newcomer “Everyday Millionaires” by Chris Hogan (2019, 250 pages, Ramsey Press/The Lampo Group, LLC).

Hogan, fresh off of his successful previous work “Retire Inspired” decided to tackle the issue of millionaires from the ground or street level. Hogan has been a regular visitor to the famed Fox Business Network, and is a part of the Dave Ramsey family of financial experts.

There is a lot in the work that may scare more than a few readers–in a good way. The book has eleven chapters, and plenty of ‘action steps’ and quotes from those in the book’s research who have ‘done it’…become everyday millionaires through hard work, sticking to their plans, and not giving up.

According to the Hogan’s research, there are more reasons why people can become millionaires than you can shake a stick at. One of the key factors in accumulating wealth rests in the work ethic of the people involved, coupled with solid marriages. Chapter titles include: “You’ve Been Lied To”, “Live on Less Than You Make”, and “Stick To It”. If you’ve ever wanted a book that can give you flat-out reasons why you can become well off financially without a lot of double-talk, THIS is the work for you.

“Everyday Millionaires” by Chris Hogan is available from your favorite bookstore or electronic book seller. It is worth the investment to give a copy to your favorite graduate, during graduation season.

The Things Millionaires DON’T Invest In

Mike Ramey is a Minister, Reviewer and Syndicated Columnist who lives in Indianapolis, Indiana. He brings current and lesser-known titles to light to re-kindle a love for reading and thinking in a sea of modern technology. Feel free to reach him via email at manhoodline@yahoo.com. © 2019 Barnstorm Communications.

Creating and managing a budget can be difficult. Even if you are not a business owner, it is important to organize your finances so that you are able to afford the things you want, and save for your future as well! There are many tools available which can help you with tracking your spending, paying your bills, and assisting you with saving and investing for the future.

Creating and managing a budget can be difficult. Even if you are not a business owner, it is important to organize your finances so that you are able to afford the things you want, and save for your future as well! There are many tools available which can help you with tracking your spending, paying your bills, and assisting you with saving and investing for the future.

One such app is called You Need A Budget (YNAB). This tool has a very intuitive interface, and syncs all of your accounts in one place. Having everything in one spot makes it simple to take an overview of your current financial status, and where you can make improvements. You are also able to sync up with family members so you all have instant access to the budget plan. YNAB costs 84 dollars a year, but on average customers save around 6,000 dollars! You can find out more about how YNAB differs from other budgeting apps here.

Secondly, it is important to make sure you are saving! It is recommended that 20 percent of your income goes towards savings. Chime bank has a helpful automatic savings tool which rounds purchases to the nearest dollar. The roundup is then transferred into your savings account! Chime also has no fees which can save you over 300 dollars a year. The average individual spends around 329 dollars a year on banking fees, so a bank with no hidden fees is another great way to save!

BillGO is another great app for assisting you with your budgeting and finances! BillGO allows you easily view all of your bills on one simple app. Everything is always up to date, and the app is extremely easy to use! They even have option which makes it easy to split bills. This feature is perfect for those who have roommates and may be splitting rent and utilities!

Although creating a budget and managing money can be difficult, there are tools out there to help. Find the app that works best for you, and get your finances back on track!

How to Kickstart a Budget When You are Doomed by Debt by Andy Masaki

What does it take to break free from your debts? What do you think? It’s money right?

Well no!! It’s a budget that can help you to be debt free.

But there’s one big problem, when you are in debts. Your head can’t think right and straight. Too many thoughts, too many debts, utter confusion, and you seem to be doomed by your own money mistakes!

Credit cards seem to be flying all around you like honeybees with their debts like poisonous stings.

Some even have payday loans to take care, while others are busy fighting student loans.

And, don’t tell about those demotivated cutie femmes, who have a mortgage or an auto loan to defeat!!

In such devastating times, the last thing you want to do is keep your debts aside and think about a budget. You might feel the rush to use up your whole paycheck to wash all of your debts!

And that’s where we make the biggest blunder of all….

Remember it’s all about right channeling of your money. If you can’t pull the rope from both ends, one end being income and the other the expense, then the rope will fall.

Here’s how to start a budget when you are in debt:

- First understand how much money you need to clear your debts:

This part is the most crucial and fundamental part for you to formulate a budget.

Your debt amounts will impact your budget to a great extent. If you don’t know how much is about to go out, then you will have no idea how much to store.

Moreover, prioritize your debts. Obviously at the first glance secured debts seem to carry the highest importance, but guess what; it’s the unsecured debts that should be your primary affair!

Secured debts like mortgages or auto loans are long term accounts, that you can’t get rid of whenever you want. They have a fixed set of terms, conditions and time limits. Clearing a loan before the scheduled time can result into a penalty.

So, our concern is definitely unsecured debts or consumer debts. These include credit cards, personal loans, and anything else that’s not backed by a security.

Therefore, calculate all your debts, and get a clear number in your head, that this amount of money is what you need to clear all of your debts.

- Second, list your regular expenses for each month:

Beside debts, we all have other expenses to deal with.

The best thing you can do is list all such expenses one by one as per their priority. Like groceries, utility bills, transportation costs, and all, are your first priority. You can’t live without doing these expenses. They comprise your livelihood.

Notably, these expenses are also flexible, and you can minimize them without much of a hassle. Everything depends on you. Say, you can avoid eating outs, or if needed stop using your car too much, and instead use public transports.

Also try to regulate energy consumption, so that you can save on your utility bills. These small changes that you will make, will save you a lot, which you can in turn use to make extra payments for your debts.

- Allocate fixed amounts to all of your expenses:

Be predictive, responsible, and assign fixed values to all of your expenses. I understand that there’s always something called unexpected expenses in everyone’s life, but your aim should be to minimize them as much as you can. Probably that’s why you should save money for emergency expenses.

Also don’t miss out on the debt payments. Count them in as a part of your expenses.

See cutie, there’s nothing called a fixed budget as such! At least I don’t believe in it. I believe that you are the budget itself!! If you want, and if your decisions are right, then a budget is accomplished.

So, list all the expenses and write down the fixed values beside them. Once you are done, add them up and see whether or not it’s crossing your total income.

If your total expenses are falling under your income limit then your budget has played well!

Practically the aim of controlling your expenses, is to increase your savings. So with whatever amount is left after subtracting your expenses from income, you use it to do extra debt payments or satisfy your savings goal.

Now what if the budgeting itself is not enough, your debt payments are huge and are crossing your overall income?

This is when you feel injustice is being done to you.

But there’s a big time solution. Take help of a debt payoff calculator to see how much you can save on your debt payments, if your income is not consenting with your debt expenses.

You can also get a part time job, or an extra side hustle if you want to increase your income.

No matter whatever you do, you still have to budget your money for your own good! Else nothing can help you in the long run.

With this we come to the end of our discussion. Hope this article was of some help for your debt situation. Don’t forget to comment down below, for further advice and queries!!

Author Bio: Andy Masaki is a financial writer and blogger who specializes on the topic of debt. He frequently writes for the Oak View Law Group and is a active member of several online forums where he shares his tips on how to lead a financially independent life.

Single Woman’s Guide to a Mortgage-worthy Credit Profile

Financial inequality can affect a woman’s credit – here’s how to build it up

Research shows women often face challenges getting approved for home loans, and financial gender inequality may be to blame.

According to a study conducted by the Woodstock Institute, women are more likely than men to be denied mortgage loans. Typical reasons for mortgage denial include a high debt-to-limit ratio or a poor overall credit history.

The gender pay gap is a big reason why many women struggle for total financial independence. While the large-scale fight for gender equality is long and collaborative, there is something you can do to play a part: maintain a high credit score.

A strong credit score is important for financial equality

Your credit score is a tool lenders use to determine your trustworthiness when borrowing money and answer questions about your financial habits. Will you max out your credit line? Will you pay your bills on time? Will you pay off your debt in full? Are you a high-risk or low-risk borrower?

Anytime you try to borrow money – whether on a credit card, small business loan, car loan or mortgage – your credit report and overall score will be reviewed to determine if you’re approved or denied and what your interest rate and credit limit will be.

A high credit score can also protect you (and your kids, if you have any) in case of divorce, a spouse’s death, or events that cause your spouse’s credit score to drop.

Gender roles in society have an effect on women and credit

Women sometimes have thin credit files due to traditional gender roles. An example is a household in which the husband is the family’s financial manager and applies for all credit cards and loans in his own name. In this case, his wife will not have an opportunity to build credit unless she obtains other credit lines in her name. If the husband dies or the couple divorces, the woman may find it difficult to strike out on her own.

A relatively low income – perhaps due to gender bias in a workplace – can also hamper a woman’s ability to build credit.

One of the most important factors lenders use to calculate your credit score is credit utilization. Credit utilization indicates how much of your total available credit you’re using. For example, if you have a card with a $2,000 limit and your balance is $1,000, you have a credit utilization ratio of 50 percent. The lower your utilization, the better your credit score will be.

Credit limits are often based in part on how much you are able to pay each month. So, since women typically make less than men (thanks, gender pay gap), that can result in a low credit limit, and a better chance of credit score damage from high utilization.

Click Here To Read More

An Exclusive Interview with James Hunt the “Celebrity Guru of Atlanta”

Special to Black Men In America.com

Posted April 1, 2018

They call him “The Credit Guru of Atlanta.” James Hunt is a celebrity wealth management expert who helps high profile individuals to manage their wealth, and most of all, get rid of negative marks on their credit that adversely affect their scores. Whenever they are looking to buy an exotic vehicle or purchase a multi-million dollar mansion in Atlanta, they stop by his office first.

Hunt helps many of the nations biggest A-list celebrities, athletes and businessmen and women to address credit issues, eliminate debt, manage their wealth and stay financially healthy. He has recently become the official credit adviser to the NBA, where he will help all 472 players with their credit starting in the 2018-2019 season. Connecting with can mean improving credit scores from 500 to 750+ and money management strategies that lay the foundation for generational wealth.

He is also the author of a book entitled “Debt Free is the New Rich,” which contains information to educate readers on things like how to identify and dispute inaccuracies, and how to remove negative marks from their credit reports. He wants people to recognize that no matter how much money one has, poor credit can have a very detrimental affect on your ability live the life you desire! Many of the rich have many of the sames issues as the everyday American. Credit education must start early, so this is perfect not only for adults or entrepreneurs, but entire families as well.

April is Financial Literacy Month and it is a perfect time to share valuable information about the importance of maintaining good credit.

In the black community, credit education is often not discussed in our homes or in church. However, poor credit is one of the biggest barriers to establishing the elusive generational wealth that we all seek for our families. James will share the work that he does not only with his wealthy clients, but also everyday individuals who are trying to get on track with their finances. He can share insight on how to better understand the information on credit reports, how to identify negative marks and inaccuracies, and also how to dispute them with creditors.

Here’s Our Exclusive Interview with the “Credit Guru of Atlanta,” James Hunt

Black Men In America.com: As the “Credit Guru of Atlanta,” can you describe for us exactly what you do to help your clients?

James Hunt: I handle credit issues and financial issues for all of the absolute top celebrity clients for the NBA, the NFL and the music and entertainment industry. Everybody from Akon to Jermaine Dupri, Bow Wow, Vincent Herbert and people I cannot even mention, you name it, I am their go-to person. I am the person helping them to secure the multi-million dollar home or the exotic car they are looking to purchase. If they need something, I make it happen.

Black Men In America.com: What is a typical day like for you?

James Hunt: I wake up and I am on my feet every morning by 6:00 am. I am in the office by about 6:20 am and then I print all of the emails and prepare all of the paperwork for when the workers arrive at 9am. From that point on, it gets crazy. I receive about 40 to 50 new clients who need help with their credit everyday.

Black Men In America.com: When considering the economic state of Black Americans in this nation, how big of an impact does credit (or lack thereof) have on our community’s inability to generate real wealth?

James Hunt: Your credit is basically your power. We have raised a new generation that simply thinks that cash is king. They find themselves trying to get cars and trying to get homes and they realize their signature means nothing. It is worthless. There are celebrities with tons of money and their signature is almost not worth anything but an autograph. Credit is really what makes the world go ‘round as far as finances are concerned. My opinion is, every door you need to get into financially is going to have something to do, if not completely to do, with your credit.

Black Men In America.com: What are some of the biggest mistakes people make regarding their credit, that they may not know they are making?

James Hunt: Neglecting to make on time payments and the assumptions that if you pay late there will be no serious repercussions, and not knowing that negative payments will show up on your credit report as a negative account for 7 years from the date of the late payment. There should never be a late payment in your credit report, ever.

Black Men In America.com: If you have a low credit score, what are some of the most important steps one should take to repair their credit?

James Hunt: This is not an easy question. If the score is only low as a result of utilization and you blowing your credit cards up, the only way to address that is to develop a plan to start putting money aside to start paying them down. If your score is low because of negative accounts, you must do everything you can to challenge those negative accounts and aggressively go after them. Make contract agreements with the creditors or collection agencies to see if you can get them to take a percentage of the debt with the agreement to remove it out of your credit report. If you see anything is inaccurate, then remove the entire trade-line by disputing those accounts and having them completely removed from your credit report.

Black Men In America.com: Word on the street is that you are currently in negotiations with the NBA to provide credit education to all 472 players in the league. Why is it important that athletes, many of whom are black, receive this help?

Photo: (From left to right): Rapper Rich Quan, James Hunt and NBA star Michael Beasley

James Hunt: I think that the tragedy with colleges across the nation is that while they prepare, or give the appearances that they are preparing you for the real world, some of the most important things in the real world they don’t prepare you for. These athletes come out of college just like any other student usually burdened with debt and even though a new NBA or NFL player has the potential to make a tremendous amount of money, they find themselves dealing with many of the same issues that regular people deal with. For instance, if you had a collection account or a student credit card that you had blown up and had late payments that went to charge-off status, all of that is going to stop you from being able to purchase that dream house or those dream cars that you wanted if you are going to finance it. Without the proper education, the cycle continues. Absent of paying a full amount in cash, if you are going to get the credit that you need, it doesn’t matter what your financial status is, you play by the same rules as everybody else. You have to make on-time payments and you have to keep your credit score up.

Black Men In America.com: Tell us about your book “Debt Free is the New Rich.” What is the meaning behind the name and what kind of information can people expect to find when reading it?

James Hunt: The name came about because I was in a heated debate with a celebrity client who was telling me that he really didn’t need credit because he was rich. I thought about it, and in the process, my argument to this particular music artist was that debt free is really the new rich, which turned out to be the title of the new book. It is a genuine argument. The person who has no debt and is debt free is the person who is really rich. So, it matters not necessarily what is in your bank account, or how many digits are in your bank account that makes you really rich, but what your debt is that determines whether you are rich or not.

Black Men In America.com: What do you say to the person who says they don’t know where to start to improve their credit?

James Hunt: We live in a society where all of the information is readily available at your fingertips with Google and the other search engines. If you really want to know what you can do and what your rights are as a consumer, you have the ability to know. The idea of not knowing is no longer an acceptable excuse. Educate yourself and get your credit in order so you can live how you desire to live.

Black Men In America.com: How can people get a hold of your book, “Debt Free is the New Rich”?

James Hunt: It will soon be available on my website, but for now, people can contact me directly at jameswhunt1963@gmail.com. You can also follow James Hunt on Instagram @thecreditguruofatlanta and @whoisjameshunt.

April is Financial Literacy Month. Here are some tips James Hunt is sharing for people to increase their credit scores and ultimately change the trajectory of their lives. Here are a few:

- Be proactive – Know what is in your credit scores. You can access your credit report once every 12 months for FREE from all three Credit Bureaus: Equifax, Experian and Transunion.

- Check your report for any discrepancies.

- Dispute any and all inaccurate information on your account immediately.

- Document Everything! Keep records and follow up with creditors. If they say they are going to remove something, make sure they do it and you have proof of their commitment.

Publisher’s Note: As a matter of policy when we post interviews about products and services we urge our site visitors to educate themselves and not be a “low information” consumer. Do your research and talk to people in an effort to educate and protect yourself.

Special thanks to Ivan Thomas for arranging this interview.

How the Average American Spends Their Lifetime Earnings

Have you wondered how much you will make in your lifetime and whether you will make enough to sustain your expenses after retirement?

This article will talk about how much money you can expect to make and how much of your income you will spend in your lifetime.

- Breakdown of Average American Salary by Age

- Education Matters

- Not All Degrees Are Created Equal