This is the page where you will find everything related to Mr. Free Spirit and his archive of blog posts and related articles.

Who is Mr. Free Spirit? Mr. Free Spirit is a Baby Boomer who spent the last two years defining and researching Retirement for African Americans. In other words, Mr. Free Spirit is a Retirement Research Specialist or (RRS) who write about retirement, travel, fine living and everything in-between.

Mr. Free Spirit defines retirement as: The next phase of living. When a person decides to start the next chapter of their life, based on the completion of the current phase. Retirement is no longer determined by age, people including African American’s are retiring earlier in life based on work, and/or lifestyle. Many years ago the thought pattern was, save for a rainy day, the current thinking is, where should I live and how should I live and we start to look at various states, cities or towns that will accommodate their new lifestyle of easy living.

Posted July 6, 2020

Things To Do While You Are Sheltered-In-Place (April 13, 2020)

Hello All: I have been blessed in many aspects of my life. Dealing with the Stay-at-Home era that we are now enduring I spend many hours reading, much more than I have ever done in my past. I understand the difference when a writer/author writes from the head or writes from the heart. To me it is a real delight to find a writer that does both. Below is something that blew me away because it really defines the current environment and it is well crafted to embody this world of Stay-at-Home.

While we are at home (where we are supposed to be), we can take the time to do other things. We are utilizing the Internet for things like social media and passing the time with movies that don’t enrich our lives. Cut back on television or bad television.

Some reality TV can be entertaining but how does it enrich your life? Your life and family are interesting and entertaining enough if you think about it (mine is). You’re pouring into someone else’s life. Look inward. Bored? You shouldn’t be. Take this time to enrich your lives:

- Get into the WORD – God’s Word. Train yourself in prayer. Utilize this time to focus on the Lord, yourself and strengthen your families – near and far.

- Are there changes in yourself that need to be made? I know I for me, there are. Well, there isn’t a better opportunity to make the changes subtly while there is minimal to no outside influence to hinder your self-improvement. Do it for YOU, no one else.

- Use your smart phones, tablets, iPad and laptops for your benefit. They cost enough!

- The internet is a tool – not just for entertainment. Take the time to learn things for yourselves instead of “what they said” or “I heard.” Don’t wait to be spoon fed information. It could be wrong!

- Take an online class – There are so many FREE classes online.

- Learn about the stock market and INVEST. It doesn’t have to be that much.

- Learn how to create multiple streams of income. There’s something for everyone. – Create a legacy for you and your family.

- Find your passion and find a way to make money from it. Doing what you love keeps you motivate to do it. Step out on faith! Jump!

- Start a business. It doesn’t always take a lot of money or in some cases any money at all.

- Sharpen your skills. There’s always room for improvement. Focus on what you CAN do and improve on it and not what you can’t do.

- Discover your God given gifts and share them with the world (online for now).

- Start a blog. You have something to say that someone wants to hear or someone that needs to be inspired. (I may be on to something myself)

- Write a book. There are ways to self-publish online.

- Learn another language. Again, there are free programs online for this.

- Replace a not so good or bad habit with a good habit or better habit. It takes an average of 21 days to form a habit for some and 18 to 254 days for others (I learned that online ). Looks like we have time on our hands to do this. Starting is the hardest step. One step at a time.

- Get in shape. Get healthy. Learn how to eat/cook healthy. Learn to work out independently. Some people feel that they need a gym or trainer to work out. You may just need accountability or motivation.

- Join or CREATE an online group or get together (online) with some friends and/or family that would do it with you.

- Clean / de-clutter your house or where you live thoroughly. Not fun, but probably needed.

- Put everything down and spend time with your family. You are in the home together. Cook together, eat together, pray together, play together, work out together, dance together, be silly together – Just do it together. Create wonderful lasting memories together.

Don’t waste this time. Use it for things you never had time to do or maybe always wanted to. It may not be easy, but we were built for this. People have achieved much more with much less. Come out of this “Shelter-in-Place” better than you went in. You are not alone. We’re all in this together!

In Peace & Love, Stacey

Mr. Free Spirit Out

The Sins of Retirement (September 2019)

This article will provide some retirement sins and depict some mistakes you can make in retirement – the kind of error that can ruin even the most carefully thought out retirement. Even though I had carefully designed my retirement I still made some errors that could have been avoided. I am finally in my retirement dream home, but I made some mistakes that had a financial impact. Watch your external influences, other people can always tell what you should do, however if they have not been through it, they are proving you their thoughts not their experiences. Below are some guidelines that will assist others in the planning:

Retire too early? Sure, many people have it in their head to retire as soon as they can. For many it is a good move, for others it is a disaster. By working longer, you can save more money, must finance fewer years with your savings, and increase your Social Security benefits. Even if you do have enough money to retire you might still not be happy. Which leads us to the next point.

Having no plan for what you will do. Retirement is a big life changing expensive. One day you had someplace to be and responsibilities to go along with that. The next day you have no boss, and no purpose – except for the ones you create for yourself. People need a purpose, even if it is to perfect a golf game, fishing or get in great physical shape, start a new hobby, or volunteer. Without a guiding force all kinds of bad things can set you into depression, bad habits, marital/relationship problems. Take the time to develop your plan is years before you retire, so you have time to work out the kinks and solidify what will keep you occupied every day.

Assume you will work into your 70’s. Many people assume they will keep working well past the traditional 65 or some other age. Sadly, most people won’t. Health issues affect people. The smarter approach is to build in a contingency. Save more, spend less, or work toward a backup plan for generating income. And aside from the financial aspect, plan for what you will do once your working days come to an end.

Taking Social Security at age 62. Sometimes people have no choice about taking Social Security early. If you have no money and no job, you might need it to survive. But if you can afford not to take it, delaying is the safest route to securing your financial health in the long term. Waiting until age 70 makes even more sense for most people, if you can afford to wait.

Don’t work on a budget. Taking the time to create a budget that compares your spending vs. your income is super important, and it needs to be done before you retire. You must know how much you will be have coming in from pension, Social Security, part-time employment, and your savings. Once you compare that to your expected expenses you will be able to get a pretty good idea of if, and for how long, you can maintain the lifestyle you dream of. Perhaps you will be lucky enough to have enough to stay in your current home, be a snowbird, or enjoy wonderful trips and experiences. More likely you will have to prioritize what is important so you can adjust make the money last. Some of those changes might involve home to a less expensive home or different state, working longer, or finding part time work. The worst thing that can happen is that you have no idea of your fiscal health, and you run out of money decades before you pass over to the other side.

Not considering moving to a different home. Perhaps the home where you live now is the perfect size, economical, set up for an older person’s abilities, and easily maintained. It might be a home where you can live the lifestyle you always dreamed about. But chances are it would fail on at least some of those attributes. To avoid committing this retirement sin you need to at least consider moving. Maybe to another community, state, or region that has a better climate or lower taxes or cost of living. Perhaps to a place where you can live the lifestyle that makes you happy. In the end you might decide to stay where you live now, but at least you would have considered the options and made a considered decision.

Buying a new home, the first year you retire can be a disaster. You probably have heard the advice that you should only make one big decision at a time – as in don’t get married, move, and take a new job in the same month. That is because major life events like retirement are disruptive; take time to process and adjust to. When you retire you need time to adjust and make sure you are making smart decisions. Sure, you might go south for the winter as I did and buy a beautiful home in a great community. But just as you probably wouldn’t marry someone after your first date, you should spend some time exploring alternatives and getting to know the home/community of your dreams as I also did. I rented for two years in different places to give me a much clearer idea of what I was getting into.

Bottom line. There were undoubtedly more sins that could wreck my retirement. Plus, there were things that could happen beyond my control – such as health issues.

I would love to hear your ideas of the kinds of the things that can wreck your retirement, along with ways to try to avoid them.

August 27, 2018

Here I am!!!!

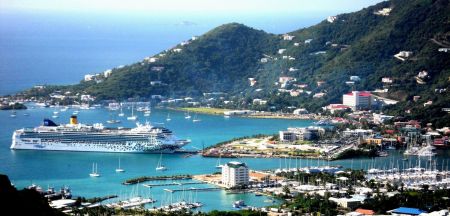

Mr. Free Spirit is working on many things, here is one: The British Virgin Island (BVI) trip for 2019.

The best things in life are not things, they are the memories you will have of the 2017 BVI reunion.

Some people are thirsting to do another yacht trip to the British Virgin Islands (BVI). I was contacted to see if this thirst was spreading or just a local group. The reunion trip of 2017 was more then fantastic, the memories will last forever, meeting new people and watching Black people uncover the unexplored within our communities. As you may already know 2 major hurricanes’ hit the islands subsequent to our departure and destruction was massive. The rebuilding of may structures is still occurring.

July 6 2019, some people are planning to return to BVI and enjoy the pleasure of another yacht adventure.

Reviewing some of the pictures bring back some awesome memories, the newbies were wide eyed and those with experience from past trips were in bliss explaining the wonders of both yachting and BVI. The parties were endless, and people of past trips looked for old friends, while the newbies found new friends. The 2017 reunion is gone, however the education of Black people in a yachting environment needs to continue.

The only way to continue the yachting experience within our communities is to rebuild the experience as they rebuild the BVI. We as a race cannot continue to be shallow based of a lack of knowledge. Experience will afford us expansion based on knowledge gained. As I write about many facets of retirement, yachting is something that be enjoyed at anytime in life, not just retirement.

Click here to look at the pictures of past trips and decide about 2019, is this something that you find interesting? Drop us a line.

Mr. Free Spirit Is Back with New Interviews (Posted February 24, 2018)

Posted February 24, 2018

Happy New Year! I decided to take a break to gather new materials for some new articles, both on Entrepreneurs and a new focus on retirement. Additionally, I have been following the article “How Do Black People Spend Their Money,” by Gary A. Johnson on Black Men In America.com. If you read that article and the Mr. Free Spirit articles a light bulb may come on.

With the current political environment, we could get depressed, if you remember or read about the struggles we have encountered in the past, it becomes hard to be positive. I have been enjoying the month off from writing my articles however I have been reading articles from some of the new Black Men In America.com (BMIA) columnists.

The new sports articles by Chris Johnson are awesome and the videos by Harold Bell and Chris are very informative and entertaining. These columnists inspired me to get back to writing my articles. I wrote an article in Nov 2017 identifying a company that was formed in the 1980s (Dante Productions), I recently had the privilege of interviewing the new President of Dante Productions Ms. Kristen Smith and it was refreshing to understand her perspective to not only bring the company back to life but enter a mass expansion. In Oct 2017, Dante came back to life and presented a Fashion Production in Central Fl. Kristen explained her vision of “Yesterday vs Today.” Below is the interview and some graphics of her vision:

Interview with Kristen Smith – President, Dante Productions

Mr. Free Spirit: Hello Kristen, now that you have taken over the position of President of Dante Productions I would like to have you answer some questions.

Kristen Smith: Sure. I’m ready.

Mr. Free Spirit: How do you feel about being the President of Dante Productions?

Kristen Smith: Although the new role was unexpected, I am excited. I am looking forward to my future growing with the company.

Mr. Free Spirit: What plans do you have to expand the company?

Kristen Smith: I intend to grow Dante Productions organically; this growth will begin with modernizing some of the business practices such as E-Tickets and an enhanced social media presence. We will continue this process of expansion through the introduction varying forms of entertainment.

Mr. Free Spirit: Now that the company is headquartered in Florida, does that enhance your role or is it more challenging?

Kristen Smith: No, the company being headquarter in Florida neither enhances nor hinders my role with Dante Productions. Although I intend to have a regular presence in Florida; we live in a virtual world and as a result most things can be done without physical presence.

Mr. Free Spirit: I understand the company has expanded to both Fashion shows and the Management of entertainers does this expectation make for a more fruitful company?

Kristen Smith: Yes, Dante Productions understands that entertainment extends beyond the world of fashion. Re-branding ourselves as a more diverse entertainment company creates endless possibilities.

Mr. Free Spirit: I understand the past President and founder of the company has moved into the position of COO, is he active?

Kristen Smith: Yes, our COO plays an extremely active role in Dante Productions. He remains in charge of all of operations in addition to client engagement.

Left to Right: COO, Chauncey Dunham, Gary Johnson, Founder, Black Men In America.com and singer Stanley Alston.

Interview with Chauncey Dunham – Chief Operating Officer, Dante Productions

Mr. Free Spirit: I understand that you as the COO has made a big move to bring Central Florida into a new era of entertainment. What can you lend to this move?

Chauncey Dunham: Hopefully I bring fresh ideas, in addition to the understanding that the landscape and demographics of our customers will slowly change over the next several years. I understand what future Dante Productions customers will demand and I plan to ensure Dante Productions remains on the bleeding edge of entertainment.

Mr. Free Spirit: I understand that the first new entertainer being managed is Stanley Alston of the singing group “The Main Ingredient.” Is that true?

Chauncey Dunham: This is true. We look forward to growing with Stanley and building an amazing future together.

Mr. Free Spirit: I saw in social media Dante Productions is doing a concert in Central Florida at a Museum with an Orchestra, is this a part of the expansion?

Chauncey Dunham: Yes, this is a large part of the expansion. With such a high demand for quality entertainment we would like to provide enhanced experiences in sunning and dramatic entertainment spaces; leaving those who patronize our events eagerly awaiting the next. I’m going to give you a scoop.

Mr. Free Spirit: OK, what’s the scoop?

Chauncey Dunham: We are going to introduce “Silver Citizen Entertainment” to Central Florida. This area will be our test market.

Mr. Free Spirit: What is a “Silver Citizen?” Isn’t that a watch?

Chauncey Dunham: (Laughing). Yes, there is a watch made by the Citizen watch company called “Silver Citizen.” A “Silver Citizen” is a very active and progressive senior citizen. I mean active and progressive in every way — mentally, physically and emotionally. “Silver Citizens” are on the move.

As a result, Dante Productions is developing an entertainment entity with four major divisions:

- Art for Silver Citizens

- Dance for Silver Citizens

- Music for Silver Citizens

- Fashion for Silver Citizens

Mr. Free Spirit: Wow! That whole “Silver Citizen” entertainment sounds exciting. I can’t wait to see how this turns out. Let me get back to your position in the production company. How did you pick the President of Dante Productions?

Chauncey Dunham: The position was passed down from me through a plan of succession. This plan ensures Dante Productions will remain a force in entertainment and will continue to serve long after we the current Principals choose not to. Additionally, Since Kristen is my Daughter she is a natural to succeed me and with her business savvy she will be successful.

Mr. Free Spirit: Is the President going to continue to live in the Washington DC area or will she move to Florida?

Chauncey Dunham: She intends to remain in the DC metro area to continue expand Dante Productions demographically.

Mr. Free Spirit: What is the new plan for Central Florida from your view point?

Chauncey Dunham: We are developing entertainment for “Silver Citizens.” Yes, I said Silver Citizens. It is our intent to bring Central FL Music that appeals to Silver Citizens. There is nothing wrong with the new music, however Silver Citizens don’t relate to the current musical trends. Therefore, I am working with Mr. Will Covington who is a music guru, and he has joined me in developing something called “Music for the Silver Citizens.”

Mr. Free Spirit: What is your marketing strategy?

Chauncey Dunham: We have engaged Mr. Gary Johnson Founder/Publisher of Black Men In America.com, to develop the marketing strategy. Gary follows current trends and develops new marketing strategies for future endeavors. Additionally, Gary is trending and writing about “How Do Black People Spend Their Money?”

Mr. Free Spirit: When and how will this effort begin?

Chauncey Dunham: March 31, 2018 is our kick off, using our newly developed Touch of Class Orchestra, who will back both Flo Logan-Worsham and headliner Stanley Alston.

Mr. Free Spirit: Thanks to both Kristen and you for allowing us to interview you and allowing us to publish your company plans. Do you have any final comments?

Chauncey Dunham: Yes, with my daughter at the helm “A Dante Production” will be a force to be reckoned with on both the Fashion Show and Musical world. We are developing a website. It is not operational at this time. We have secured the following domain name www.adanteproduction.com.

You are never to OLD to set a new goal or dream a new dream!

Mr. Free Spirit Out!

Retirement is a big issue. We have Mr. Free Spirit who guides us around the world through his writing on retirement and fine living. Forbes magazine has written a number of very informative articles on this topic including, “The Retirement Crisis Facing African Americans.”

You can also read some great articles on Black and Retired.com.

The Retirement Crisis Facing African Americans — By Rodney Brooks, Next Avenue Contributor

There’s a saying: When white America catches a cold, black America catches pneumonia. So, if there is an impending retirement crisis in America, what does that mean for African Americans? The answer to that question is discouraging.

Credit: Shutterstock

There is a huge gap in retirement preparation of African Americans compared to white Americans, generally speaking. According to the Urban Institute’s Nine charts about wealth inequality in America:

The pay gap and the wealth gap are among the many reasons African Americans enter retirement in poor financial shape, says Maya Rockeymoore, President of Center for Global Policy Solutions in Washington, D.C. Other explanations include financial literacy and investing habits.

The Pay Gap

“There is a pay gap when it comes to what African Americans earn when it compares to whites, even when you control for education,” says Rockeymoore. “We are starting with less.”

The hourly pay gap has widened to the worst in 40 years, according to the Economic Policy Institute (EPI) — a roughly 27% difference in 2015. Whites earned an average of $25.22 an hour vs. $18.49 for blacks, the EPI says. Declining unionization, the failure to raise the minimum wage and lax enforcement of anti-discrimination laws have contributed to the growing black-white wage gap, according to the EPI.

“We need to be having forums addressing labor-market decisions,” Rockeymoore says. Blacks are earning less than whites and it is not a reflection of talents or skills, she notes. “It is a reflection of discrimination in the labor market. We talk about the gender-pay gap, but we need to talk about the racial-pay gap.”

The Wealth Gap

According to the Federal Reserve’s Survey of Consumer Finances, in 2013, the median white household had $13 in net wealth for every $1 in net wealth of the median black household. Also, according to a Pew Charitable Trusts report, What resources do families have for financial emergencies, the typical white household has slightly more than one month’s worth of income in liquid savings, compared with just five days for the typical African-American household.

The Federal Reserve report said that whites are five times more likely to receive large gifts and inheritances than blacks and the amounts tend to be much larger for whites. “That is one of the main issues,” says financial planner Nick Abrams of AJW Financial Partners in Columbia, Md. “We [African Americans] are starting at ground zero every generation. That is hurting us financially.”

Rockeymoore agrees. “The wealth gap is serious,” she says, pointing to disparities between blacks and whites regarding employer-sponsored retirement plans.

“A significant number of us [blacks] are in jobs where we do not have access to pre-tax preferred retirement vehicles like 401(k) or 403(b) accounts,” says Rockeymoore. Many blacks work in small businesses where such plans frequently are not offered.

“If we do work in jobs that offer tax-preferred vehicles, we tend to not contribute at rates that whites do. And we take out loans out at higher rate,” adds Rockeymoore.

One solution, she notes, would be more access to such employer-sponsored plans.

Home ownership also plays a big part in the wealth gap. The typical white household aged 47 to 64 has housing wealth of $67,000; the typical household of color in this age group has zero home equity, according to the December 2016 report, Social Security and the Racial Gap in Retirement Wealth, from the National Academy of Social Insurance.

Debt can limit the ability to achieve other financial goals, especially retirement planning, too. “Among African American employees surveyed who are offered an employer-sponsored retirement account but contribute less than the employer match or do not contribute at all, 40% say that paying down debt is a higher priority for them than making retirement contributions, according to Prudential’s 2015-2016 African American Financial Experience.

Financial Literacy

There are also big differences in financial literacy between blacks and whites. Only one in 10 African Americans work with a financial professional compared with one in four white Americans, the Prudential report said.

“Many African Americans have had no history of someone who was a grandfather or someone who gave them some level of financial education in that household,” says James Brewer, president of Envision Wealth Planning in Chicago and president of the Association of African American Financial Advisors. “So, one of the challenges is around some level of financial education.”

Theodore Daniels, president of the Society for Financial Education and Professional Development agrees. “There has got to be more education. People have got to be willing to attend financial education workshops. Some people don’t know what they don’t know. Once they attend, they say ‘I can do this.’ If they are not educated, they are not comfortable making decisions, and they won’t do it,” Daniels notes.

African Americans Tend Not to Invest in Stocks

Some analysts also say that African Americans often shy away from investing in the stock market. “Whatever discretionary income we have, we tend not to invest in equities,” says Rockeymoore. “We don’t have a diversification.”

This may be due to a lack of comfort with the stock market.

“African Americans are risk-averse,” says Deborah Owens, a former Fidelity Investments vice president who calls herself America’s Wealth Coach. “So, one of the major reasons they have less in retirement savings is they are ultra-conservative, particularly African Americans who work in the public sector and nonprofit organizations.”

Owens says black investors typically focus on guaranteed or fixed investments that are low-risk or no-risk. As a result, their retirement funds aren’t compounding at a high rate of return.

According to the Federal Reserve, the average balance of African Americans in 401(k)s is only $23,000. And Social Security and the Racial Gap in Retirement Wealth found the average balance for African Americans in pensions and IRAs was $10,300, vs. $105,600 for white Americans.

Owens believes many African American workers don’t take full advantage of all the choices in their employer-sponsored plans because they don’t understand them. “The tendency to be risk averse is directly correlated to their lack of knowledge,” she says.

What Employers and Policymakers Could Do to Help

Brewer believes employers could play a bigger educational role.

“It is important for companies or organizations who have higher percentages of African American employees to realize that there are some differences, and they need to bring in people who have some cultural sensitivities to those differences, and come up with a plan to help those groups,” says Brewer.

He says African Americans need financial advice on issues such as having higher student loan debt than white counterparts and, often, a greater need to financially assist less affluent family members. Rockeymoore says African Americans, even in retirement, tend to support other family members, including children and adult children. Also, they are disproportionately taking care of grandchildren, making them unable to save more for retirement.

All in all, says Rockeymoore: “There needs to be a national campaign to encourage young African Americans to save and invest. Home ownership is the pathway to wealth. They [blacks] need to be educated in the homebuying process and also to diversify their investments to include stocks and bonds.”

McKernan believes policymakers also need to take action to close the racial retirement security gap. “This country is built on the premise that it provides economic opportunity,” she says. “But this country continues a history of discrimination and the result of that is passed from generation to generation.”

The Retirement Savings Racial Disparity

The average white family had more than $130,000 in liquid retirement savings (cash in accounts such as 401(k)s, 403(b)s and IRAs) vs. $19,000 for the average African American in 2013, the most recent data available.

The wealth gap is growing. The average wealth of white families in 2013 was more than $500,000 higher than that of African American families ($95,000). In 1963, the average wealth of white families was $117,000 higher than for black families.

White families accumulate more wealth over their lives than African American families, on average, which widens the wealth gap as they age. In their 30s, whites have an average of $140,000 more in wealth than African Americans (three times as much). By their 60s, whites have over $1 million more in wealth than African Americans (11 times as much).

“The American dream has not happened for African Americans and Hispanics,” says Signe-Mary McKernan, economist and co-director, opportunity and ownership initiative at the Urban Institute. “Retirement wealth is at the end of the cycle. A lot of things can happen along the way before you get there.”

In partnership with Fidelity, The Huffington Post presents Retire Well, a section dedicated to highlighting all the topics that pre-retirees care about, from healthy aging to healthy finances. Covering retirement news, health, wellness, and finance, this section of the website aims to explore the exciting developments that are changing the face of retirement today.

Here’s are a few articles featured on their site.

The 10 Best U.S. Cities For Retirement

This May Be The Single Biggest Retirement Mistake You Can Make

Boredom is retirement’s four-letter word.

Click here to read more…

2017 British Virgin Island (BVI) Reunion: New Discovery by Mr. Free Spirit

By Mr. Free Spirit, (Posted July 2, 2017)

Remember when I stated: “This is the last article before the trip, Mr. Free Spirit will send pictures back during the trip for publication and the September article will be the trip summary.”

Well a new development has occurred. Did you know, this will be the largest gathering of Black Boaters/Yachters in the history of Black boating? We are not talking about the events on the cruise ships, we are talking about private yachts. This event started with one (1) welcome party July 28,2017, it has grown to three (3) welcome parties one July 27 and two (2) July 28th. I remember my first trip in 2008, I was fascinated with the collaboration of that number of Black boaters. We had qualified Black Captains from the United States. I am now amazed at the numbers of both the experienced Black boaters and the new people that want to enjoy the experience of renting a yacht and cruising the British Virgin Islands (BVI).

If you read the article in Black Men in America.com, “How Do Black People Spend Their Money?,” you will find some interesting statistics:

According to Nielsen:

- Blacks are more aggressive consumers of media and they shop more frequently.

- Blacks watch more television (37%), make more shopping trips (eight), purchase more ethnic beauty and grooming products (nine times more), read more financial magazines (28%) and spend more than twice the time at personal hosted websites than any other group.

- Blacks make an average of 156 shopping trips per year, compared with 146 for the total market. Favoring smaller retail outlets, blacks shop more frequently at drug stores, convenience stores, and Dollar stores.

- Beauty supply stores are also popular within the black community, as they typically carry an abundance of ethnic hair and beauty aids reside that cater specifically to the unique needs of black hair textures

The overall results are very revealing.

Many of the articles in BMIA are intertwined. Read the articles about entrepreneurship. Can you imagine a Black Photographer and/or Videographer investing in going on this trip? What would be the Return on Investment (ROI)? Since history is going to be made on this trip, can you imagine the ROI?

Just think how many people it took to make this happen, via conference calls and emails. Below is just a small sample of the groups involved to make this historic event occur:

Boating clubs around the United States have been invited and the response appears to be great. Here is a list of just some of the boat/yacht clubs invited:

- No Drama Vacation- MD

- Seafarers Yacht -Club Annapolis MD

- Seafarers Yacht -Washington D.C.

- Universal Sailing Club

- Neptune’s Yacht Club-Baltimore

- Nauti by Nature

- Sankofa Odyssey

- Downriggers Fishing

- Sailfete-New York

- Black Boaters Summit

- Chesapeake Flotillas.com

- Edock-Ms. Bev—Metro Detroit-Power

- Chesapeake Flotillas

This does not include all the people and the tremendous efforts on their part.

During a conference call between Mr. Gary Johnson, Black Men In America.com and Mr. Free Spirit a decision was made to document this historic event with a pictorial and/or video slideshow. Representatives of Black Men in America.com will work with participants after the event and assess the available photos and film to determine the best method of documenting the event. This will be a collaborative effort coordinated by Mr. Free Spirit.

“Never be limited by other people’s limited imaginations.”

Mr. Free Spirit Out!

By Mr. Free Spirit (Posted June 12, 2017)

- How old do you have to be to be a successful entrepreneur?

- Want to Be a Successful Entrepreneur?

Learn to reinvent Yourself if your first attempt fails.

Some entrepreneurs told me how incredibly stressful it is to pitch ideas in front of would-be investors. It was described like “Shark Tank,” but instead of watching it on TV, you’re right there under the lights, in the action. For an entrepreneur, who maybe shy, introverted, and modest by nature, it could be terrifying. Speaking of terrifying, some entrepreneurs recently told me about how difficult it is to deliver bad news.

The point is that few entrepreneurs, especially first-time entrepreneurs, are ready for what comes at them from a people perspective when building a business. To succeed, you need to be able to step outside of your comfort zone and reinvent yourself – finding the courage to do things they never thought they’d have to do, or that they’d can do.

So how can entrepreneurs get out of this box and learn to reinvent themselves while at the same time reinventing their current business thoughts?

Let’s break this up into steps:

- The first step is two-fold: recognizing that reinventing yourself is just as important a task as reinventing your business.

Then, once you’ve convinced yourself of the imperative, doing an inventory of your challenges. No one likes to admit weaknesses, but just as you look for the strengths, weaknesses, opportunities and threats in a business deal, use that same thought pattern on yourself. Where are your blind spots? What do you struggle with? Be honest with yourself and stay dedicated to reality. - The second step is to assess your own personal motivation.

You’ve done your personal analysis and find that you struggle with sales, or networking or at delivering bad news. The next step is making sure that this is something you care about improving. What’s in it for you to get better at this? Will it help your company grow and thrive? We can’t help everyone, but everyone can help someone. Will it help you become a more effective businessperson? Will it help you achieve your goals and ambitions? Definitely. Embracing your internal motivation is an essential step for making anything happen, especially personal transformation. Give light and the darkness will disappear of itself. - Finally, the last step is to test your newly reinvented self.

Try out the new behavior. Look at how others do it, and ask friends for help. Maybe even enlist the help of a coach. If test number one doesn’t work, try again. Change your behavior, or try it in a different setting. Remind yourself of your motivation to go out there and do it, and just like you’d test and improve a product/service, do the same with this new version of yourself.

In the end, personal reinvention isn’t easy, but it is essential. Don’t let the most critical task of an entrepreneurial career fall by the wayside. Step outside of your comfort zone, embrace change, and you’ll be well on your way to achieving your goals.

A Marketing Funnel

A marketing funnel is a system of enticing your target market to your business and then leading them through a process that allows them to learn about you and, hopefully, to buy.

Through each stage of the funnel, the prospect engages a little bit more with you. At each stage, the number of prospects gets smaller, but their interest is growing.

There are several stages of the funnel, but in general, the funnel moves a lead from their initial awareness of you to making a purchase.

The stages of the funnel are:

1. Awareness: This is the widest part of the funnel where leads first discover you.

2. Interest: Once you’ve made yourself known, your job is to capture the leads’ interest and have them learn more about you and the value you provide.

3. Desire/Consideration: You’ve piqued your prospects’ interests to the point they want what you’re offering, but they’re still working to determine if they really want to invest in the product or service, and if so, if they want to buy from you.

4. Action/Purchase: If you’ve satisfied the prospect’s questions and concerns, he’ll move into the lowest, narrowest part of the funnel and become your customer or client.

One of the nice things about a marketing funnel is that some aspects can be automated. However, it’s important to remember that the goal is to build trust, credibility and rapport so that prospects feel good about hiring or buying from you. This means through each stage you’re providing more value and developing a stronger relationship with your leads.

How to Set Up a Marketing Funnel

The widest part at the top has the most prospects. It’s where everyone who first encounters your businesses enters. One you have their attention, you want to offer a variety of resources that pique their interest further, deliver value, and builds trust and rapport. These resources are used by the consumer in their evaluation of your business. If you’re successful, the prospect moves through the funnel to the end and hires or buys from you.

Let’s talk about real entrepreneurs that have either started and are successful or a new entrepreneur that I mentor.

I will start with Mr. Gary Johnson:

Most people are afraid to: STOP! AND TAKE A SERIOUS ASSESSMENT OF THEIR LIFE!

At one time Gary Johnson was like most of the people described above. After years of personal frustration, Gary conducted an honest self-assessment of his abilities and decided that he was not living up to his potential. He learned how to develop goals and achieve personal success and fulfillment. A successful senior officer, Gary shocked his colleagues by announcing that he was leaving his “good government job” to spend more time with his children.

With the support of his family, Gary exercised his faith and courage to live his dreams and do what he wanted to do with his life.

Gary is a dreamer, a thinker and a winner in life! He had a plan. A plan where he defined his success!

Gary Johnson has inspired and entertained thousands of people with his powerful story telling ability. At the age of 23, Gary was assigned to The White House where he worked for three Assistants to the President for National Security Affairs. Throughout his 40-year career, including 18-years with the federal government, Gary worked as a Mail Clerk, Intelligence Watch Analyst, Security Officer, Special Agent/Investigator, Supervisor, Manager and Training Consultant, Strategist and Talent Acquisition Expert.

Growing up Gary was unwilling to let others evaluate his potential based on test scores and other subjective criteria. He was determined to define his own success. Eleven years later, Gary graduated with a BS degree in Organizational Management from Columbia Union College and had attended the Antioch University School of Law, where he studied in the Masters of Legal Science program.

Gary learned how to set goals. He also learned how to network, be mentored and be strategic within an organization. In the end, Gary used his personal power to define his success. The same personal power that we all have, but don’t always know how to use.

As a certified management trainer, facilitator and consultant, Gary either independently or in collaboration with other HR firms, provided training, consulting and facilitation services to numerous Fortune 500 companies in almost every industry, Wall St. firms and government organizations. Among these organizations are John Deere, United Airlines, Southwest Airlines, Abbott Labs, American Honda Motor Company, The World Bank, the Departments of Defense, Homeland Security and the National Institutes of Health (NIH) to name a few.

Gary is the Founder and Publisher of Black Men In America.com, an online news and magazine and Homework Help Page, a comprehensive compendium of web links designed to help parents and children with homework and research projects.

What is the online Black Men in America.com all about?

Black Men in America.com is a popular website with a focus on black men. Approximately 45% of our site visitors are women. According to Alexa Internet and Ranking.com, Black Men in America.com is consistently ranked as one of the Top 10 most popular web sites (online community) on the Internet in the Ethnic/African/African-American category. Although our focus is on black men, we welcome all people, points of views and perspectives.

Let’s move on to Ms. Joia Bullock (https://twitter.com/artbyjoia)

Joia Bullock is a young, female artist from Prince George’s County Maryland. As a child, she began drawing and painting small pictures for personal recreation and for family members. At the age of 15, she began to take art more seriously and started to create paintings on canvas. Throughout her adolescent years, her talent as an artist and love for art grew and she decided to pursue art as a career. In 2015, she ventured to San Francisco, California to study at the Academy of Art University to hone her skills. After a year of studying at the Academy of Art University, she started a business and branded herself as “artbyjoia” designing hats and other merchandise based on her own art. She is currently continuing her studies at Frostburg State University working towards a Bachelor’s Degree in Fine Art. “To live is to experience and through experience I create” is her own personal motto and is how she finds inspiration for her art. Her artwork is based from dreams she’s had and places she’s gone. Through experience, her love for art grows every day.

Keep in mind Joia is both young and a college student, therefore I spoke with Joia and her family and gave them a proposal. My proposal was if Joia continued her studies and her grades warranted, Mr. Free Spirit, Black men in America and The JLB Group will open a gallery in 2018 and feature Joia’s works. Of course, Joia and her family accepted the offer. The name of the new art gallery will be “The Art Inferno” and will open in 2018.

Put your heart, mind and soul into even your smallest act, this is the secret of success!

Mr. Free Spirit out.

You Can Be An Entrepreneur by Mr. Free Spirit

By Mr. Free Spirit (Posted June 12, 2017)

Did you know? The fastest-growing group of entrepreneurs in America are African/American Women.

The number of businesses owned by African American women grew 322% since 1997, making black females the fastest growing group of entrepreneurs in the U.S.

Overall, the number of women-owned businesses grew by 74% between 1997 and 2015—a rate that’s 1.5 times the national average, according to the recently published “2015 State of Women-Owned Businesses Report” commissioned by American Express Open. Women now own 30% of all businesses in the U.S., accounting for some 9.4 million firms. And African American women control 14% of these companies, or an estimated 1.3 million businesses. That figure is larger than the total number of firms owned by all minority women in 1997, the report found.

“The only bright spot in recent years with respect to privately-held company job growth has been among women-owned firms,” according to the report. These businesses have added an estimated 340,000 jobs to the economy since 2007, while employment at companies owned by men (or with equally shared ownership) has declined.

None of this surprises Margot Dorfman, CEO of the U.S. Women’s Chamber of Commerce. Her organization has seen an uptick in membership from black women entrepreneurs.

“We attribute the growth in women-owned firms to the lack of fair pay, fair promotion, and family-friendly policies found in corporate America,” she said. “Women of color, when you look at the statistics, are impacted more significantly by all of the negative factors that women face. It’s not surprising that they have chosen to invest in themselves.”

Nobody can predict your outcome but you!

Everybody was an Entrepreneur at some point during life, remember when you cut grass, washed cars or ran to the store for someone. You considered it an errand however you earned money for that errand.

A Real Entrepreneurial Story

Let’s zero in on a company I know very well, I will give you the entire history of this company. It’s called Dante Productions. Dante Productions was started in the 1980’s based on a group of men in Philadelphia wanting to go skiing. They went to upstate New York and it was recognized after some hours on the slopes you return at the lodge and there was nothing to do but drink and talk smack. That was the beginning of a person saying it would be nice to have some entertainment. One of the members, Mr. Chauncey Dunham said let’s do this again and I will get some entertainment to travel with us. That was an entrepreneurial move.

Chauncey Dunham engaged a troubled young man who was in high school with the permission of his family to travel on the next trip to spin records. However, the young man did not have turntables or records. This group of me chipped in and made the purchase of the necessary equipment and off they went again to go skiing. This caught on so fast that the number of buses increased from one bus to many buses of men and women. Again, this was the beginning of the expansion of an Entrepreneurial move. Chauncey moved from Philadelphia to the Washington D.C. area and continued the trend. It grew so fast that it became an effort that required a team to handle the flow. Chauncey got others involved, Mr. Richard (Dicky) Jacobs became Chauncey’s business partner and the number of buses continue to increase. Fast Forward, this effort quickly moved into a winter and summer event. Skiing in the winter and the addition of Fashion Productions during the summer, Pool Side relating to a musical event. The events were pool side near Valley Forge (Music Fair) Pa when Diana Ross, Gladys Knight and the likes were preforming. Chauncey met a young designer (Mr. Schbert Baber) that was a magical connection. The following continue to grow, now not only was it a show the logistics became a challenge, buses, hotel rooms and shows.

Family life came into play and Chauncey decided to slow it down. A real entrepreneur does not have time to sleep and the family gets neglected. Therefore, the company went dormant for some years. However, some ladies (Ladies of Style) renewed the spark and Dante Productions came back to life. Dante has developed a team which includes a graphic artist, a management company, a printer, and a master of video to revive the efforts in a new area. If you check the background on LinkedIn you will notice Chauncey has moved from the position of President to Vice President. This was a legacy move to allow a family members to carry the torch. The Bookends are now forming. This entrepreneurial story continues so stay tuned.

Mr. Free Spirit out!

The difference between winning and losing is most often not quitting.

The 2017 BVI Reunion

Posted June 12, 2017

Well it’s almost time, just think this trip has been in the planning stages for a year. It is now time to start packing, checking the location of your passport and notifying your credit card companies you will be out of the United States.

The final list of activities is limitless and sleep will be a rare commodity. Can you visualize yachts of African/ American’s sailing the blue waters of the British Virgin Islands (BVI) together? The events will be endless and loaded with fun. Just think, beach activates, pool parties, Regatta Sailing Race, snorkeling and all the other activities.

Pebbles said: Like the Jackson’s………”I can feel it”…we are going to have the best trip ever!

Questions are coming in from the newbies? This may help you.

What to Pack?

The average temperature is 85-95 degrees daily. This vacation is very casual. Do not over pack.

Since we will be around water 98% of the time, you will need to pack

light summer wear, swimwear, cover-ups, shorts, tops, Capri’s, t-shirts, flip flops, scandals, shower shoes, sun visors, hats, sunglasses, sunscreen, lotion, mosquito spray with deet, trunks, short sleeve shirts, back pack, extra beach towel, camera, games and music. Decorations for the boat.

Pack (1) White outfit for the party at the BEYC. Pack a grass skirt or Hawaiian something for our theme party at Virgin Gorda.

All medications, personal documents and valuables should not be packed in your luggage, but hand carried.

Safety & Security

Leave a copy of your passport and driver’s license number with someone at home.

Emergency phone numbers to leave with someone at home: Do not bring lots of cash. Most places in the BVI accept major credit cards.

Do not bring valuable jewelry.

Make sure your luggage is tagged right when checking in at the airport.

Make sure the boat is locked when unoccupied.

Be extra careful stepping on and off the yacht.

Wear life jacket when on the dinghy or in rough water.

Be extra careful when cooking on board.

Cell phones work in the BVI but are very expensive. Check with you cell phone company before you go to see if they have a temporary plan for you. You can also rent a minute phone while there and add minutes as needed.

Don’t forget your phone charger and/or a good camera!

Some surprise stops have been discussed on the power boat side, see below:

PETER ISLAND

THIS IS THAT PLACE. PARADISE IN PARADISE.

There is no other place like it anywhere in the world. And certainly, no other place like it if you’re seeking a true British Virgin Islands vacation. A casually elegant British Virgin Island resort and spa hidden away on an 1,800-acre oasis of tranquility.

Scrub Island

A PLACE LIKE NO OTHER.

Adventure and luxury living set within the magic and beauty of the British Virgin Islands, Scrub Island Resort, Spa & Marina is your own pristine secluded island retreat. You’re not looking for an average vacation. Good. This is not your average place. Divine secluded beaches. The clearest of waters. Boundless adventures on and beyond our breathtaking shores.

Anegada ANEGADA

The only coral island in the Virgin Islands’ volcanic chain, Anegada is characterized by its nearly flat elevation, the striking coral reefs that surround it, secluded sandy beaches and clear springs bubbling from coral beds.

A variety of wildlife special to the Virgin Islands area thrive on Anegada, including loblolly, frangipani, turpentine trees, feathery sea lavender and wild orchids. On the nature trail at Bones Bight, catch a glimpse of the rare rock iguanas native to the island, or discover the exotic birds at Nutmeg Point.

Snorkelers and scuba divers will delight in the reef’s mazes, tunnels and drops, which are rich in needle fish, bonefish, stingrays, parrot fish and other marine life, while those with sea legs will enjoy water sports, sport fishing and bone fishing. Beachgoers will find no lack of calm and quiet shores, including Cow Wreck Beach, Flash of Beauty, Bones Bight and Windlass Bight.

Discover Anegada’s history through a maze of stone walls that surround the Main Town’s Settlement or the Arawak’s ancient conch mounds in the East End. Or, explore the wreckages of numerous Spanish galleons, American privateers and British Galleons.

This is the last article before the trip, Mr. Free Spirit will send pictures back during the trip for publication and the Sept article will be the trip summary. I did receive a call asking is there any room left for a late comer, the answer is, YES but it is limited. The power side only has ONE cabin available, I am not sure about the sail boat side.

Mr. Free Spirit Out!

Let us be grateful to people who make us happy, they are the charming gardeners who make our souls blossom.

2017 BVI Update (April 30, 2017)

Well time is really getting close and this reunion will be one for the history books, who ever heard of this many people of color having a boating reunion?

You can’t imagine the efforts in the planning of a reunion of this magnitude, the logistics related in the movement of this many people is a task that is bigger than big. The planning committee has really put a great deal of time and effort to make this venture a unforgettable venture.

Many new things are occurring every day. If you are trying to make your decision about going on this reunion, ACT Now!!! Some of the Yachts may still have some cabins left. After hearing from some of the groups many new features have been added and the earlier features have been enhanced.

The adventure will begin with two Welcome Parties, one at the Moorings hosted by Joe Banks, and one at Soper’s Hole hosted by “No Drama Vacations”.

Music and food will be on tap for a fun-filled evening before the voyage.

Out of the gate Mr. Free Spirit is having a pool party which will be followed by an afternoon beach Bar-B- Que organized by Capt. Ken Washington & Capt. Craig Martin at Spring Bay.

The evening will wrap up with the theme party sponsored by Ms. Bev and the e-dock crew, with a performance starring the elegant style and grace of vocalist Ms.Pamela Diggs.

Let the party start. All the yachts will meet at Anegada for dinner. Can you imagine all of the yacht’s in one place at the same time? After leaving Anegada, the yachts will sail to the Bitter End Yacht Club to attend the “No Drama Vacation” Black and White Party, or cruise to Leverick Bay for dinner & DJ, hosted by Joe Banks.

E-Dock power yachts will head to the lap of luxury in Scrub Island Resort. The main event at Scrub Island Resort will be a Poolside Concert starring the jazzy and classy Ms. Pamela Diggs.

Joe Banks and his group is having the dinner of all dinners at Nanny Cay, this is the location where everybody will say good bye to the new friends you met from other cities. The Nanny Cay event will be held at the “Peg Leg’s” restaurant. Besides an extensive buffet menu and a cash bar, they will have a DJ for entertainment and we also plan to take group pictures there at that time. The event promises to be a fun one and the last night on the Island for several of the groups in the Flotilla.

For those who want one more event Shaun Brown and crew will have a WHITE party at the Ritz Carlton hotel in St. Thomas VI.

For more information, please contact www.harrisandbrown.com which will lead you to the party info. There are more events and fun things happening, but it’s just too many to list.

Mr. Free Spirit OUT!! There is only one way to avoid criticism: Do nothing, say nothing, and be nothing!

April 6, 2017

By Mr. Free Spirit

As you know I have been sitting in on the national planning committee conference calls for the 2017 BVI Reunion. I must say the conference calls are very detailed and packed with enthusiasm. Many thumbs up to the people around the United States for the time, research and effort they are extending to make this a trip to go into the history books. It was my intent to develop a repository of events being presented by the different organization, however the list of events is just too long and to fluid for me to list.

One of the main questions is: How many boats and people are going? I lost track at 50 boats and stopped counting. There is both a Sail Side and a Power Side and tracking the many events will be difficult to reflect. I feel blessed to be covering this event and during a conversation with a planning representative from New York I stated this reunion will be a true fishbowl. With our current political environment, a chance to portray the ability of people of color to do something positive is a real plus.

Since I will be traveling on the power boat side I am more familiar with their itinerary, and it is power packed. E-Dock is still adding events. They have people traveling from California, Maryland, Florida, Michigan, Georgia, Arizona and Hawaii to make this trip.

Since most of you won’t know me, that gives me a chance to interview you for www.blackmeninamerica.com without you knowing it’s an interview. The opportunity for people of color to meet people from other walks of life will be fantastic. My current column on what it takes to be an entrepreneur will play a big part in the reunion interviews, based on the concept of JUMP!

The black boaters have played a BIG part in our thoughts to enlarge Black Men In America.com. We are currently on the drawing board making major moves to expand. A section on black boaters will be included in the expansion.

Mr. Free Spirit Tackles Entrepreneurship

March 15, 2017

Publisher’s Note: This month Mr. Free Spirit tackles the issue of entrepreneurship. I don’t know if he knows what he’s about to unleash with his article. Entrepreneurship, especially in the black community has many facets. One of the questions that Mr. Free Spirit asks is “How old must you be to be an entrepreneur?” That is a great question.

When you take a detailed look at how black people spend their money, most people will agree that entrepreneurship is a very viable option. If you have no idea how black people spend their money, and want to learn about how different ethnic groups spend their money click here to read an informative blog post.

The following links are just two examples of young entrepreneurs who are making a difference in their communities:

http://blackmeninamerica.com/mos-bows-13-year-old-ceo-of-mos-bows-memphis/

http://time.com/4277590/whole-foods-bees-lemonade/ (BeeSweet Lemonade)

I applaud Mr. Free Spirit for writing about entrepreneurship and I hope you enjoy his article. As always, feel free to scroll down to the end of the page and express yourself in the form of a comment. You can also suggest a topic for future discussion.

Gary Johnson, Publisher – Black Men In America.com

Entrepreneurship by Mr. Free Spirit

Posted March 15, 2017

Let me start this column with two questions.

Question #1: How old must you be to be an entrepreneur?

Answer: Any age.

Question #2: What is an entrepreneur?

Answer: a person who organizes and manages any enterprise, especially a business, usually with a considerable initiative and risk.

Entrepreneurship has traditionally been defined as the process of designing, launching and running a new business, which typically begins as a small business, such as a startup company, offering a product, process or service for sale or hire, and the people who do so are called ‘entrepreneurs’.

It has also been defined as the “…capacity and willingness to develop, organize, and manage a business venture along with any of its risks in order to make a profit.” While definitions of entrepreneurship typically focus on the launching and running of businesses, due to the high risks involved in launching a start-up, a significant proportion of businesses have to close, due to a “…lack of funding, bad business decisions, an economic crisis — or a combination of all of these” or due to lack of market demand. In the 2000s, the definition of “entrepreneurship” has been expanded to explain how and why some individuals (or teams) identify opportunities, evaluate them as viable, and then decide to exploit them, whereas others do not and, in turn, how entrepreneurs use these opportunities to develop new products or services, launch new firms or even new industries and create wealth.

Recent advances stress the fundamentally uncertain nature of the entrepreneurial process, because although opportunities exist their existence cannot be discovered or identified prior to their actualization into profits. What appears as a real opportunity might actually be a non-opportunity, or one that cannot be actualized by entrepreneurs lacking the necessary business skills, financial or social capital.

OK, let’s break it down; first age is not a factor. You can be 9 years or 90 years old to venture into the world of independence. At the age of 9 years you may shovel snow, cut grass or do odd jobs for the people on the block. Once you retire from your 9 to 5 job, you may not want to sit around with nothing to do, and you want to do something light. You have a talent, use it.

Start a company! Doing something of which you have knowledge and you think it’s fun, is not guarantee for success. We all have a talent of sorts, maybe it was your hobby when you had a job and you found it relaxing.

I found a company that picks up your clothes and takes them to the cleaners and returns them a week later. They started with 5 customers and now have 700 customers. This is a legitimate business.

I met a man that did home remolding in Iowa. He is now the local handyman and he takes the jobs he wants and turns down others. He only takes cash (no money trail to the IRS).

I also found a lady who was a volunteer at the local hospital. She now uses her SUV to take disabled people to their doctor and medical appointments. Again, this went from a hobby to a business.

You have a talent, use it!

Black Men in America.com was launched in 2001 in Gary Johnson’s basement to counter the overwhelming negative images of black men in the media with positive images of black fathers, husband, sons and friends. Today the site reaches millions of people and has site visitors in over 92 countries. Black Men In America.com is fast becoming a brand in addition to being a business.

You can do something other than sitting around complaining that you have nothing to do. You have a “Honey-Do” list. Look at that list and get creative. Think out the box. Is there anything on that list that you can convert into a business?

I don’t know about you, but I’m not feeling real “secure” right about now. It’s no secret that the world is undergoing some big changes. President Trump and all of the uncertainty surrounding his administration is terribly unsettling for small businesses and middle-class people and below.

And while I cannot tell you what will happen next, I can tell you this much: “When the world is in flux, it never hurts to prepare for the future.”

One way to prepare for the future is to create an emergency fund. Pay yourself first. Put away some cash. Even if you have to put away $5.00 a week, do it. Over time you will be surprised at how much money you will have saved.

You can also create an emergency fund so that when something unexpected happens you will be prepared.

I understand that for some of you reading this article it is very hard to put money away for an emergency because you don’t have “extra” money. I also understand that for many people your interest rates are high, which mean you are paying more money for your mortgage, your car payment and your credit cards and loans.

If you are fortunate enough to have a high credit score, your interest rates are lower because you have demonstrated that you can pay your bills on time over a sustained period of time. To the lending institutions you are a “safe” risk. This means that it is easier for you to find “extra” money to save for an emergency. People with high credit scores can also refinance their debt at a lower interest rate, which again affords you the opportunity to save money.

With this political turmoil, I am reminded of a song written by Kenneth Gamble and Leon Huff for Harold Melvin and the Blue Notes featuring Teddy Pendergrass. That song is “Wake Up Everybody.” Here are the lyrics:

Wake up everybody, no more sleepin’ in bed

No more backward thinkin’ time for thinkin’ ahead

The world has changed so very much from what it used to be

So there is so much hatred war an’ poverty

Wake up all the teachers, time to teach a new way

Maybe then they’ll listen to whatcha have to say

‘Cause they’re the ones who’s coming up and the world is in their hands

When you teach the children, teach ’em the very best you can

The world won’t get no better

If we just let it be

The world won’t get no better

We gotta change it, yeah, just you and me

Wake up all the doctors, make the ol’ people well

They’re the ones who suffer an’ who catch all the hell

But they don’t have so very long before the judgment day

So won’tcha make them happy before they pass away?

Wake up all the builders, time to build a new land

I know we can do it if we all lend a hand

The only thing we have to do is put it in our mind

Surely things will work out, they do it every time

The world won’t get no better

If we just let it be

The world won’t get no better

We gotta change it, yeah, just you and me

Mr. Free Spirit Out

“It’s not the length of life…but the depth of life.”

Heard Ya Missed Me…Well, I’m Back by Mr. Free Spirit

Where was Mr. Free Spirit? Let’s let him tell you himself.

Let me explain my absence in football terms. If you followed my adventures and reports on retirement you will remember that first half of my journey last year was packed full of adventure and events. Last year I traveled to the Midwest preparing to drive back east. However, my body told me to ship the car back and catch a plane. This is when the stress started.. After contacting many car transport companies I finally found one that told the truth. I found one to be totally the worst (AT 123), the advertisement was FALSE and getting my money back was a nightmare. I finally found one (F1 Auto Transport) that was very honest.

My car was picked up on the arranged day and off to the airport that I designated. F1 told me the day and time my car would arrive and he was an hour early calling me to say he arrived at the drop off destination.

Everything was going well!!

Now it was time for half-time to end and I could start the third quarter. I was in my hotel preparing for a good night’s sleep. I was looking forward to the next day. Well, the next day came and I was admitted to the hospital and stayed there as a patient for 21 days. When you plan for retirement, plan for the unexpected, whatever that may be.

If you do not plan for the unexpected you are taking a risk. In most cases circumstances will have some type of crisis that will have an impact on your finances, especially, if you’re not prepared. The loads of people that flew in to visit me at the hospital was unbelievable, family and friends were really concerned and I got instructions that were more like warnings on a regular based about “running for the end zone.”

Here it is. The 4th quarter and thanks to rehab things are almost back to normal. The publisher of Black Men in America said I could not come back to work until I was 100%, however I am 97% now so hopefully that works. The interesting thing is I have not been behind the wheel of a car since Oct 2016, driving for the first time will be interesting. The fourth quarter includes the items on my bucket list such as watching snow on TV and not up close and personal. This has been accomplished. I wake up watching water every day and I have the option of long or short pants.

My new community is wonderful. There is always someone checking on me. Some of the family members fly in constantly house hunting.

I had a conversation with Mr. Gary Johnson, Publisher of Black Men In America.com about the new additions to the website for 2017. It all sounds very exciting. The fourth quarter has started off in a very positive manner. Mr. Free Spirit is back up and running at 97%, once I get back to 100% I will unveil the new initiatives. For now, it’s fun in the sun and get healthy.

Mr. Free Spirit says: “Take ever chance you get in life, some things only happen ONCE.”

Mr. Free Spirit Talks 2017 British Virgin Island Trip

October 9, 2017

By Mr. Free Spirit

I started the first British Virgin Island (BVI) reunion article by stating: “There is a difference between EXTRA and EXTRAORDINARY.”

The 2017 British Virgin Island (BVI) reunion is moving further into the category of EXTRAORDINARY. Based on some of the plans that have been provided to me thus far, this will be a reunion that will never be forgotten.

Boating clubs around the United States have been invited and the response appears to be great. Here is a list of just some of the boat/yacht clubs invited:

- Seafarers Yacht -Club Annapolis MD

- Seafarers Yacht -Washington D.C.

- Universal Sailing Club

- Neptune’s Yacht Club-Baltimore

- Nauti by Nature

- Sankofa Odyssey

- Downriggers Fishing

- Sailfete-New York

- Black Boaters Summit

- Chesapeake Flotillas

- com

- Edock-Ms. Bev—Metro Detroit-Power

- Chesapeake Flotillas

I know you have a question: Do I know how many boats are required so far? — YES

Am I going to provide the number? Not yet

Based on the information I’ve received; this will be an unforgettable experience. If you miss this BVI reunion written words will never be able to describe it. As I watch the people doing the planning of this reunion I can only say that they are doing a fantastic job.

To list the events that will occur during this reunion would take too much time and I know I would omit something. As I coordinate the events for our boat I realize this is mind blowing, so I can imagine what others are doing. I can only hope that each group decides to have breakfast late each morning due to the extensive list of activities available. The method of itinerary distribution is at the discretion of each group organizer. For Black Men In America.com we will provide the itinerary via email to those going in our group. Every detail is being reviewed to have this trip smooth.

I rarely get mesmerized, however some of the boat/yacht clubs for the BVI reunion have people coming from all over the United States. I went online to research the room rate per night at a yacht club in BVI that we will visit and it was $ 1,000.00 USD per night.

I attended a party this year held by E-Dock/Ms. Bev/Metro Detroit and I was always told “stepping” in Chicago was a way of life and nobody could touch them. Well, Detroit was really in the house.

You know being the new kid on the block, observing this effort is a sight to behold. I must commend all of the individuals’ doing the planning. The job you are doing is fantastic! It is almost impossible to write about all of the things going on. I will say if you attend this reunion you will need a vacation upon your return home.

From what I see every detail is covered, they plan non-stop entertainment and activities throughout the day and night, there’s more than you can possibly do on a single week! Whether you’re traveling solo, with a friend, family member, or significant other, the 2017 BVI has fun activities for everyone.

I have received some interesting questions about this trip. Let me help you!

You know that fancy luggage you have? Leave it home. There are some wonderful duffle bags on the market and it will be easier to store.

Where do you apply for a US Passport?

You can apply for your US passport at many post offices, selected regional federal buildings and at some circuit court offices. The easiest way to find your closest passport application acceptance facility is to go to the State Department’s website and search by ZIP code. The search form allows you to select handicap access sites and find nearby locations where you can have passport photographs taken.

This BVI reunion has inspired the Gary A. Johnson Company to publish a new online magazine that caters to black boaters. A preview of the content can be found at this link: http://blackmeninamerica.com/black-boating-and-yachting/. The online mag is tentatively scheduled for publication in November 2016. All boaters are invited to submit articles for publication. More information and submission guidelines will be available next month.

Mr. Free Spirit says:

When looking back doesn’t interest you anymore you must be doing something RIGHT!

Mr. Free Spirit Talks About Retiring

October 9, 2016

Well, folks let’s talk about retirement for me. I have done some things in my retirement that I had no idea that I would ever do. I took 5 months to just travel around the United States and visit family and friends. You know you talk to a family member and they will inform you of another family who lives in a city that you have never visited. So after a phone call to make the initial connection to that city I would go. The cities I have visited are too numerous to list, however, I did meet the children, grandchildren and even the great grandchildren that I never knew about. Some of the cities are in the cold part of country which is not for me. I also rekindled my friendships with friends that I have not seen for years including my British Virgin Islands friends from many years ago.Modern technology has saved me more than once. I do everything online. I’ve almost packed and departed for a trip, only to have my PC pop-up and remind me that I leave “tomorrow.” Since I have purchased plenty of warm weather clothes for the islands I don’t have to worry about what I need when I get home. Yep, it’s time to head home to warm weather now.However, let me provide some retirement wisdom about meGoing home to hibernate for the winter. If you plan to ever use an auto transportation company, please be careful. Do your homework. The things you have to worry about are numerous.

- Read the fine print and ask questions about a deposit and weight limits regarding your vehicle. For example, if you’re planning to put all of your suitcases in the car DON’T DO IT!” That adds to the weight of the vehicle.

- The driver makes the decision as to when he/she will depart and arrive. In other words, your timeline may not be the same as the driver’s timeline. In some cases, the transport driver has been known to ask for additional monies to deliver your car. Watch out for “low ball” companies too, they are good at “bait and switch.”

Some of the Biggest Retirement Planning Mistakes You Can AvoidOne of the biggest dilemmas for those approaching retirement is balancing the life they want to live today with the life they want to live in retirement.There are some common, yet avoidable mistakes that prevent many people from retiring “on time.” With some planning, you can steer clear of the mistakes that could derail your retirement.

Retirement Planning Mistake: Living Too LargeOne of the first questions you need to ask yourself when it comes to a retirement plan is: “How much income do you need to maintain your current lifestyle in retirement?” Not surprisingly, most people don’t know how much money they need. If your estimate is too high, the goal of retirement may seem unattainable, and the entire planning process is discouraging. If the assumption is too low, (which is most often the case), you are likely facing a difficult financial situation that would require you to make drastic or unwanted changes in your plan.The general rule of thumb is to plan that you will need approximately 80% of your current annual income in retirement. I’m not a fan of this rule, however, some people underestimate how much money they will need in retirement.Keep in mind that retirees spend more on travel, entertainment and eating out especially earlier on in retirement when they have the time and good no health concerns that prohibit them from enjoying activities. Keep in mind, health care costs are expensive and can escalate quickly.