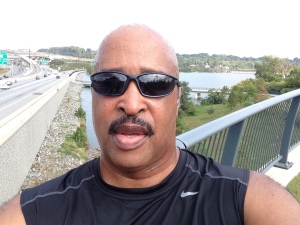

After years of personal frustration, one-day Gary Johnson conducted an honest self-assessment of his abilities and decided that he was not living up to his potential. He learned how to develop goals and achieve personal success and fulfillment. He joined an Intelligence Community agency at 19 years old and resigned as a senior manager in the Training & Education office. Gary shocked his colleagues by announcing that he was leaving his “good government job” to spend more time with his children.

With the support of his family, Gary exercised his faith and his courage to execute his dream of being a self-employed businessman who would get involved in his community. That’s what he wanted to do with his life. That was in 1995.

Gary had a plan. He was determined to define his own success. He knew he needed a college education. He worked full time and went to night school for over 11 years. He has a degree in Secondary Education, and another degree in Organizational Behavior. He also was accepted into and attended the Antioch University School of Law, where he studied in the Masters of Legal Science program.

Gary learned how to set goals. He also learned how to network, be mentored and be strategic within an organization. In the end, Gary used his personal power to define his success. The same personal power that we all have, but don’t always know how to use.

Today Gary Johnson has inspired and entertained thousands of people with his powerful story telling ability. At the age of 23, Gary was assigned to The White House where he worked for three Assistants to the President for National Security Affairs. Throughout his 30+-year career, Gary worked as a Mail Clerk, Intelligence Watch Analyst, Special Agent/Investigator, Supervisor, Manager and Training Consultant, Senior Business Strategist and Talent Acquisition Expert for the government, the military and many Fortune 500 companies in every industry. Some of those companies include: Citibank, Bank of America, Wells Fargo, J.P. Morgan, Chase, John Deere, United Airlines, Southwest Airlines, Abbott Labs, American Honda Motor Company, The World Bank, Astra/Zeneca, the American Petroleum Institute and many more.

Gary Johnson is the Founder and Publisher of multiple online platforms, including BlackMenInAmerica.com, BlackBoatingandYachting.com, and others. He is also the author of 25 Things That Really Matter in Life: A Quick and Comprehensive Guide to Making Your Life Better—Today! and a contributing author to The Black Father Perspective: What We Want America to Know and In Search of Fatherhood – Transcending Boundaries: International Conversations on Fatherhood.

Gary launched MasterChef Gary’s Premium Organic Seasoning in 2019 and has since expanded his ventures to include Calculations Talk Show, The Thought Brothers, and a podcast and website supporting the Justice for Black Farmers movement. In 2023, he founded Gary Johnson Media, LLC to focus on public relations and social media strategy.

Most recently, he created Gary’s Weight Loss Journey, a motivational site chronicling his personal path to better health.

Learn more about Gary’s work at Gary Johnson Media, LLC.

Nah Bruh–This Ain’t It: Noose Necktie Designer “Apologizes”

September 2, 2021

Apparently, some misguided young Black man from South Africa named Daniel Ngobeni is selling “Daniel’s Rope Ties,” which are described as “African rope wear” for “all genders.” Really? It has also been reported that Ngobeni refers to his product as a “rope of honor.” Are you getting me? There is ALWAYS someone who will sell his soul and set his community back for a dollar.

WTF is “African Rope Wear?” Only with Black people it seems, is this kind of crap acceptable and in some cases encouraged. This is what years of racism does to the psyche of a culture. No other culture would accept this. There would be no product for sale. When was the last time you purchased Holocaust SWAG? Black people will buy anything. There is a certain segment of our population that simply knows no boundaries when it comes to buying shit. Don’t believe me? Click here and read how black people spend their money.

Anyone who purchases any one of these products is simply uneducated, has no knowledge of American or Black history, or is a jackass. That’s probably the kindest thing I can say about someone who would buy this “product.” I will leave it at that.

For the record, Daniel Ngobeni acknowledged that many people online have been critical of his product. (No shit)! In what crafted as an apology, Ngobeni explained that he was trying to do something that’s never been done in fashion. He further explained, “I asked myself, ‘Can the same rope that has been used to take someone’s life, can it be used for a better purpose?'” he explained. “Can the same object be used in a different way?’ So I thought of the tie.” You just have to shake your head when you hear shit like that.

“I would like to extend my apologies to my Black brothers and sisters in America,” he continued. “I didn’t mean to hurt anyone. I am sorry to people who see this as something bad.” Despite this so-called apology, Ngobeni says, he still intends to sell the ties. Of course he will continue to sell the ties. There is a market and he has every right to sell them. If people did not buy them, he would design or sell something else. Again, black folks, it seems, will buy anything.

That my friend should tell you everything that you need to know about Daniel Ngobeni and the people who purchase his product. He’s probably a nice young man who is capitalizing on an opportunity to make a dollar off of some gullible Black Americans. There’s nothing illegal about what he’s doing. I will wrap up my commentary by saying, “All money ain’t good money, and some of it (the money), is not worth the effort). I might suggest that brother Ngobeni look up the word “integrity.”

I am speaking for myself when I write: “Apology NOT accepted!”

Gary A. Johnson is the Founder of Gary A. Johnson Company & Associates, LLC, a management training and consulting company. The company manages a variety of Internet and digital media enterprises including Black Men In America.com, a top-ranked website in the category of “African American Online Communities. Gary is also the author of the book “25 Things That Really Matter In Life,”: A Quick and Comprehensive Guide To Making Your Life Better—Today!, and a contributing author to two other books, “The Black Father Perspective: What We Want America To Know,” and “In Search of Fatherhood – Transcending Boundaries: International Conversations on Fatherhood.“ In addition, the company manages Black Boating and Yachting.com, a site that highlights the adventures of boating enthusiasts. In 2019, Gary developed a line of spices under the name of “MasterChef Gary’s Premium Organic Seasoning.” In his spare time, Gary uses his platform to help the Black Farmers of America. He built the website Justice for Black Farmers to help educate others about the plight of the Black Farmer and their fight against the U.S. Department of Agriculture.

Joe Biden Should Not Debate Donald Trump

August 2, 2020

By Gary A. Johnson, Founder & Publisher – Black Men In America.com

Not that anyone asked for my opinion (that’s never stopped me before), but Joe Biden should not debate Donald Trump. There is NOTHING to gain. Trump has shown us who he is. Debates have rules. Rules mean nothing to Donald Trump. All Trump will do is lie, exaggerate, deflect, insult, and hide from the facts. Unless there is a real-time fact checker onsite, there is nothing to gain.

Trump is not an intellectual. He will look for ways to insult you and drag you down. Trump has proven that he cannot be out “guttered.” He will go as low as he has to to win as he defines winning.

Donald Trump is totally unpredictable. Well, let me correct that. The one thing that we can count on when it comes to Donald Trump is that tomorrow will be worse than today.

Biden is ahead in most, if not all the major polls, including some FOX News polls. Trump is flailing with his total mismanagement of the COVID-19 pandemic and his bad trade deals with other countries.

COVID-19 has forced “Uncle Joe” to spend a lot of his time in his basement. When he does make a public appearance, he wears a mask, practices social distancing and shows that he is not anti-science.

Most people are not a horrible as Donald Trump, and I mean horrible as a human being. If you engage him in a debate here is the likely scenario: Trump will tell so many lies that you will feel compelled to correct him. You have a limited time during debates. If you spend your time trying to correct his lies, you can’t get your message out and the thing most people will remember, is what Trump said, which over time will be a mountain of lies.

Trump has proven that he does not care about public opinion. He is openly corrupt, petulant, lacks empathy and has no intellectual curiosity. According to the Fact Checker team at the Washington Post, between Trump’s inauguration on Jan. 20, 2017, he made over 20,000 false or misleading claims.

Trump will also use every racist dog whistle he can get his hands on. Trump will probably evoke Barack Obama’s name with a boatload of lies. President Obama lives “rent fee” in Trump’s head. Donald Trump is obsessed with President Obama. Trump cannot stand to be upstaged. Look at how he whined at a recent press conference because Dr. Anthony Fauci has a higher approval rating.

The ultimate weapon for Joe Biden would be to NOT debate Donald Trump and spare the country a sideshow of the best of “the Donald’s” racist and sexist rhetoric and embarrassing Presidential behavior.

Trump needs the debate. “Uncle Joe” is riding high in the polls right now. There is no need to take this risk. Trump is damaging his campaign every day. The danger with Trump is that he knows he is losing. He is trying everything just short of “burning the entire house down.”

Just say “No” Joe.

How Do Black People Spend Their Money? (The Racial Wealth Gap) by Gary A. Johnson

By Gary A. Johnson – Publisher, Black Men In America.com

Updated August 3, 2020 (Originally posted on November 5, 2010).

How black people spend their money has been a hotly debated topic not only on this site, but in our office, at social events and in beauty and barber shops across America. This article has been the most read and commented article for 10 years running. Once I learned that this was the most popular and discussed article on the website, I decided to do some research and share this information with others.

The Nielsen Company issued a report last year entitled, “It’s in the Bag: Black Consumers’ Path to Purchase,” found that spending by Black consumers is especially influenced by advertising.

The report found, that Black folks love to spend their money on beauty and grooming products, shelling out about $573.6 million on an annual basis for “personal soap and bath needs.” That was about 19 percent higher than any other demographic. Black consumers also like to spend their money at high-end department stores, with 63 percent of Black folks saying in a survey they like to buy from Saks Fifth Avenue, 45 percent at Neiman Marcus (45%) and 24 percent at Bloomingdales.

“More than half (52%) of African Americans find in-store shopping relaxing, compared with 26% of the total population” and “55% of Black consumers say they enjoy wandering the store looking for new, interesting products,” the Nielsen report found. “When shopping, African Americans are more influenced than the total population by store staff (34% more likely), in-store advertising (28% more likely) and merchandising (27% more likely).”

Black folks accounted for almost 90% of the overall spending in the beauty supply industry. Black consumers are also influenced by celebrities. If a celebrity designs a product, Blacks are more likely to buy it.

This article explores all of the above and more.

Let’s start by watching this short video that explains the “racial wealth gap” in America.

Here are the facts:

- 96.1 percent of the 1.2 million households in the top one percent by income were white.

- America’s 100 richest people control more wealth than the entire Black population.

- The 5 largest white landowners own more land than all Black people combined.

- The average Black family would need 228 years to build the wealth of a white family today.

I predict that even after reading this article there a significant number of Black people who will NOT change their habits and work toward changing their situation. Over time, when things go unchallenged, they seem normal. After centuries of slavery, black people must realize that they need to work toward building generational wealth and learn to invest their money and establish Trust funds for their wealth that can be passed down to future generations.

So what does this really mean? According to The Nielson Company research, Black consumers are speaking directly to brands in unprecedented ways and achieving headline-making results. Through social media, Black consumers have brokered a seat at the table and are demanding that brands and marketers speak to them in ways that resonate culturally and experientially—if these brands want their business. And with African Americans spending $1.2 trillion annually, brands have a lot to lose.

“Our research shows that Black consumer choices have a ‘cool factor’ that has created a halo effect, influencing not just consumers of color but the mainstream as well,” said Cheryl Grace, Senior Vice President of U.S. Strategic Community Alliances and Consumer Engagement, Nielsen. “These figures show that investment by multinational conglomerates in R&D to develop products and marketing that appeal to diverse consumers is, indeed, paying off handsomely.”

Generally speaking, Black people are still living for the moment with a “to hell with the future” mindset when it comes to money. Too many Black folks tend to only worry about themselves and the money that they have NOW. That way of thinking is crippling and must STOP now!

A common scenario for many Black folks when they get a “huge” chunk of money or their tax refund deposit is to run to the nearest appliance store, high-end mall or car dealer–(we just love those shiny new rims). According to The State of Working America, Black people spend 4 percent more money annually than any other race despite the fact that they are the least represented race and the race that lives in poverty at the highest rate.

If current economic trends continue, the average Black household will need 228 years to accumulate as much wealth as their white counterparts hold today. For the average Latino family, it will take 84 years. Absent significant policy interventions, or a seismic change in the American economy, people of color will never close the gap. (Institute for Policy Studies (IPS) and the Corporation For Economic Development).

Dr. Boyce Watkins shares the secret to money that most rich people understand. Check out this short video.

Faced with that reality, I wanted to know: How long does money stay in the various communities?

A dollar circulates:

- 6 hours in the Black community

- 17 days in the White community

- 20 days in the Jewish community

- 30 days in the Asian community

How Did This Happen?

According to Brian Thompson, a contributor to Forbes.com, the term “systemic racism”ruffles a lot of feathers. It often triggers emotional arguments about how people feel about racism and its effects. Yet concrete data over long periods of time shows very clearly that systemic racism exists.

Blacks were historically prevented from building wealth by slavery and Jim Crow Laws (laws that enforced segregation in the south until the Civil Rights act of 1964). Government policies including The Homestead Act, The Chinese Exclusion Act and even the Social Security Act, were often designed to exclude people of color.

Last year, Janelle Jones wrote and article for the Economic Policy Institute titled “The Racial Wealth Gap: How African-Americans Have Been Shortchanged Out Of The Materials To Build Wealth.”

In her article Jones writes, “Wealth is a crucially important measure of economic health. Wealth allows families to transfer income earned in the past to meet spending demands in the future, such as by building up savings to finance a child’s college education. Wealth also provides a buffer of economic security against periods of unemployment, or risk-taking, like starting a business. And wealth is needed to finance a comfortable retirement or provide an inheritance to children. In order to construct wealth, a number of building blocks are required. Steady well-paid employment during one’s working life is important, as it allows for a decent standard of living plus the ability to save. Also, access to well-functioning financial markets that provide a healthy rate of return on savings without undue risks is crucial.”

The gaps in wealth and income between white and black Americans are stark – and haven’t narrowed significantly in 50 years. Credit Suisse and Brandeis University’s Institute on Assets and Social Policy took a closer look at disparities between whites and Blacks. There are some notable differences in how each group approaches their money. Here are a few:

- The wealthiest 5% of Black Americans are slightly less likely to hold financial assets (stocks, bonds, and so on) in their asset mix. Of the financial assets they do invest in, wealthy Blacks are more likely than wealthy whites to invest in safer assets, preferring CDs, savings bonds, and life insurance to higher risk (and higher reward) assets.

- Wealthy Black Americans have more money in real estate holdings than equally wealthy white Americans. The former hold 41% of their non-financial assets in (non-primary residence) real estate, while the figure for the latter is just about 22%. Adding in primary residences brings those numbers to 57% and 34%, respectively. Even after the housing bust, real estate is considered a lower-risk investment.

- Wealthy Black Americans are less likely to hold equity in business assets. Looking at this group’s non-financial assets, 9% are equity in business assets. That figure is 37% for comparably wealthy Whites. The numbers are similarly stark if you look at this as a percentage of total assets: 21% of the wealthy Whites’ total assets are invested in their own businesses, versus just 6% for wealthy Blacks. Because both groups are equally likely to run their own companies – 23% in both cases – the researchers calculate that this means white business owners are investing in their businesses at a rate 7 times higher than Black business owners. In raw dollar terms, it means that Black business owners have about $68k in their businesses, while White business owners have roughly $468k.

“The American Dream remains out of reach for many African-American and Hispanic families,” said Signe-Mary McKernan, co-director of the Opportunity and Ownership Initiative at the Urban Institute. “Families of color, who will be the future majority population of this country, are not on a firm wealth-building path.”

There are three main reasons for the widening gap, according to McKernan. Blacks and Hispanics are less likely to be homeowners or participate in retirement accounts, which build wealth.

Federal government programs aimed at helping Americans buy homes and save for retirement rely on tax breaks and aren’t as available to Blacks and Hispanics, who typically have lower incomes. The bottom 20% of taxpayers, in terms of income, received less than 1% of federal subsidies for home ownership or retirement.

And the earnings gap between the races makes it harder for Blacks and Hispanics to save.

Blacks and Hispanics have also socked away a lot less for retirement in 401(k)s and IRAs. And as these voluntary retirement plans replace pensions, black and Hispanic families are left on shakier ground in what should be their Golden Years.

According to the Curators of Dopeness blog, Black people love to spend money on fashion. Black people get made fun of for not having on the newest Jordan’s or a brand name shirt that’s “in style”. Expensive purses and high heels are a must if you’re ever stepping out. Your hair needs to be flawless at all times. So in order to compensate for lack of confidence or trying the whole “look good, feel good” approach, Black people spend their dollars on looking good. This is some dumb shit that needs to be taken out of this culture because you need to crawl before you walk. First handle the foundation then move up to Jordan Brand products and red bottom shoes..

Check out this 1954 film made to educate white merchants on the spending habits of Black Americans.

The Secret of Selling the Negro Market is a 1954 film financed by Johnson Publishing Company, the publisher of Ebony magazine, to encourage advertisers to promote their products and services in the African-American media. The film showed African-American professionals, housewives and students as participants in the American consumer society, and it emphasized the economic power of this demographic community. The film, which was shot in Kodachrome Color, featured appearances by Sinclair Weeks, Secretary of the U.S. Department of Commerce, and radio announcer Robert Trout. The film had its premiere in July 1954 at the Joseph Schlitz Brewing Company in Milwaukee, Wisconsin, and was shown on a non-theatrical basis.

Watch this film and measure how far we’ve come over the last 60+ years.

White people love to spend money on fashion too. White people love to buy expensive cufflings, designer purses, custom suits. Their efforts are more to make sure they look presentable to potential employers. They really don’t care about being made fun off on a day off. That’s why you see white people with sandals on or those really high shorts. White people tend to over do it on the suits but they tend to last them a very long time so they treat them more like investments than clothes.

Black people love to spend money on cars. Chrysler 300’s, Dodge Chargers and the new model mustangs are a favorite. Black people also customize cars and don’t really bother with leasing. The car becomes an investment instead of just something to drive.

White people love to spend money on cars too. They lease new cars. Most of the BMW’s and Benz’s that you see are leased. They have a more economic car and then a leased car. They figure it’s just a car and pretty soon I’ll need another one so I’ll just rent the newest one out. Leasing a car is throwing away money that could be used somewhere else. More on cars later in this article.

According to Tingba Muhammad of the Nation of Islam Research Organization (NOIRG) wasteful Black spending is rooted in slavery. Earlier this year, Minister Louis Farrakhan gave speech on the root of black spending behaviors and what black people need to do to correct some of these bad habits. According to the research 42 million Blacks have a spending power amounting to $1.1 trillion, which gives each man, woman, and child an annual spending power of $26,200 dollars. Black spend their money overwhelmingly with white businesses on the following products and services.

- tobacco $3.3 billion

- whiskey, wine, and beer $3 billion

- non-alcoholic $2.8 billion

- leisure time spending $3.1 billion

- toys, games, and pets $3.5 billion

- telephone services $18.6 billion

- gifts $10 billion

- charitable contributions $17.3 billion

- healthcare $23.6 billion

The NOIRG theorizes that when most Blacks emerged from slavery, it frightened the hell out of White people. They knew that money and knowledge in Black hands meant that Blacks would have the power to determine their own destiny apart from White domination and control. The first impulse Blacks had after slavery was to get as far away from whites as possible. They even set up over 60 all-Black towns, in which they managed free of white authority. This trend had to be stopped because with Black independence came the total loss of the labor that whites totally depended on. This created a tremendous amount of oppression. Blacks responded to this oppression by becoming fast spenders.

So, today, many Blacks don’t trust banks, or the courts—Blacks “trust” only that which they can hold in their hands at that very moment. As destructive as that behavior is to Black progress is exactly how profitable that behavior is to whites—who will do anything to keep Blacks on that thinking track.

Hmmmmm! Something to think about.

Another school of thought is shared by blogger Matthew Corbin who wrote 5 Reasons Why Black People Are Still Broke. Here are Corbin’s 5 reasons:

- Black people spend more money than the make

- Black people don’t support black businesses

- Black people don’t save their money

- Black people don’t know how to invest

- Black people aren’t working towards getting out of poverty

Click here to read Corbin’s explanation for each reason.

Donald J. Trump is the 45th President of the United States. Some say life under a Trump administration won’t be that bad, in fact, it Donald Trump may do more for Blacks than the last several presidents. Time will tell. Trump says he will be great for blacks. Click here to read Donald Trump’s plan for the black community.

The following information comes from the website Racism In America.com. As the largest racial minority in the United States, blacks make up approximately 13.2% of the population, but have a spending power of over one-trillion dollars. So why is it that Blacks have the lowest net worth of all racial classes?

During the Civil War, small banks were established throughout the country to be financially responsible for freed and runaway slaves’ deposits. However, many of those individuals lost their money because the banks “lost” their deposits. And after the Civil War, Blacks had practically no economic resources, access to capital, or entrepreneurial abilities, making it almost impossible to build, accrue, and pass on wealth. But in an attempt to financially assist soldiers and emancipated slaves with transitioning into “freedom,” Congress established the Freedman’s Saving and Trust Company–a financial institution for Blacks. The bank’s objective was to help Blacks “increase their financial strength.”

In the 21st century, many Blacks still don’t possess bank accounts, but instead rely on check cashing services, prepaid debit cards, and cash apps on their cell phones. Living an “all cash” lifestyle allows for more spending and less saving. However, because of the history of being financially defrauded, Blacks have grown to rely on tangible items to justify their finances. In other words, many of them feel more secure being able to see and spend their money instead of trusting a financial institution. Consequently, the more items bought and the more expensive items may be, signifies many Blacks’ interpretation of their net worth and status as opposed to what a savings account may reflect or indicate.

Studies have shown that managing: household expenses and budget, money and debt, investments, and to save for college education are areas that many Blacks aren’t financially literate.

In a 2013 survey, Prudential Research reported that 40% of Blacks considered themselves to be spenders, 51% savers, and only 9% that actually invest. To this date, Blacks only possess 5% of America’s wealth, oppose to Whites that own 61%, Asians 28%, and Hispanics 6%.

Therefore, the real reason why Blacks spend their money and don’t save is because systematic racism prevented them from safely investing in banks, and is currently impacting their ability to own property, land, or businesses, thus leaving them with nothing to pass down to future generations. They were forced into a mindset of poverty–spend now before it’s gone, impacting them generationally. Historical experiences blinded Blacks from recognizing the importance of financial literacy and because of their monetary ignorance, blacks possess the least amount of wealth in America.

I decided to post this article as a clear example of how, in this case, this Black person spends his money. Why do many Black folks feel the need to flaunt their money? In many cases, what’s “money” to them, is “small change” to people in other ethnic groups. I’m not a psychologist, but it is an interesting question to ponder. The previous 1954 video on Black consumers shopping and spending habits may shed some answers.

A recent report from Nielsen, “The Increasingly Affluent, Educated and Diverse,” explores the “untold story” of Black consumers, particularly Black households earning $75,000 or more per year. According to the report, Black people in this segment are growing faster in size and influence than whites in all income groups above $60,000. And as Black incomes increase, their spending surpasses that of the total population in areas such as insurance policies, pensions and retirement savings.

According to Nielsen, “African-American households spend more on basic food ingredients and beverages and tend to value the food preparation process, spending more time than average preparing meals. Other popular buying categories include fragrances, personal health and beauty products, as well as family planning, household care and cleaning products.”

The authors of this report emphasize that as the social and cultural clout of the Black consumer is on the ascendancy, it is incumbent upon advertisers and marketers of consumer brands to develop a long-tern game with the Black community.

As TheAtlanticnotes, Black buying power is expected to reach $1.2 trillion this year, and $1.4 trillion by 2020, according to the University of Georgia’s Selig Center for Economic Growth.

LetsBuyBlack365 is a national grassroots movement that utilizes the online community and local networking to harness Black buying power, with a goal to create jobs and resources to help Black people.

A few years ago we updated our original post with some information from an article written in September 2013, by Stacy M. Brown posted on the Washington Informer.com website titled, “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars.” In that article, Ms. Brown writes, “If black America counted as an independent country, its wealth would rank 11th in the world. However, African Americans continue to squander their vast spending power, relegating blacks to economic slavery instead of financial freedom, according to several consumer reports detailing the use of cash in the black community.”

We also incorporated 2014 data from the Nielsen Company. If history is any indication of future behavior, this updated article will be hotly debated in 2018. Let’s hope that we can make some progress in this area and close the wealth gap.

Compared to all consumers, Black people as a group spend 30 percent more of their total income — even though we make $20,000 less than the average household. A whopping 87 percent of annual retail spending consists of Black consumers. But where does our money go? Hudson Valley Press Onlinegives us the scoop via an article from Nielsen’s SVP of public affairs and government relations, Cheryl Pearson-McNeil.

When it comes to shopping at the mall, we make eight more annual trips than any other group pulling in an average of 154 visits. Blacks also patronize dollar stores the most; we make seven more trips than the average group making a total of 20 trips. Lastly, Black Americans made more visits to convenience/gas stores by a small margin: making a total of 15 annual visits.

However, Black trips to grocery stores and warehouse clubs (like Costco) are a bit more scarce. “Less time is spent at grocery stores, with three fewer trips. The exception to grocery store shopping, though, is with Blacks who earn upwards of $100K annually. We also make three fewer trips to warehouse stores and two fewer trips to mass merchandisers than the total market. However, more upper-income Blacks (73%) shop at warehouse clubs than non-Blacks annually,” Pearson-McNeil said.

It could be that the lack of grocery stores and other healthy establishments in Black neighborhoods that contribute to this trend. This is why it’s not at all surprising that Black people frequent McDonald’s and Burger King more than other U.S. household.

What you probably won’t see in our carts are diary products such as milk and yogurt. “[T]his could be because many of us are lactose-intolerant,” Pearson-McNeil adds.

But probably the largest retail disparity between Blacks and other groups rests in the hair and beauty industry. We spend about nine times more on hair care and beauty products in comparison to other demographics. “In fact, 46% of Black households shop at Beauty Supply Stores and have an average annual total spend of $94 on products at these stores,” Pearson-McNeil says.

All the aforementioned figures were pulled from Resilient, Receptive, and Relevant: The African-American Consumer 2013 Report. With African Americans approaching $1 trillion buying power, one must wonder why aren’t marketers paying more attention to Black consumer trends.

** The average Black household contains 2.57 persons. In addition, Black households averaged 1.25 owned vehicles. Most of these households were renters, living in apartments or flats.8 Their dwellings averaged 5.45 rooms (including finished living areas and excluding all baths) and 1.49 bathrooms. Black households’ annual expenditures averaged $36,149, which was 79.8 percent of their average income before taxes. The amount spent on housing ($13,530) consumed the biggest portion of annual expenditures, accounting for more than one-third of the total. This was followed by transportation ($5,946) and food ($5,825). The remaining expenditures made up roughly 30 percent of total spending: personal insurance and pensions, healthcare, entertainment, cash contributions, apparel, and education, in addition to personal care, tobacco, alcohol, reading, and miscellaneous expenditures.

Black Americans are just 13 percent of the U.S. population, and yet, we’re on trend to have a buying power of $1.4 trillion by 2019. A new Nielsen study hints that marketers may want to start developing a better consumer-producer relationship with African Americans if they want to make big bucks.

Titled “The Multicultural Edge: Rising Super Consumers,” the report finds that the Black American sweet spot, in terms of buying power, lies in ethnic hair and beauty aids (surprise, surprise). Black American dollars make up a whopping 85.8 percent of the industry.

**Here are highlights of the spending patterns of low-income versus high-income Black households:

- On average, low-income Black households spent $16,627 in total annual expenditures, compared with high-income Black households who spent approximately $50,000 more.

- Housing was the biggest expenditure for both types of households. For the high-income Black households, housing was 34.2 percent of the total annual expenditure. For the low-income Black households, it was nearly half of the total annual expenditure, at 45.5 percent.

- Food was another large spending category for both types of households. However, it made up only 12.7 percent of total expenditures for high-income Black households, compared with 23.5 percent for low-income Black households.

- Transportation and personal insurance and pensions made up only 11.5 percent and 1.9 percent, respectively, of total expenditure for the low-income Black households. However, for the high-income Black households, these shares were 17.1 percent and 15.0 percent, respectively.

- Cash contributions, such as charitable donations, was a smaller expenditure category in which low and high-income Black households differed. Cash contributions were 2.1 percent for the low-income Black households and 4.6 percent for the high-income Black households.

- Among the remaining expenditure categories, alcoholic beverages, apparel and services, healthcare, entertainment, personal care, reading, education, and miscellaneous expenditures, low-income and high-income Black households had similar expenditure shares.

- Tobacco and smoking supplies was the only expenditure category in which low-income Black households spent both a higher share and a higher actual dollar outlay than their high-income counterparts. For low-income Black households, tobacco and smoking supplies was 1.5 percent ($248) of their total expenditure but made up only 0.3 percent ($218) of total expenditure for high-income Black households.13

Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), http://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

According to Nielsen:

- Blacks are more aggressive consumers of media and they shop more frequently.

- Blacks watch more television (37%), make more shopping trips (eight), purchase more ethnic beauty and grooming products (nine times more), read more financial magazines (28%) and spend more than twice the time at personal hosted websites than any other group.

- Blacks make an average of 156 shopping trips per year, compared with 146 for the total market. Favoring smaller retail outlets, blacks shop more frequently at drug stores, convenience stores, and Dollar stores.

- Beauty supply stores are also popular within the black community, as they typically carry an abundance of ethnic hair and beauty aids reside that cater specifically to the unique needs of black hair textures.

While the numbers indicate that Black folks are an important part of the buying public, companies spend just three-percent (3%) of their advertising budgets marketing to black consumers. According to Cheryl Pearson McNeil, a Vice President at Nielsen, “The Black population is young, hip and highly influential. We are growing 64 percent faster than the general market,” she explains.

However, Noel King, a reporter for NPR’s Marketplace, cautions companies against trying to reach Black consumers without knowing our needs. “If you want to market to those groups, then you should know what particular group buys your stuff,” says King. “Blacks tend to spend more on electronics, utilities, groceries, footwear. They spend a lot less on new cars, alcohol, entertainment, health care, and pensions.”

Despite our collective buying power, statistical data reflects that much of that money is spent outside of the Black community and not with Black-owned businesses.

Compare these numbers about “dollar circulation” reported by the NAACP:

“Currently, a dollar circulates in Asian communities for a month, in Jewish communities approximately 20 days and white communities 17 days. How long does a dollar circulate in the Black community? 6 hours! Black American buying power is at 1.1 Trillion; and yet only 2 cents of every dollar blacks spend in this country goes to black owned businesses.”

If the “dollar circulation” data does not get your attention, consider the following information from an article written by financial expert Ryan Mack:

55 percent of Black Americans are unbanked or under-banked meaning they do not have a bank account or the appropriate bank account (Federal Deposit Corporation Survey)

- “About a quarter of all Hispanic (24 percent) and Black (24 percent) households in 2009 had no assets other than a vehicle, compared with just 6 percent of white households. These percentages are little changed from 2005.” (Pew Research)

- “The median amount Black households reported saving on a monthly basis is $189, compared to $367 among White households…. [This is] the first time in a decade that Black households have reported saving less than $200 per month.” (Ariel Investments 2010 Black Investor Survey)

- “Blacks on the average are six times more likely than Whites to buy a Mercedes, and the average income of a Black who buys a Jaguar is about one-third less than that of a White purchaser of the luxury vehicle.” Earl Graves, Black Enterprise Magazine

- Although Blacks make up 13-percent of the U.S. population, just seven-percent (7%) of small business are owned by Blacks. Access to capital, clientele, and other resources hinder many Black folks from starting business, despite a long history of entrepreneurship.

Highlights from “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars”:

- Blacks consistently outpace the total market population in overall growth, smart phone ownership, television viewing and annual shopping trips according to the new study, “Resilient, Receptive and Relevant: The African-American Consumer 2013 Report,” a collaborative effort by the Nielsen Company in New York and the National Newspaper Publishers Association (NNPA), located in Northwest Washington, D.C.

- Black buying power continues to increase, rising from its current $1.1 trillion level to a forecasted $1.3 trillion by 2017.

- Despite the strong economic outlook, Blacks continue to spend most of their money outside of the Black community and, according to Nielsen and NNPA, advertisers have repeatedly slighted the black media, spending only three percent, or $2.24 billion, of the $75 billion spent with all media last year.

- Each year, Blacks spend more than $47 billion on Lincoln automobiles, $3.7 billion on alcohol, $2.5 billion on Toyotas, $2 billion on athletic shoes, and $600 million each year on McDonald’s and other fast foods, according to Target Market News Inc., a Chicago-based marketing research group.

- Blacks also spend wildly to keep up their appearances. The black hair care and cosmetics industry counts as a $9 billion a year business, but while African Americans are spending the most, they are profiting the least, said officials from the Black Owned Beauty Supply Association (BOBSA) in Palo Alto, Calif. Beauty product lines designed for African Americans were once 100 percent owned and operated by blacks, today other ethnic groups control more than 70 percent of the market.

- The current homeownership rate reveals that 73.5 percent of whites own homes while approximately 43.9 percent of Blacks are homeowners, according to the Harvard Joint Center for Housing Studies State of the Nation report for 2013.

- Sixty percent of Blacks have less than $50,000 saved in company retirement plans and only 23 percent have more than $100,000.

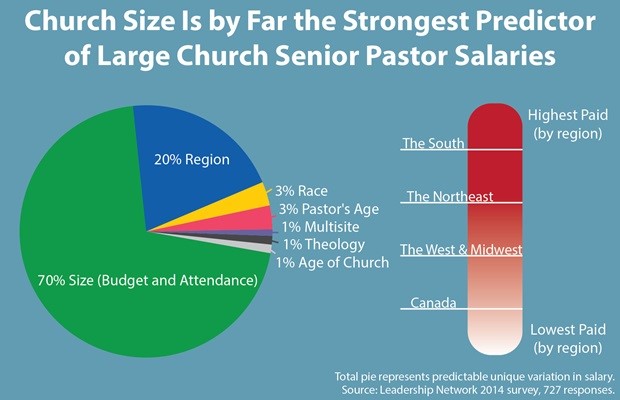

The loyalty Blacks have to their church also has proven costly, said officials at Faith Communities Today, a nonprofit based in Hartford, Conn. A 2013 study revealed that Black churches have collected more than $420 billion in tithes and donations nationwide since 1980, an average of $252 million a week.

“What people fail to see and understand is that, the church pastors aren’t waiting for miracles to fund their lifestyles, they don’t have to pray, day in and day out, to make their ends meet,” said Northwest resident and author, Byron Woulard. They are getting rich off God, not from God,” he said. Woulard, whose books include, the 2011, “Pawn Queen,” noted that the money spent tithing could buy as many as 93,333 homes valued at $150,000; pay for tuition up to $15,000 a year for 933,333 college students, and feed every homeless American for a year. “It’s the best hustle on the planet. If you don’t get it here on earth, you’ll get it when you die and go to heaven,” Woulard said. “And, it just so happens that not one person in the history of this planet has died, went to heaven, and come back to tell everyone that it’s true.”

Rich Blacks vs. Poor Blacks: Income and Spending Patterns

Data from the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey provide information on annual household spending. Looking at demographic subgroups of the population can provide a deeper understanding of consumption preferences and spending behavior for a particular group. Using data from the CE Survey, the following charts compares and contrasts the spending patterns of low-income Black households to their high-income counterparts.

| Category | All Black

households |

High-income Black

households |

Low-income Black

households |

|---|---|---|---|

| Total average annual expenditures | $36,148.98 | $67,114.17 | $16,627.29 |

| Tobacco and smoking supplies | $239.06 | $218.26 | $248.34 |

| Housing | $13,529.96 | $22,956.40 | $7,569.19 |

| Total food | $5,825.34 | $8,514.41 | $3,910.12 |

| Transportation | $5,945.94 | $11,469.17 | $1,915.35 |

| Personal insurance and pensions | $3,678.55 | $10,043.75 | $315.33 |

| Cash contributions | $1,347.50 | $3,081.13 | $349.31 |

| Healthcare | $1,794.27 | $3,240.21 | $689.57 |

| Apparel and services | $1,000.48 | $1,907.43 | $474.05 |

| Education | $503.25 | $1,354.23 | $190.31 |

| Entertainment | $1,362.24 | $2,485.95 | $635.57 |

| Personal care | $318.71 | $645.89 | $117.30 |

| Reading | $45.22 | $97.22 | $12.86 |

| Alcoholic beverages | $168.09 | $329.53 | $95.40 |

| Miscellaneous expenditure | $390.37 | $770.58 | $104.60 |

The only category which low-income Black households were not outspent was tobacco and smoking supplies. This particular statistic supports the phenomenon that tobacco tends to be a higher share of total expenditures for those with lower income as compared to those with higher income.

Source: Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), https://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

Click Here To Change Your Life and Purchase This DVD “Generation One: The Search For Black Wealth” Now!

Stacy M. Brown’s article posted on the Washington Informer.com website concludes with what is described as an inescapable fact: When black folks make money, they are quick to spend it!

According to Dr. Boyce Watkins, a Scholar in Residence in Entrepreneurship and Innovation at Syracuse University in New York, also known as “the people’s scholar,” “We don’t use money to invest or produce,” said Watkins, 42.” When we get our tax refund, we go straight to the store.”

The 17th annual report on “The Buying Power of Black America” also includes a dollar-by-dollar breakdown of the Black economy.

Copies of “The Buying Power of Black America” can be purchased from Target Market News for $99.00 for the hard copy version and $65.00 for the digital version. For more information call 312-408-1881, or click here to purchase online.

Below is our original article posted in November 2010. Have their been any improvements? You be the judge.

“How Do Black People in America Spend $507 Billion Dollars Annually?”

With $836 Billion in Total Earning Power, only $321 Million Spent on Books while $7.4 Billion Spent on Hair and Personal Care Products and Services

New ‘Buying Power’ report shows black consumers spend as economy improves

New 16th edition shows expenditures rise to $507 billion

(November 1, 2010) African Americans consumers are cautiously increasing their spending in some key product categories, even as they continue to make adjustments in a slowly growing economy. The finding comes from the soon to be issued 16th annual edition of “The Buying Power of Black America” report.

In 2009, Black households spent an estimated $507 billion in 27 product and services categories. That’s an increase of 16.6% over the $435 billion spent in 2008. African-Americans’ total earned income for 2009 is estimated at $836 billion.

The report, which is published annually by Target Market News, also contains data that reflect the economic hardships all consumers are facing. There were significant declines in categories — like food and apparel — that have routinely shown growth in black consumers’ spending from year-to-year.

“These latest shifts in spending habits are vital for marketers to understand,” said Ken Smikle, president of Target Market News and editor of the report, “because they represent both opportunities and challenges in the competition for the billions of dollars spent by African-American households. Expenditures between 2007 and 2008 were statistically flat, so black consumers are now making purchases they have long delayed. At the same time, they re-prioritizing their budgets, and spending more on things that add value to their homes and add to the quality of life.”

The median household income for Blacks dropped by 1.4% in 2009, but because of students going out on their own, and couples that started their lives together, the number of black households grew 4.2%. This increase meant that many household items showed big gains. For example, purchases of appliances rose by 33%, consumer electronics increased 33%, household furnishings climbed 28%, and housewares went up by 37%.

Estimated Expenditures by Black Households – 2009

| Apparel Products and Services | $29.3 billion |

| Appliances | 2.0 billion |

| Beverages (Alcoholic) | 3.0 billion |

| Beverages (Non-Alcoholic) | 2.8 billion |

| Books | 321 million |

| Cars and Trucks – New & Used | 29.1 billion |

| Computers | 3.6 billion |

| Consumer Electronics | 6.1 billion |

| Contributions | 17.3 billion |

| Education | 7.5 billion |

| Entertainment and Leisure | 3.1 billion |

| Food | 65.2 billion |

| Gifts | 9.6 billion |

| Health Care | 23.6 billion |

| Households Furnishings & Equipment | 16.5 billion |

| Housewares | 1.1 billion |

| Housing and Related Charges | 203.8 billion |

| Insurance | 21.3 billion |

| Media | 8.8 billion |

| Miscellaneous | 8.3 billion |

| Personal and Professional Services | 4.1 billion |

| Personal Care Products and Services | 7.4 billion |

| Sports and Recreational Equipment | 995 million |

| Telephone Services | 18.6 billion |

| Tobacco Products | 3.3 billion |

| Toys, Games and Pets | 3.5 billion |

| Travel, Transportation and Lodging | 6.0 billion |

Source: Target Market News,

“The Buying Power of Black American – 2010”

“The Buying Power of Black America” is one of the nation’s most quoted sources of information on African-American consumer spending. It is used by hundreds of Fortune 1000 corporations, leading advertising agencies, major media companies and research firms.

The report is an analysis of consumer expenditure (CE) data compiled annually by the U.S. Department of Commerce. The CE data is compiled from more than 3,000 Black households nationally through dairies and interviews. This information is also used for, among things, computing the Consumer Price Index.

The report provides updated information in five sections:

– Black Income Data

– Purchases in the Top 30 Black Cities

– Expenditure Trends in 26 Product & Services Categories

– The 100-Plus Index of Black vs. White Expenditures

– Demographic Data on the Black Population

According to Forbes magazine, Floyd Mayweather, Jr., made more than $420 million in 2015. He is the highest paid athlete in the world.

Click here to read how Floyd Mayweather, Jr. spends his money.

Portions of this article came from Clutch Mag online.

If you want to educate yourself and others about how to earn and spend your money responsibly, read the book, Black Dollars Matter: Teach Your Dollars How to Make More Sense, by James Clingman. Clingman is a friend to this site. He’s also the founder of the Greater Cincinnati African American Chamber of Commerce and the nation’s most prolific writer on economic empowerment for Black people. He can be reached through his website, www.blackonomics.com. Black Dollars Matter: Teach Your Dollars How to Make More Sense is available through the website www.professionalpublishinghouse.com and Amazon Kindle e-Books.

If you want to educate yourself and others about how to earn and spend your money responsibly, read the book, Black Dollars Matter: Teach Your Dollars How to Make More Sense, by James Clingman. Clingman is a friend to this site. He’s also the founder of the Greater Cincinnati African American Chamber of Commerce and the nation’s most prolific writer on economic empowerment for Black people. He can be reached through his website, www.blackonomics.com. Black Dollars Matter: Teach Your Dollars How to Make More Sense is available through the website www.professionalpublishinghouse.com and Amazon Kindle e-Books.

There is a great organization called World of Money. Founded in 2005, the World of Money is a New York City based 501(c)(3) non-profit organization whose mission is to empower youth through the engaged, local delivery of professional quality financial education. World of Money Founder and CEO, Sabrina Lamb, while attending a financial planning seminar, was inspired by a compelling question. Are children, in the course of their education and upbringing, getting this information on how to manage their financial life? After conducting some research on the subject, Ms. Lamb found that the answer to her question was a resounding “no”. So, after affirming the detrimental effects of this knowledge gap, she set forth to leverage her experience as an entrepreneur and love of working with children to create World of Money. Click here to visit their website and learn more.

There are already over 35 Black owned banks and credit unions in the United States where you can put your money if you find these type of efforts for financial stability and reinvestment in the black community important.

Check out the list below!

- Omega Psi Phi Credit Union – Lawrenceville, Georgia

- Phi Beta Sigma Federal Credit Union – Washington, DC

- One United Bank – Los Angeles,California

- FAMU Federal Credit Union – Tallahassee, Florida

- Credit Union of Atlanta – Atlanta, Georgia

- North Milwaukee State Bank – Milwaukee, Wisconsin

- Seaway Bank – Chicago, Illinois

- The Harbor Bank- Baltimore, Maryland

- Liberty Bank – New Orleans, Louisiana

- United Bank of Philidelphia – Philidelphia, Penn

- Alamerica Bank – Birmingham, Alabama

- Broadway Federal Bank – Los Angeles, California

- Carver State Bank – Savannah, Georgia

- Capital City Bank – Atlanta, Georgia

- Citizens Trust Bank – Atlanta, Georgia

- City National Bank – Newark, New Jersey

- Commonwealth National Bank – Mobile, Alabama

- Industrial Bank – Washington D.C.

- First Tuskegee Bank – Tuskegee, Alabama

- Mechanics & Farmers Bank – Durham, North Carolina

- First Independence Bank – Detroit, Michigan

- First State Bank – Danville, Virginia

- Illinois Service Federal – Chicago, Illinois

- Unity National Bank – Houston, Texas

- Carver Federal Savings Bank – New York, New York

- OneUnited Bank – Miami, Florida

- OneUnited Bank – Boston, Massachusetts

- Tri-State Bank – Memphis, Tennesse

- Citizens Bank – Nashville, Tennessee

- South Carolina Community Bank – Columbia, South Carolina

- Columbia Savings and Loan – Milwaukee, Wisconsin

- Liberty Bank – Baton Rouge, Louisiana

- Liberty Bank – Kansas City, Missouri

- Citizen Trust Bank – Birmingham, Alabama

- Liberty Bank – Chicago, Illinois

- Liberty Bank – Jackson, Mississippi

- Toledo Urban Credit Union – Toledo, Ohio

- Hill District Credit Union – Pittsburgh, Pennsylvania

Are you currently putting money in a Black owned bank? Leave any testimonials you have below!

Photo credit: Couple counting money — Image by © Jose Luis Pelaez Inc/Blend Image/Blend Images/Corbis

** Sources: U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey, http://racisminamerica.org/the-real-reason-why-blacks-spend-their-money-and-dont-save/, CNN, Harvard Business Review, http://curatorsofdopenessblog.tumblr.com/post/72870270050/black-money-white-money

Gary A. Johnson is the Founder of Gary A. Johnson Company & Associates, LLC, a management training and consulting company. The company manages a variety of Internet and digital media enterprises including Black Men In America.com, a top-ranked website in the category of “African American Online Communities. Gary is also the author of the book “25 Things That Really Matter In Life,”: A Quick and Comprehensive Guide To Making Your Life Better—Today!, and a contributing author to two other books, “The Black Father Perspective: What We Want America To Know,” and “In Search of Fatherhood – Transcending Boundaries: International Conversations on Fatherhood.” In addition, the company manages Black Boating and Yachting.com, a site that highlights the adventures of boating enthusiasts.

Here’s another related and informative article on black spending.

How Blacks’ Dollars Can Achieve Black Power by William Reed

By William Reed (Posted June 12, 2017)

What is your view of black economic development? Most blacks say they are tired of being slighted and disrespected; yet the majority of us ignore tried and true capitalistic practices that would improve the race’s poor economics. It’s too bad there’s no accumulation of Blacks oriented toward race-based economic empowerment and wealth building. Black people collectively pooling economic resources aren’t the “wishful thinking” that many suggest. The thing we need to recognize is “to do for self‘”. When blacks across the nation make economic growth and development functioning realities collectively practicing means and methods that create jobs and opportunities we will be well on our way to respect and admiration.

It is generally accepted that there’s been progress for black Americans over the last 60 years, yet our overall status is bleak. Too many blacks are focused to rid the country of “white supremacy”. Black politicians and civil rights “leaders” boast that they’ve gotten blacks to 72 percent parity with whites. Truth is whites have “superior” understandings and adaptations of capitalistic procedures. Blacks must “stay awake” to more than partisan politics. Even as our poverty and unemployment rates continue to be higher than whites’, it’s a challenge to get most blacks to see benefits that can accrue if we come together and do more financially for betterment of our communities.

Black buying power is currently $1.3 trillion according to a Nielsen and National Newspaper Publishers Association Report.” With such money and buying power blacks should be utilizing methods and practices that circulate those dollars to Black owned initiatives. Each of us should look at our own actions and practices that keep us from spending substantial portions of money we get with Black-owned businesses. Why do we not deposit in Black-owned banks when doing this enables black financial institutions to fund our projects, goods and services.

To “be equal” in American society, blacks must learn how to build business/investments, hold onto it and pass it on. Some skeptical blacks must see the value in spending their money with our businesses. More blacks must “do more for self” to bring about Black Economic Power.” The prevailing “Black Leadership” has its focus on partisan politics and elusive “’racial harmony”. When will blacks learn that it’s imperative for concerned individuals, groups, organizations, churches and businesses push vital black financial and entrepreneurial cooperation to turn around disproportionate negative conditions that continue in Black communities?

Opportunities exist across the nation for black individuals, their organizations, churches, lodges, frats and entrepreneurs to provide educational programs, workshops and business conferences that teach and show people how and why to do for self. America needs local black leadership demonstrating the power of the black dollar and increase community awareness to recycle dollars within our community, by banking with black-owned banks and buying from black businesses. The solution to the high unemployment and income inequality black communities must come from us. It includes development of black businesses. Local or national groups, be them small or large: the thing is to do for self. If we are serious about tackling unemployment in our community, the quickest fix is to start financially supporting Black-owned businesses. Too many blacks rely on getting whites to remedy their financial problems. Data suggests that if African-Americans invested more money in Black-owned businesses, these businesses would be sources of employment for more of us.

The stand we suggest all blacks adopt is empowering the black community toward taking control and redirecting its wealth and investments. Blacks need more education on consuming and capitalism. More blacks must establish locations where people come and learn economic and financial principles on how to create and sustain Black businesses where they live. Let’s more of us hold power networking conferences for training and networking to bolster and educate Blacks. We all have to engage what we know and have toward operational unity. Enterprising individuals and organizations can sponsor regular business networking socials and gatherings. Do them at Black-owned establishments. Be sure to invite blacks in banking. Those provide opportunities for entrepreneurial blacks to meet one another, exchange ideas and partner.

William Reed is publisher of “Who’s Who in Black Corporate America” and available for projects via Busxchng@his.com

Gary A. Johnson is the Founder of Gary A. Johnson Company & Associates, LLC, a management training and consulting company. The company manages a variety of Internet and digital media enterprises including Black Men In America.com, one of the most popular web sites on the Internet, Black Men In America.com Dating and the Black Men In America.com Syndicated Blog. In addition, the company manages Black Boating and Yachting.com, a site that highlights the adventures of boating enthusiasts..

If Donald J. Trump invited you to a meeting, would you accept the invitation?

By Gary A. Johnson – Publisher, Black Men In America.com

Here are some of the notables who have met with Donald Trump since he won the 2016 presidential election:

- NFL Hall of Famer and Activist Jim Brown

- NFL Hall of Famer and Broadcaster Ray Lewis

- Rapper/Songwriter/Producer Kanye West

- Black Entertainment Television (BET) Founder Robert Johnson

- Comedian and Game Show Host Steve Harvey

- Civil Rights Activist Martin Luther King, III

After his meeting with Donald Trump, Steve Harvey said, “I walked away feeling like I had just talked with a man who genuinely wants to make a difference in this area. I feel that something really great could come out of this.”

Left to Right: NFL great Jim Brown, former professional football player Ray Lewis, and Pastor Darrell Scott (Photo by Drew Angerer/Getty Images)

Other famous people who are friendly with or support Donald Trump are boxer Floyd Mayweather, Jr., Reality Show Contestant and Trump Advisor Omarosa Manigault, Trump Religious Advisor Pastor Darrell Scott, Dr. Ben Carson, Russell Simmons, Rev. Run, Mike Tyson, boxing promoter Don King, singer Azealia Banks, former NFL star Terrell Owens, NBA Hall of Famer Dennis Rodman, former NFL great Herschel Walker, former NFL Linebacker Shawn Merriman, actress Stacey Dash and who can forget Trump black female supporters Diamond and Silk.

ESPN’s Stephen A. Smith delivered a commentary on the black community attacking black leaders for meeting with President-elect Donald Trump. Smith believes that it is counterproductive to call and label people who meet with Donald Trump as “sellouts.” Smith called on other prominent black leaders to meet with Trump instead of bashing those who do.

So, what would you do? Would you meet with Donald Trump? Why? Why not?

Please scroll down and share your response.

Photo Credit: NFL great Jim Brown, former professional football player Ray Lewis, and Pastor Darrell Scott (Photo by Drew Angerer/Getty Images)

Gary A. Johnson is the Founder of Gary A. Johnson Company & Associates, LLC, a management training and consulting company. The company manages a variety of Internet and digital media enterprises including Black Men In America.com, one of the most popular web sites on the Internet, Black Men In America.com Dating and the Black Men In America.com Syndicated Blog. In addition, the company manages Homework Help Page.com, an educational resource site for children, college students and parents.

To learn more about Gary click here.

A Collection of Thoughts on President Obama’s Legacy

December 31, 2016

By Gary A. Johnson – Publisher, Black Men in America.com

Barack Obama the person is a hugely popular and likeable person. From everything we can gather he is a solid husband, father and family man. Barack Obama, the President, is a different story. Despite his popularity in the polls, the majority of Americans feel that he has taken the country in the wrong direction. For President Obama, it appears by his actions that he thinks it is vitally important to help Americans understand how his two terms have reshaped American life. He knows that once he leaves office, President Trump may undo much of what he accomplished, including reforming the Affordable Care Act (Obamacare).

In terms of his legacy, will President Obama be remembered for who he is? Or remembered for what he did?

Ever since Donald Trump won the 2016 presidential election, President Obama and the Democrats at times, have behaved like arrogant sore losers who can’t accept the fact that their party lost what was arguably the easiest and most winnable presidential race in the last 40 years.

President Obama campaigned across the country for Hillary Clinton claiming that a vote for her would continue his policies. He claimed that he would be personally offended if folks did not vote for Clinton. On election day the majority of the people rejected the President’s policies by either casting their vote for Donald Trump or not voting. Those are the facts. The President, the Clinton campaign and a lot of Americans are having a hard time swallowing this defeat. Several college campuses cancelled classes, established “cry-ins” and brought in therapy dogs, Play-Doh and coloring books to help the students cope with the election results. I’m not lying. Click here to read more about this.

It appears that the President can’t bring himself to think that people would reject his policies. Instead, he said that “they” (the Democrats) didn’t do a good job of messaging and getting the word out. The word and the message was received and it was rejected. Why? Everyone has an opinion.

A month before the election, President Obama, the Democratic Party and Hillary Clinton got cocky. Most polls reflected that Hillary Clinton had double-digit lead over Donald Trump. Obama and the Democrats talked about running up the score in key swing states. President Obama was seen as Hillary Clinton’s secret weapon. A sitting and popular President campaigning for her was a move toward positioning the Democrats to retake control of the legislative branch. Here we are, 3 weeks after the election and the Democrats, Hillary Clinton and President Obama got their asses kicked. Not only did they loss the presidency, the loss Congressional and Senate seats.

Hillary Clinton ran a terrible campaign. There was NOTHING clever or smart about her strategy. One of her main campaign slogans was: “I’m with her.” What does that mean?

Ms. Clinton could not connect with young people, even after the campaign and the Democratic National Convention (DNC) rigged the primaries and stole the election from Bernie Sanders. She was deemed as dishonest and untrustworthy by many in the American public.

Now soon to be ex-President Barack Obama said he will position himself as the leader to help rebuild the Democratic party. President Obama appears to have a hard time accepting that his agenda was unpopular to many voters. The old saying, “What goes around, comes around,” has bitten Obama. After he won the election to become President, Barack Obama repeatedly reminded his adversaries that he won the election and on a few occasions told them that it was their turn to get in the back of the bus. Now that his team has loss, President Obama is concerned about his legacy.

The President’s legacy is arguably tarnished in the eyes of some for his failure to be honest about the Affordable Care Act aka Obamacare. The President is on record over 30 times making a series of promises and commitments to the American people, many of which turned out to be false or outright lies. For purposes of this article, let’s call them “broken promises.” For example, President Obama repeatedly assured Americans: “If you like your health care plan, you’ll be able to keep your health care plan, period. No one will take it away, no matter what.” According to healthcare giant Aetna, in 2016, Obamacare tossed over 2 million Americans out of their health plans.

According to Chris Conover, a contributing writer for Forbes.com, here are the most glaring statements connected to Obamacare:

- Universal coverage

- No new taxes on the middle class

- Annual premium savings of $2,500

- No increase in the deficit

- You can keep your plan if you like it

Here are the facts:

Up to 9.3 million people lost their coverage during the first open enrollment period. As of mid-September 2016, 18 of Obamacare’s 24 CO-OPs had failed, leaving 932,181 members to scramble to find alternative coverage; there’s only 6 CO-OPs remaining. In addition, At least 811,000 additional Obamacare plan members are involuntarily losing coverage in 2016 due to the withdrawal of UnitedHealth, Aetna and Oscar from various Obamacare exchanges.

In many speeches across the country President Obama said: “We will keep this promise to the American people: If you like your doctor, you will be able to keep your doctor, period.” Can you guess what one of the worst parts of all those plan cancellations is? Obamacare often forced patients to switch doctors and hospitals in the middle of their treatment.

At a rally in Florida in September 2016, President Obama claimed “a handful of people” would face hefty health-insurance premium increases for 2017. Last year, eight states had Obamacare plans whose premiums increased by 39% or more. Half the states saw increases of 30% or more.

Premiums are projected to rise even faster in 2017. Across Tennessee’s three exchange-participating insurers, the lowest average increase will be 44%. The highest will be 62%. On average, premiums are going up by 25%, but in some states, the increase will exceed 100%. Given that 15% of exchange plan members do not get subsidized coverage, about 9.1 million will face the full brunt of premium increases for Obamacare-compliant plans in the non-group market.

“I will not sign a plan that adds one dime to our deficits — either now or in the future.” – President Obama, Sept. 9, 2009.

Less than four years later, the Government Accountability Office announced ObamaCare would increase the federal deficit by $6.2 trillion over the next 75 years.

“You should know that once we have fully implemented, you’re going to be able to buy insurance through a pool so that you can get the same good rates as a group that if you’re an employee at a big company you can get right now — which means your premiums will go down.” —President Obama, July 16, 2012.

Not only did premiums go up, they have continued to rise. The Congressional Budget Office now predicts that, by 2025, employment-based coverage will cost about 60 percent more than this year because of the Affordable Care Act.

With Obamacare being the President’s signature piece of legislation, it was embarrassing that the website didn’t work, the promises were broken and it was a huge public embarrassment that had to be re-worked for millions of dollars at the tax payers expense. Where was the accountability for this?

President Obama’s legacy will likely be tarnished because of the President’s and the administration’s lies and deception connected to the Iran Nuclear Deal and for going against a long-held policy of NOT paying our enemies money in exchange for prisoners. In addition, public and Congressional reports claim that the Obama administration misled the public about the Iran nuclear deal’s contents in order to stymie opponents. The deal was touted as keeping Iran from a nuclear bomb for 15 years, but the new disclosures reveal that Iran could be six months away from a bomb within a decade of the deal.

President Obama appears to have a hard time accepting that his agenda was unpopular to many voters. There are elements of Obama’s agenda that remain unpopular. But a larger concern for aides is that Clinton failed to make the case for her own candidacy, and not be seen solely as an agent of the status quo.

There were times during the President’s two terms in office where he felt comfortable “talking down” to black folks and lecturing us on how to be better fathers and citizens. OK. We need to do better, but some folks were irritated by the format and the way the message was presented to us. One has to be careful when you decide to publicly castigate your most loyal supporters, that you often ignored and neglected on issues important to them.

The President’s preface for the use of drones to fight overseas has gone unnoticed by many. However, the Obama drone program has arguably taken more innocent lives than any other administration with almost no accountability.

This past election reflected another mid-term shellacking on President Obama’s watch. According to most polls, despite his popularity, most Americans believe that President Obama has been moving the country in the wrong direction. Most Democrats did not want to be seen or associated with the President. They did not want him to campaign for them. The massive debt he accumulated was a hard sell for any politician. On January 20, 2009, when he was sworn in, the debt was $10.626 trillion. Today it’s $19.78 trillion.

It’s misleading to hold President Obama (or any other President) accountable for the deficit incurred during his first year of office. That’s because the previous Administration already set the federal budget for that fiscal year.

The average annual deficit by President Nixon was $11 billion dollars, President Ford $40 billion, President Carter $61 billion, President Reagan $165 billion, President H.W. Bush $235 billion, President Clinton $40 billion, President George W. Bush $250 billion and President Obama $1.3 trillion.

In fairness, Obama inherited a mess when he took office and if that wasn’t enough, this man was disrespected often as the sitting President of the United States. Do you remember Gov. Jan Brewer (R-AZ) putting her finger in the President’s face in front of reporters? Brewer had the nerve to say that she felt “a little threatened” by President Obama. WTF? He should have grabbed her hand and firmly told her, “You got 10 seconds to get your fucking finger out of my face.”

Here are some other memorable moments of disrespect against President Obama:

- 9 months into his presidency as he addresses Congress Rep. Wilson yells, “you lie” during the President’s State of the Union speech.

- The whole “birther movement.”

- Senate Minority Leader Mitch McConnell (R-KY) publicly announced, “Our top political priority over the next two years should be to deny President Obama a second term.”

- Rep. Joe Wilson, yelling “You Lied,” during the President’s address to the nation.

Much of what President Obama accomplished happened with a “hidden hand” via Executive Order and because of that, and his perceived arrogance in doing so, many of those accomplishments can easily be undone by President Trump. President Obama, talking about his Executive Orders once said: “Where I can act without Congress, I’m going to do so.” — that just pissed off his opponents and strengthened their resolve to reverse his achievements–and they will just to teach him a lesson. Had the President been able to advance his agenda by passing laws, his achievements would be difficult to reverse.

Here are a few thoughts and theories on why Hillary Clinton lost the election, President Obama’s legacy and how Donald Trump won the election:

- Chicago, Obama’s hometown, witnessed 762 homicides last year, the most in two decades, and 1,100 more shootings than in 2015. Obama’s protestations to the contrary notwithstanding, the reason is the Ferguson effect, according to the Manhattan Institute’s Heather MacDonald. What’s more, statistics show that police are three times less likely to shoot unarmed black suspects than white ones.

- According to Peter Roff, a contributing editor to U.S News & World Report.com, under President Obama, the national debt rose to $19.9 trillion dollars according to the U.S. Treasury. Not all of that is his responsibility; just $9.2 trillion of it, which is still a pretty considerable number.

- Politically, President Obama has been the worst thing to happen to his party since Bill Clinton. During the eight years he was president, the Democratic Party has lost 717 seats in state houses across the country, 231 seats in state senates, 63 seats in the U.S. House of Representatives, 12 governorships and 12 seats in the United States Senate. As he leaves the stage, 70 state legislative chambers are under GOP control – including those in 32 states where the legislature is all Republican, compared to just 13 for the Democrats. And in 24 of the 32 states with Republican-controlled legislatures, voters also elected Republican governors, whereas the Democrats control everything in just seven. (U.S News & World Report.com)