By Gary A. Johnson – Publisher, Black Men In America.com

Updated September 12, 2022 (Originally posted on November 5, 2010).

How black people spend their money has been a hotly debated topic in offices, at social events, and in beauty and barber shops across America. This article, “How Do Black People Spend Their Money?,” has been the most read and commented article for 12 years running. Once I learned that this was the most popular and discussed article on the website, I decided to do some research and share this information with others. Over the years I found the process of gathering data and updating the site to be exhausting. It’s a lot to read. I update the site 1-2 times per year. This year I decided to update the article via video in the form of a pictorial slideshow. This way the reader has options. You can watch a 9-minute video which is the equivalent of having a summary video or a “Cliff Notes” version of how Black people spend their money, which includes a new component. I developed, “Gary’s 10 Tips To Prosperity and Emotional Fulfillment,” as part of the 2022 update. Or, you can read and review the exhaustive data and charts/graphs.

A recently released study by Merrill Lynch explored the ways wealthy Black people in the US spend their money.

What they found is that many well-to-do Black Americans:

- Take care of their family members, invest in their friends’ businesses, and eliminate debt

- Spend their earnings preparing for the future and retirement

The study, entitled “Diverse Viewpoints: Exploring Wealth in the Black/African American Community,” surveyed 455 affluent Black people –– defined as a household with annual income of $125,000 or more. The study’s findings indicate that this group of the US population is actually growing in size and has been since 2015.

The study participants reported working harder than other people in the affluent income category and charter their own career pathways. Affluent Black in the US are five times more likely to financially support their parents business.

Another great source of information is “How Black/African Americans Pursue—and Define—Success,“ by Diallo Hall, a longtime content strategist and editor whose experience includes serving as Director of Thought Leadership at Fortune and Senior Editor at the Economist Intelligence Unit. In that article you will read about the “Black Rules for Success,” from other successful Black/African American survey respondents.

![]()

There is an article on Mater Meta.com, by Kimberly Anderson-Mutch, about how to build generational wealth. Kimberly outlines the following 5 things that Black families can do to build generational wealth.

- Talk to your children about wealth.

- Buy a home or invest in real estate to create generational wealth.

- Start a business.

- Invest in stocks.

- Establish an estate plan.

![]()

Part 1: The Narrative

Let’s start by watching this short video that explains the “racial wealth gap” in America.

Here are the facts:

- 96.1 percent of the 1.2 million households in the top one percent by income were white.

- America’s 100 richest people control more wealth than the entire Black population.

- The 5 largest white landowners own more land than all Black people combined.

- The average Black family would need 228 years to build the wealth of a white family today.

I predict that even after reading this article there a significant number of Black people who will NOT change their habits and work toward changing their situation. Over time, when things go unchallenged, they seem normal. After centuries of slavery, black people must realize that they need to work toward building generational wealth and learn to invest their money and establish Trust funds for their wealth that can be passed down to future generations.

So what does this really mean? According to The Nielson Company research, Black consumers are speaking directly to brands in unprecedented ways and achieving headline-making results. Through social media, Black consumers have brokered a seat at the table and are demanding that brands and marketers speak to them in ways that resonate culturally and experientially—if these brands want their business. And with African Americans spending $1.2 trillion annually, brands have a lot to lose.

“Our research shows that Black consumer choices have a ‘cool factor’ that has created a halo effect, influencing not just consumers of color but the mainstream as well,” said Cheryl Grace, Senior Vice President of U.S. Strategic Community Alliances and Consumer Engagement, Nielsen. “These figures show that investment by multinational conglomerates in R&D to develop products and marketing that appeal to diverse consumers is, indeed, paying off handsomely.”

Generally speaking, Black people are still living for the moment with a “to hell with the future” mindset when it comes to money. Too many Black folks tend to only worry about themselves and the money that they have NOW. That way of thinking is crippling and must STOP now!

A common scenario for many Black folks when they get a “huge” chunk of money or their tax refund deposit is to run to the nearest appliance store, high-end mall or car dealer–(we just love those shiny new rims). According to The State of Working America, Black people spend 4 percent more money annually than any other race despite the fact that they are the least represented race and the race that lives in poverty at the highest rate.

If current economic trends continue, the average Black household will need 228 years to accumulate as much wealth as their white counterparts hold today. For the average Latino family, it will take 84 years. Absent significant policy interventions, or a seismic change in the American economy, people of color will never close the gap. (Institute for Policy Studies (IPS) and the Corporation For Economic Development).

Dr. Boyce Watkins shares the secret to money that most rich people understand. Check out this short video.

Faced with that reality, I wanted to know: How long does money stay in the various communities?

A dollar circulates:

- 6 hours in the Black community

- 17 days in the White community

- 20 days in the Jewish community

- 30 days in the Asian community

How Did This Happen?

According to Brian Thompson, a contributor to Forbes.com, the term “systemic racism” ruffles a lot of feathers. It often triggers emotional arguments about how people feel about racism and its effects. Yet concrete data over long periods of time shows very clearly that systemic racism exists.

Blacks were historically prevented from building wealth by slavery and Jim Crow Laws (laws that enforced segregation in the south until the Civil Rights act of 1964). Government policies including The Homestead Act, The Chinese Exclusion Act and even the Social Security Act, were often designed to exclude people of color.

Last year, Janelle Jones wrote and article for the Economic Policy Institute titled “The Racial Wealth Gap: How African-Americans Have Been Shortchanged Out Of The Materials To Build Wealth.”

In her article Jones writes, “Wealth is a crucially important measure of economic health. Wealth allows families to transfer income earned in the past to meet spending demands in the future, such as by building up savings to finance a child’s college education. Wealth also provides a buffer of economic security against periods of unemployment, or risk-taking, like starting a business. And wealth is needed to finance a comfortable retirement or provide an inheritance to children. In order to construct wealth, a number of building blocks are required. Steady well-paid employment during one’s working life is important, as it allows for a decent standard of living plus the ability to save. Also, access to well-functioning financial markets that provide a healthy rate of return on savings without undue risks is crucial.”

The gaps in wealth and income between white and black Americans are stark – and haven’t narrowed significantly in 50 years. Credit Suisse and Brandeis University’s Institute on Assets and Social Policy took a closer look at disparities between whites and Blacks. There are some notable differences in how each group approaches their money. Here are a few:

- The wealthiest 5% of Black Americans are slightly less likely to hold financial assets (stocks, bonds, and so on) in their asset mix. Of the financial assets they do invest in, wealthy Blacks are more likely than wealthy whites to invest in safer assets, preferring CDs, savings bonds, and life insurance to higher risk (and higher reward) assets.

- Wealthy Black Americans have more money in real estate holdings than equally wealthy white Americans. The former hold 41% of their non-financial assets in (non-primary residence) real estate, while the figure for the latter is just about 22%. Adding in primary residences brings those numbers to 57% and 34%, respectively. Even after the housing bust, real estate is considered a lower-risk investment.

- Wealthy Black Americans are less likely to hold equity in business assets. Looking at this group’s non-financial assets, 9% are equity in business assets. That figure is 37% for comparably wealthy Whites. The numbers are similarly stark if you look at this as a percentage of total assets: 21% of the wealthy Whites’ total assets are invested in their own businesses, versus just 6% for wealthy Blacks. Because both groups are equally likely to run their own companies – 23% in both cases – the researchers calculate that this means white business owners are investing in their businesses at a rate 7 times higher than Black business owners. In raw dollar terms, it means that Black business owners have about $68k in their businesses, while White business owners have roughly $468k.

“The American Dream remains out of reach for many African-American and Hispanic families,” said Signe-Mary McKernan, co-director of the Opportunity and Ownership Initiative at the Urban Institute. “Families of color, who will be the future majority population of this country, are not on a firm wealth-building path.”

There are three main reasons for the widening gap, according to McKernan. Blacks and Hispanics are less likely to be homeowners or participate in retirement accounts, which build wealth.

Federal government programs aimed at helping Americans buy homes and save for retirement rely on tax breaks and aren’t as available to Blacks and Hispanics, who typically have lower incomes. The bottom 20% of taxpayers, in terms of income, received less than 1% of federal subsidies for home ownership or retirement.

And the earnings gap between the races makes it harder for Blacks and Hispanics to save.

Blacks and Hispanics have also socked away a lot less for retirement in 401(k)s and IRAs. And as these voluntary retirement plans replace pensions, black and Hispanic families are left on shakier ground in what should be their Golden Years.

According to the Curators of Dopeness blog, Black people love to spend money on fashion. Black people get made fun of for not having on the newest Jordan’s or a brand name shirt that’s “in style”. Expensive purses and high heels are a must if you’re ever stepping out. Your hair needs to be flawless at all times. So in order to compensate for lack of confidence or trying the whole “look good, feel good” approach, Black people spend their dollars on looking good. This is some dumb shit that needs to be taken out of this culture because you need to crawl before you walk. First handle the foundation then move up to Jordan Brand products and red bottom shoes..

Check out this 1954 film made to educate white merchants on the spending habits of Black Americans.

The Secret of Selling the Negro Market is a 1954 film financed by Johnson Publishing Company, the publisher of Ebony magazine, to encourage advertisers to promote their products and services in the African-American media. The film showed African-American professionals, housewives and students as participants in the American consumer society, and it emphasized the economic power of this demographic community. The film, which was shot in Kodachrome Color, featured appearances by Sinclair Weeks, Secretary of the U.S. Department of Commerce, and radio announcer Robert Trout. The film had its premiere in July 1954 at the Joseph Schlitz Brewing Company in Milwaukee, Wisconsin, and was shown on a non-theatrical basis.

Watch this film and measure how far we’ve come over the last 60+ years.

White people love to spend money on fashion too. White people love to buy expensive cufflings, designer purses, custom suits. Their efforts are more to make sure they look presentable to potential employers. They really don’t care about being made fun off on a day off. That’s why you see white people with sandals on or those really high shorts. White people tend to over do it on the suits but they tend to last them a very long time so they treat them more like investments than clothes.

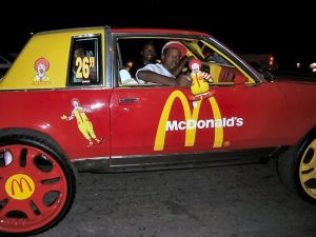

Black people love to spend money on cars. Chrysler 300’s, Dodge Chargers and the new model mustangs are a favorite. Black people also customize cars and don’t really bother with leasing. The car becomes an investment instead of just something to drive.

White people love to spend money on cars too. They lease new cars. Most of the BMW’s and Benz’s that you see are leased. They have a more economic car and then a leased car. They figure it’s just a car and pretty soon I’ll need another one so I’ll just rent the newest one out. Leasing a car is throwing away money that could be used somewhere else. More on cars later in this article.

According to Tingba Muhammad of the Nation of Islam Research Organization (NOIRG) wasteful Black spending is rooted in slavery. Earlier this year, Minister Louis Farrakhan gave speech on the root of black spending behaviors and what black people need to do to correct some of these bad habits. According to the research 42 million Blacks have a spending power amounting to $1.1 trillion, which gives each man, woman, and child an annual spending power of $26,200 dollars. Black spend their money overwhelmingly with white businesses on the following products and services.

- tobacco $3.3 billion

- whiskey, wine, and beer $3 billion

- non-alcoholic $2.8 billion

- leisure time spending $3.1 billion

- toys, games, and pets $3.5 billion

- telephone services $18.6 billion

- gifts $10 billion

- charitable contributions $17.3 billion

- healthcare $23.6 billion

The NOIRG theorizes that when most Blacks emerged from slavery, it frightened the hell out of White people. They knew that money and knowledge in Black hands meant that Blacks would have the power to determine their own destiny apart from White domination and control. The first impulse Blacks had after slavery was to get as far away from whites as possible. They even set up over 60 all-Black towns, in which they managed free of white authority. This trend had to be stopped because with Black independence came the total loss of the labor that whites totally depended on. This created a tremendous amount of oppression. Blacks responded to this oppression by becoming fast spenders.

So, today, many Blacks don’t trust banks, or the courts—Blacks “trust” only that which they can hold in their hands at that very moment. As destructive as that behavior is to Black progress is exactly how profitable that behavior is to whites—who will do anything to keep Blacks on that thinking track.

Hmmmmm! Something to think about.

Another school of thought is shared by blogger Matthew Corbin who wrote 5 Reasons Why Black People Are Still Broke.

Here are Corbin’s 5 reasons:

- Black people spend more money than they make

- Black people don’t support black businesses

- Black people don’t save their money

- Black people don’t know how to invest

- Black people aren’t working towards getting out of poverty

Here’s something to think about. Blogger Matthew Corbin lists 5 Reasons Why Black People Are Still Broke.

Here are Corbin’s 5 reasons:

- Black people spend more money than they make

- Black people don’t support black businesses

- Black people don’t save their money

- Black people don’t know how to invest

- Black people aren’t working towards getting out of poverty

Click here to read Corbin’s explanation for each reason.

![]()

There is an article on Mater Meta.com, by Kimberly Anderson-Mutch, about how to build generational wealth. Kimberly outlines the following 5 things that Black families can do to build generational wealth.

- Talk to your children about wealth.

- Buy a home or invest in real estate to create generational wealth.

- Start a business.

- Invest in stocks.

- Establish an estate plan.

![]()

Click here to read Corbin’s explanation for each reason.

Donald J. Trump was the 45th President of the United States. Some say life under a Trump administration won’t be that bad, in fact, it Donald Trump may do more for Blacks than the last several presidents. Time will tell. Trump says he will be great for blacks. Click here to read Donald Trump’s plan for the black community.

The following information comes from the website Racism In America.com. As the largest racial minority in the United States, blacks make up approximately 13.2% of the population, but have a spending power of over one-trillion dollars. So why is it that Blacks have the lowest net worth of all racial classes?

During the Civil War, small banks were established throughout the country to be financially responsible for freed and runaway slaves’ deposits. However, many of those individuals lost their money because the banks “lost” their deposits. And after the Civil War, Blacks had practically no economic resources, access to capital, or entrepreneurial abilities, making it almost impossible to build, accrue, and pass on wealth. But in an attempt to financially assist soldiers and emancipated slaves with transitioning into “freedom,” Congress established the Freedman’s Saving and Trust Company–a financial institution for Blacks. The bank’s objective was to help Blacks “increase their financial strength.”

In the 21st century, many Blacks still don’t possess bank accounts, but instead rely on check cashing services, prepaid debit cards, and cash apps on their cell phones. Living an “all cash” lifestyle allows for more spending and less saving. However, because of the history of being financially defrauded, Blacks have grown to rely on tangible items to justify their finances. In other words, many of them feel more secure being able to see and spend their money instead of trusting a financial institution. Consequently, the more items bought and the more expensive items may be, signifies many Blacks’ interpretation of their net worth and status as opposed to what a savings account may reflect or indicate.

Studies have shown that managing: household expenses and budget, money and debt, investments, and to save for college education are areas that many Blacks aren’t financially literate.

In a 2013 survey, Prudential Research reported that 40% of Blacks considered themselves to be spenders, 51% savers, and only 9% that actually invest. To this date, Blacks only possess 5% of America’s wealth, oppose to Whites that own 61%, Asians 28%, and Hispanics 6%.

Therefore, the real reason why Blacks spend their money and don’t save is because systematic racism prevented them from safely investing in banks, and is currently impacting their ability to own property, land, or businesses, thus leaving them with nothing to pass down to future generations. They were forced into a mindset of poverty–spend now before it’s gone, impacting them generationally. Historical experiences blinded Blacks from recognizing the importance of financial literacy and because of their monetary ignorance, blacks possess the least amount of wealth in America.

I decided to post this article as a clear example of how, in this case, this Black person spends his money. Why do many Black folks feel the need to flaunt their money? In many cases, what’s “money” to them, is “small change” to people in other ethnic groups. I’m not a psychologist, but it is an interesting question to ponder. The previous 1954 video on Black consumers shopping and spending habits may shed some answers.

A recent report from Nielsen, “The Increasingly Affluent, Educated and Diverse,” explores the “untold story” of Black consumers, particularly Black households earning $75,000 or more per year. According to the report, Black people in this segment are growing faster in size and influence than whites in all income groups above $60,000. And as Black incomes increase, their spending surpasses that of the total population in areas such as insurance policies, pensions and retirement savings.

According to Nielsen, “African-American households spend more on basic food ingredients and beverages and tend to value the food preparation process, spending more time than average preparing meals. Other popular buying categories include fragrances, personal health and beauty products, as well as family planning, household care and cleaning products.”

The authors of this report emphasize that as the social and cultural clout of the Black consumer is on the ascendancy, it is incumbent upon advertisers and marketers of consumer brands to develop a long-tern game with the Black community.

As The Atlantic notes, Black buying power is expected to reach $1.2 trillion this year, and $1.4 trillion by 2020, according to the University of Georgia’s Selig Center for Economic Growth.

LetsBuyBlack365 is a national grassroots movement that utilizes the online community and local networking to harness Black buying power, with a goal to create jobs and resources to help Black people.

A few years ago we updated our original post with some information from an article written in September 2013, by Stacy M. Brown posted on the Washington Informer.com website titled, “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars.” In that article, Ms. Brown writes, “If black America counted as an independent country, its wealth would rank 11th in the world. However, African Americans continue to squander their vast spending power, relegating blacks to economic slavery instead of financial freedom, according to several consumer reports detailing the use of cash in the black community.”

We also incorporated 2014 data from the Nielsen Company. If history is any indication of future behavior, this updated article will be hotly debated in 2018. Let’s hope that we can make some progress in this area and close the wealth gap.

Compared to all consumers, Black people as a group spend 30 percent more of their total income — even though we make $20,000 less than the average household. A whopping 87 percent of annual retail spending consists of Black consumers. But where does our money go? Hudson Valley Press Online gives us the scoop via an article from Nielsen’s SVP of public affairs and government relations, Cheryl Pearson-McNeil.

When it comes to shopping at the mall, we make eight more annual trips than any other group pulling in an average of 154 visits. Blacks also patronize dollar stores the most; we make seven more trips than the average group making a total of 20 trips. Lastly, Black Americans made more visits to convenience/gas stores by a small margin: making a total of 15 annual visits.

However, Black trips to grocery stores and warehouse clubs (like Costco) are a bit more scarce. “Less time is spent at grocery stores, with three fewer trips. The exception to grocery store shopping, though, is with Blacks who earn upwards of $100K annually. We also make three fewer trips to warehouse stores and two fewer trips to mass merchandisers than the total market. However, more upper-income Blacks (73%) shop at warehouse clubs than non-Blacks annually,” Pearson-McNeil said.

It could be that the lack of grocery stores and other healthy establishments in Black neighborhoods that contribute to this trend. This is why it’s not at all surprising that Black people frequent McDonald’s and Burger King more than other U.S. household.

What you probably won’t see in our carts are diary products such as milk and yogurt. “[T]his could be because many of us are lactose-intolerant,” Pearson-McNeil adds.

But probably the largest retail disparity between Blacks and other groups rests in the hair and beauty industry. We spend about nine times more on hair care and beauty products in comparison to other demographics. “In fact, 46% of Black households shop at Beauty Supply Stores and have an average annual total spend of $94 on products at these stores,” Pearson-McNeil says.

All the aforementioned figures were pulled from Resilient, Receptive, and Relevant: The African-American Consumer 2013 Report. With African Americans approaching $1 trillion buying power, one must wonder why aren’t marketers paying more attention to Black consumer trends.

** The average Black household contains 2.57 persons. In addition, Black households averaged 1.25 owned vehicles. Most of these households were renters, living in apartments or flats.8 Their dwellings averaged 5.45 rooms (including finished living areas and excluding all baths) and 1.49 bathrooms. Black households’ annual expenditures averaged $36,149, which was 79.8 percent of their average income before taxes. The amount spent on housing ($13,530) consumed the biggest portion of annual expenditures, accounting for more than one-third of the total. This was followed by transportation ($5,946) and food ($5,825). The remaining expenditures made up roughly 30 percent of total spending: personal insurance and pensions, healthcare, entertainment, cash contributions, apparel, and education, in addition to personal care, tobacco, alcohol, reading, and miscellaneous expenditures.

Black Americans are just 13 percent of the U.S. population, and yet, we’re on trend to have a buying power of $1.4 trillion by 2019. A new Nielsen study hints that marketers may want to start developing a better consumer-producer relationship with African Americans if they want to make big bucks.

Titled “The Multicultural Edge: Rising Super Consumers,” the report finds that the Black American sweet spot, in terms of buying power, lies in ethnic hair and beauty aids (surprise, surprise). Black American dollars make up a whopping 85.8 percent of the industry.

**Here are highlights of the spending patterns of low-income versus high-income Black households:

- On average, low-income Black households spent $16,627 in total annual expenditures, compared with high-income Black households who spent approximately $50,000 more.

- Housing was the biggest expenditure for both types of households. For the high-income Black households, housing was 34.2 percent of the total annual expenditure. For the low-income Black households, it was nearly half of the total annual expenditure, at 45.5 percent.

- Food was another large spending category for both types of households. However, it made up only 12.7 percent of total expenditures for high-income Black households, compared with 23.5 percent for low-income Black households.

- Transportation and personal insurance and pensions made up only 11.5 percent and 1.9 percent, respectively, of total expenditure for the low-income Black households. However, for the high-income Black households, these shares were 17.1 percent and 15.0 percent, respectively.

- Cash contributions, such as charitable donations, was a smaller expenditure category in which low and high-income Black households differed. Cash contributions were 2.1 percent for the low-income Black households and 4.6 percent for the high-income Black households.

- Among the remaining expenditure categories, alcoholic beverages, apparel and services, healthcare, entertainment, personal care, reading, education, and miscellaneous expenditures, low-income and high-income Black households had similar expenditure shares.

- Tobacco and smoking supplies was the only expenditure category in which low-income Black households spent both a higher share and a higher actual dollar outlay than their high-income counterparts. For low-income Black households, tobacco and smoking supplies was 1.5 percent ($248) of their total expenditure but made up only 0.3 percent ($218) of total expenditure for high-income Black households.13

Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), http://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

According to Nielsen:

- Blacks are more aggressive consumers of media and they shop more frequently.

- Blacks watch more television (37%), make more shopping trips (eight), purchase more ethnic beauty and grooming products (nine times more), read more financial magazines (28%) and spend more than twice the time at personal hosted websites than any other group.

- Blacks make an average of 156 shopping trips per year, compared with 146 for the total market. Favoring smaller retail outlets, blacks shop more frequently at drug stores, convenience stores, and Dollar stores.

- Beauty supply stores are also popular within the black community, as they typically carry an abundance of ethnic hair and beauty aids reside that cater specifically to the unique needs of black hair textures.

While the numbers indicate that Black folks are an important part of the buying public, companies spend just three-percent (3%) of their advertising budgets marketing to black consumers. According to Cheryl Pearson McNeil, a Vice President at Nielsen, “The Black population is young, hip and highly influential. We are growing 64 percent faster than the general market,” she explains.

While the numbers indicate that Black folks are an important part of the buying public, companies spend just three-percent (3%) of their advertising budgets marketing to black consumers. According to Cheryl Pearson McNeil, a Vice President at Nielsen, “The Black population is young, hip and highly influential. We are growing 64 percent faster than the general market,” she explains.

However, Noel King, a reporter for NPR’s Marketplace, cautions companies against trying to reach Black consumers without knowing our needs. “If you want to market to those groups, then you should know what particular group buys your stuff,” says King. “Blacks tend to spend more on electronics, utilities, groceries, footwear. They spend a lot less on new cars, alcohol, entertainment, health care, and pensions.”

Despite our collective buying power, statistical data reflects that much of that money is spent outside of the Black community and not with Black-owned businesses.

Compare these numbers about “dollar circulation” reported by the NAACP:

“Currently, a dollar circulates in Asian communities for a month, in Jewish communities approximately 20 days and white communities 17 days. How long does a dollar circulate in the Black community? 6 hours! Black American buying power is at 1.1 Trillion; and yet only 2 cents of every dollar blacks spend in this country goes to black owned businesses.”

If the “dollar circulation” data does not get your attention, consider the following information from an article written by financial expert Ryan Mack:

55 percent of Black Americans are unbanked or under-banked meaning they do not have a bank account or the appropriate bank account (Federal Deposit Corporation Survey)

- “About a quarter of all Hispanic (24 percent) and Black (24 percent) households in 2009 had no assets other than a vehicle, compared with just 6 percent of white households. These percentages are little changed from 2005.” (Pew Research)

- “The median amount Black households reported saving on a monthly basis is $189, compared to $367 among White households…. [This is] the first time in a decade that Black households have reported saving less than $200 per month.” (Ariel Investments 2010 Black Investor Survey)

- “Blacks on the average are six times more likely than Whites to buy a Mercedes, and the average income of a Black who buys a Jaguar is about one-third less than that of a White purchaser of the luxury vehicle.” Earl Graves, Black Enterprise Magazine

- Although Blacks make up 13-percent of the U.S. population, just seven-percent (7%) of small business are owned by Blacks. Access to capital, clientele, and other resources hinder many Black folks from starting business, despite a long history of entrepreneurship.

Highlights from “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars”:

- Blacks consistently outpace the total market population in overall growth, smart phone ownership, television viewing and annual shopping trips according to the new study, “Resilient, Receptive and Relevant: The African-American Consumer 2013 Report,” a collaborative effort by the Nielsen Company in New York and the National Newspaper Publishers Association (NNPA), located in Northwest Washington, D.C.

- Black buying power continues to increase, rising from its current $1.1 trillion level to a forecasted $1.3 trillion by 2017.

- Despite the strong economic outlook, Blacks continue to spend most of their money outside of the Black community and, according to Nielsen and NNPA, advertisers have repeatedly slighted the black media, spending only three percent, or $2.24 billion, of the $75 billion spent with all media last year.

- Each year, Blacks spend more than $47 billion on Lincoln automobiles, $3.7 billion on alcohol, $2.5 billion on Toyotas, $2 billion on athletic shoes, and $600 million each year on McDonald’s and other fast foods, according to Target Market News Inc., a Chicago-based marketing research group.

- Blacks also spend wildly to keep up their appearances. The black hair care and cosmetics industry counts as a $9 billion a year business, but while African Americans are spending the most, they are profiting the least, said officials from the Black Owned Beauty Supply Association (BOBSA) in Palo Alto, Calif. Beauty product lines designed for African Americans were once 100 percent owned and operated by blacks, today other ethnic groups control more than 70 percent of the market.

- The current homeownership rate reveals that 73.5 percent of whites own homes while approximately 43.9 percent of Blacks are homeowners, according to the Harvard Joint Center for Housing Studies State of the Nation report for 2013.

- Sixty percent of Blacks have less than $50,000 saved in company retirement plans and only 23 percent have more than $100,000.

The loyalty Blacks have to their church also has proven costly, said officials at Faith Communities Today, a nonprofit based in Hartford, Conn. A 2013 study revealed that Black churches have collected more than $420 billion in tithes and donations nationwide since 1980, an average of $252 million a week.

“What people fail to see and understand is that, the church pastors aren’t waiting for miracles to fund their lifestyles, they don’t have to pray, day in and day out, to make their ends meet,” said Northwest resident and author, Byron Woulard. They are getting rich off God, not from God,” he said. Woulard, whose books include, the 2011, “Pawn Queen,” noted that the money spent tithing could buy as many as 93,333 homes valued at $150,000; pay for tuition up to $15,000 a year for 933,333 college students, and feed every homeless American for a year. “It’s the best hustle on the planet. If you don’t get it here on earth, you’ll get it when you die and go to heaven,” Woulard said. “And, it just so happens that not one person in the history of this planet has died, went to heaven, and come back to tell everyone that it’s true.”

Rich Blacks vs. Poor Blacks: Income and Spending Patterns

Data from the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey provide information on annual household spending. Looking at demographic subgroups of the population can provide a deeper understanding of consumption preferences and spending behavior for a particular group. Using data from the CE Survey, the following charts compares and contrasts the spending patterns of low-income Black households to their high-income counterparts.

Data from the U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey provide information on annual household spending. Looking at demographic subgroups of the population can provide a deeper understanding of consumption preferences and spending behavior for a particular group. Using data from the CE Survey, the following charts compares and contrasts the spending patterns of low-income Black households to their high-income counterparts.

| Category | All Black

households |

High-income Black

households |

Low-income Black

households |

|---|---|---|---|

| Total average annual expenditures | $36,148.98 | $67,114.17 | $16,627.29 |

| Tobacco and smoking supplies | $239.06 | $218.26 | $248.34 |

| Housing | $13,529.96 | $22,956.40 | $7,569.19 |

| Total food | $5,825.34 | $8,514.41 | $3,910.12 |

| Transportation | $5,945.94 | $11,469.17 | $1,915.35 |

| Personal insurance and pensions | $3,678.55 | $10,043.75 | $315.33 |

| Cash contributions | $1,347.50 | $3,081.13 | $349.31 |

| Healthcare | $1,794.27 | $3,240.21 | $689.57 |

| Apparel and services | $1,000.48 | $1,907.43 | $474.05 |

| Education | $503.25 | $1,354.23 | $190.31 |

| Entertainment | $1,362.24 | $2,485.95 | $635.57 |

| Personal care | $318.71 | $645.89 | $117.30 |

| Reading | $45.22 | $97.22 | $12.86 |

| Alcoholic beverages | $168.09 | $329.53 | $95.40 |

| Miscellaneous expenditure | $390.37 | $770.58 | $104.60 |

The only category which low-income Black households were not outspent was tobacco and smoking supplies. This particular statistic supports the phenomenon that tobacco tends to be a higher share of total expenditures for those with lower income as compared to those with higher income.

Source: Reginald A. Noël, “Income and spending patterns among Black households,” Beyond the Numbers: Prices & Spending, vol. 3, no. 24 (U.S. Bureau of Labor Statistics, November 2014), https://www.bls.gov/opub/btn/volume-3/income-and-spending-patterns-among-black-households.htm

Click Here To Change Your Life and Purchase This DVD “Generation One: The Search For Black Wealth” Now!

Stacy M. Brown’s article posted on the Washington Informer.com website concludes with what is described as an inescapable fact: When black folks make money, they are quick to spend it!

According to Dr. Boyce Watkins, a Scholar in Residence in Entrepreneurship and Innovation at Syracuse University in New York, also known as “the people’s scholar,” “We don’t use money to invest or produce,” said Watkins, 42.” When we get our tax refund, we go straight to the store.”

The 17th annual report on “The Buying Power of Black America” also includes a dollar-by-dollar breakdown of the Black economy.

Copies of “The Buying Power of Black America” can be purchased from Target Market News. For more information call 312-408-1881, or click here to purchase online.

Below is our original article posted in November 2010. Have their been any improvements? You be the judge.

“How Do Black People in America Spend $507 Billion Dollars Annually?”

With $836 Billion in Total Earning Power, only $321 Million Spent on Books while $7.4 Billion Spent on Hair and Personal Care Products and Services

New ‘Buying Power’ report shows black consumers spend as economy improves

New 16th edition shows expenditures rise to $507 billion

(November 1, 2010) African Americans consumers are cautiously increasing their spending in some key product categories, even as they continue to make adjustments in a slowly growing economy. The finding comes from the soon to be issued 16th annual edition of “The Buying Power of Black America” report.

In 2009, Black households spent an estimated $507 billion in 27 product and services categories. That’s an increase of 16.6% over the $435 billion spent in 2008. African-Americans’ total earned income for 2009 is estimated at $836 billion.

The report, which is published annually by Target Market News, also contains data that reflect the economic hardships all consumers are facing. There were significant declines in categories — like food and apparel — that have routinely shown growth in black consumers’ spending from year-to-year.

“These latest shifts in spending habits are vital for marketers to understand,” said Ken Smikle, president of Target Market News and editor of the report, “because they represent both opportunities and challenges in the competition for the billions of dollars spent by African-American households. Expenditures between 2007 and 2008 were statistically flat, so black consumers are now making purchases they have long delayed. At the same time, they re-prioritizing their budgets, and spending more on things that add value to their homes and add to the quality of life.”

The median household income for Blacks dropped by 1.4% in 2009, but because of students going out on their own, and couples that started their lives together, the number of black households grew 4.2%. This increase meant that many household items showed big gains. For example, purchases of appliances rose by 33%, consumer electronics increased 33%, household furnishings climbed 28%, and housewares went up by 37%.

Estimated Expenditures by Black Households – 2009

| Apparel Products and Services | $29.3 billion |

| Appliances | 2.0 billion |

| Beverages (Alcoholic) | 3.0 billion |

| Beverages (Non-Alcoholic) | 2.8 billion |

| Books | 321 million |

| Cars and Trucks – New & Used | 29.1 billion |

| Computers | 3.6 billion |

| Consumer Electronics | 6.1 billion |

| Contributions | 17.3 billion |

| Education | 7.5 billion |

| Entertainment and Leisure | 3.1 billion |

| Food | 65.2 billion |

| Gifts | 9.6 billion |

| Health Care | 23.6 billion |

| Households Furnishings & Equipment | 16.5 billion |

| Housewares | 1.1 billion |

| Housing and Related Charges | 203.8 billion |

| Insurance | 21.3 billion |

| Media | 8.8 billion |

| Miscellaneous | 8.3 billion |

| Personal and Professional Services | 4.1 billion |

| Personal Care Products and Services | 7.4 billion |

| Sports and Recreational Equipment | 995 million |

| Telephone Services | 18.6 billion |

| Tobacco Products | 3.3 billion |

| Toys, Games and Pets | 3.5 billion |

| Travel, Transportation and Lodging | 6.0 billion |

Source: Target Market News,

“The Buying Power of Black American – 2010”

“The Buying Power of Black America” is one of the nation’s most quoted sources of information on African-American consumer spending. It is used by hundreds of Fortune 1000 corporations, leading advertising agencies, major media companies and research firms.

The report is an analysis of consumer expenditure (CE) data compiled annually by the U.S. Department of Commerce. The CE data is compiled from more than 3,000 Black households nationally through dairies and interviews. This information is also used for, among things, computing the Consumer Price Index.

The report provides updated information in five sections:

– Black Income Data

– Purchases in the Top 30 Black Cities

– Expenditure Trends in 26 Product & Services Categories

– The 100-Plus Index of Black vs. White Expenditures

– Demographic Data on the Black Population

According to Forbes magazine, Floyd Mayweather, Jr., made more than $420 million in 2015. He is the highest paid athlete in the world.

Click here to read how Floyd Mayweather, Jr. spends his money.

Portions of this article came from Clutch Mag online.

Here’s a great resource to Black wealth:

Black Wealth 2020, a movement, aims to unite some of the most historic national economic, civic and civil rights organizations with a goal to impact economic outcomes in Black America through the year 2020. The group’s three-pronged strategy is to significantly increase the number of Black homeowners, strong Black-owned businesses and deposits in Black banks.

If you want to educate yourself and others about how to earn and spend your money responsibly, read the book, Black Dollars Matter: Teach Your Dollars How to Make More Sense, by James Clingman. Clingman is a friend to this site. He’s also the founder of the Greater Cincinnati African American Chamber of Commerce and the nation’s most prolific writer on economic empowerment for Black people. He can be reached through his website, www.blackonomics.com. Black Dollars Matter: Teach Your Dollars How to Make More Sense is available through the website www.professionalpublishinghouse.com and Amazon Kindle e-Books.

There is a great organization called World of Money. Founded in 2005, the World of Money is a New York City based 501(c)(3) non-profit organization whose mission is to empower youth through the engaged, local delivery of professional quality financial education. World of Money Founder and CEO, Sabrina Lamb, while attending a financial planning seminar, was inspired by a compelling question. Are children, in the course of their education and upbringing, getting this information on how to manage their financial life? After conducting some research on the subject, Ms. Lamb found that the answer to her question was a resounding “no”. So, after affirming the detrimental effects of this knowledge gap, she set forth to leverage her experience as an entrepreneur and love of working with children to create World of Money. Click here to visit their website and learn more.

There are already over 35 Black owned banks and credit unions in the United States where you can put your money if you find these type of efforts for financial stability and reinvestment in the black community important.

Check out the list below!

- Omega Psi Phi Credit Union – Lawrenceville, Georgia

- Phi Beta Sigma Federal Credit Union – Washington, DC

- One United Bank – Los Angeles,California

- FAMU Federal Credit Union – Tallahassee, Florida

- Credit Union of Atlanta – Atlanta, Georgia

- North Milwaukee State Bank – Milwaukee, Wisconsin

- Seaway Bank – Chicago, Illinois

- The Harbor Bank- Baltimore, Maryland

- Liberty Bank – New Orleans, Louisiana

- United Bank of Philidelphia – Philidelphia, Penn

- Alamerica Bank – Birmingham, Alabama

- Broadway Federal Bank – Los Angeles, California

- Carver State Bank – Savannah, Georgia

- Capital City Bank – Atlanta, Georgia

- Citizens Trust Bank – Atlanta, Georgia

- City National Bank – Newark, New Jersey

- Commonwealth National Bank – Mobile, Alabama

- Industrial Bank – Washington D.C.

- First Tuskegee Bank – Tuskegee, Alabama

- Mechanics & Farmers Bank – Durham, North Carolina

- First Independence Bank – Detroit, Michigan

- First State Bank – Danville, Virginia

- Illinois Service Federal – Chicago, Illinois

- Unity National Bank – Houston, Texas

- Carver Federal Savings Bank – New York, New York

- OneUnited Bank – Miami, Florida

- OneUnited Bank – Boston, Massachusetts

- Tri-State Bank – Memphis, Tennesse

- Citizens Bank – Nashville, Tennessee

- South Carolina Community Bank – Columbia, South Carolina

- Columbia Savings and Loan – Milwaukee, Wisconsin

- Liberty Bank – Baton Rouge, Louisiana

- Liberty Bank – Kansas City, Missouri

- Citizen Trust Bank – Birmingham, Alabama

- Liberty Bank – Chicago, Illinois

- Liberty Bank – Jackson, Mississippi

- Toledo Urban Credit Union – Toledo, Ohio

- Hill District Credit Union – Pittsburgh, Pennsylvania

Are you currently putting money in a Black owned bank? Leave any testimonials you have below!

Photo credit: Couple counting money — Image by © Jose Luis Pelaez Inc/Blend Image/Blend Images/Corbis

** Sources: U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure (CE) Survey, http://racisminamerica.org/the-real-reason-why-blacks-spend-their-money-and-dont-save/, CNN, Harvard Business Review, http://curatorsofdopenessblog.tumblr.com/post/72870270050/black-money-white-money

Here’s another related and informative article on black spending.

How Blacks’ Dollars Cn Achieve Black Power by William Reed

By William Reed (Posted June 12, 2017)

What is your view of black economic development? Most blacks say they are tired of being slighted and disrespected; yet the majority of us ignore tried and true capitalistic practices that would improve the race’s poor economics. It’s too bad there’s no accumulation of Blacks oriented toward race-based economic empowerment and wealth building. Black people collectively pooling economic resources aren’t the “wishful thinking” that many suggest. The thing we need to recognize is “to do for self‘”. When blacks across the nation make economic growth and development functioning realities collectively practicing means and methods that create jobs and opportunities we will be well on our way to respect and admiration.

It is generally accepted that there’s been progress for black Americans over the last 60 years, yet our overall status is bleak. Too many blacks are focused to rid the country of “white supremacy”. Black politicians and civil rights “leaders” boast that they’ve gotten blacks to 72 percent parity with whites. Truth is whites have “superior” understandings and adaptations of capitalistic procedures. Blacks must “stay awake” to more than partisan politics. Even as our poverty and unemployment rates continue to be higher than whites’, it’s a challenge to get most blacks to see benefits that can accrue if we come together and do more financially for betterment of our communities.

Black buying power is currently $1.3 trillion according to a Nielsen and National Newspaper Publishers Association Report.” With such money and buying power blacks should be utilizing methods and practices that circulate those dollars to Black owned initiatives. Each of us should look at our own actions and practices that keep us from spending substantial portions of money we get with Black-owned businesses. Why do we not deposit in Black-owned banks when doing this enables black financial institutions to fund our projects, goods and services.

To “be equal” in American society, blacks must learn how to build business/investments, hold onto it and pass it on. Some skeptical blacks must see the value in spending their money with our businesses. More blacks must “do more for self” to bring about Black Economic Power.” The prevailing “Black Leadership” has its focus on partisan politics and elusive “’racial harmony”. When will blacks learn that it’s imperative for concerned individuals, groups, organizations, churches and businesses push vital black financial and entrepreneurial cooperation to turn around disproportionate negative conditions that continue in Black communities?

Opportunities exist across the nation for black individuals, their organizations, churches, lodges, frats and entrepreneurs to provide educational programs, workshops and business conferences that teach and show people how and why to do for self. America needs local black leadership demonstrating the power of the black dollar and increase community awareness to recycle dollars within our community, by banking with black-owned banks and buying from black businesses. The solution to the high unemployment and income inequality black communities must come from us. It includes development of black businesses. Local or national groups, be them small or large: the thing is to do for self. If we are serious about tackling unemployment in our community, the quickest fix is to start financially supporting Black-owned businesses. Too many blacks rely on getting whites to remedy their financial problems. Data suggests that if African-Americans invested more money in Black-owned businesses, these businesses would be sources of employment for more of us.

The stand we suggest all blacks adopt is empowering the black community toward taking control and redirecting its wealth and investments. Blacks need more education on consuming and capitalism. More blacks must establish locations where people come and learn economic and financial principles on how to create and sustain Black businesses where they live. Let’s more of us hold power networking conferences for training and networking to bolster and educate Blacks. We all have to engage what we know and have toward operational unity. Enterprising individuals and organizations can sponsor regular business networking socials and gatherings. Do them at Black-owned establishments. Be sure to invite blacks in banking. Those provide opportunities for entrepreneurial blacks to meet one another, exchange ideas and partner.

William Reed is publisher of “Who’s Who in Black Corporate America” and available for projects via Busxchng@his.com

Click Here To Read The Entire Updated Article

The series of articles and versions of “How Do Black People Spend Their Money?” contain opinions from outside sources not affiliated with Black Men In America.com. This series is for information and educational purposes only. The opinions and views expressed do not necessarily reflect the opinions and views of Gary Johnson, Black Men In America.com or any of its affiliates.

Gary is the Founder and Publisher of Black Men In America.com, an online news and magazine, Black Boating and Yachting.com and several other online sites. Gary is also the author of the book “25 Things That Really Matter In Life,”: A Quick and Comprehensive Guide To Making Your Life Better—Today! and “The Black Father Perspective: What We Want America To Know,” and “In Search of Fatherhood – Transcending Boundaries: International Conversations on Fatherhood.“ In 2019, Gary developed a line of spices under the name of “MasterChef Gary’s Premium Organic Seasoning.” In 2021, Gary launched a motivational website and talk show called “Calculations.“ For motivational content and exclusive interviews with interesting people, visit Calculations Talk Show.com. In his spare time, Gary uses his platform to help the Black Farmers of America. He built the website Justice for Black Farmers to help educate others about the plight of the Black Farmer and their fight against the U.S. Department of Agriculture.

Scroll down and leave a comment. Tell us what you think.

Don’t Lose The War Of The Mouth by Dr. Fredrick Clark

Dr. Fredrick D. Clark is not your average dentist. Dr. Clark is an “Oral Physician” and dental child care advocate who is on a mission. According to Dr. Clark, dental care cannot be relegated to the “out of sight, out of mind” category if one wishes to retain their teeth.

One of the primary reasons many of us do not get dental care is a lack of perceived need. Unfortunately the need may be present in spite of the absence of pain or apparent symptoms. Don’t loose the daily battles out of fear or apprehension, neglect or thinking that you know everything about your own teeth; you don’t. Only your dentist knows for sure. Don’t loose the war of the mouth.

Dr. Clark sat down with me for an impromptu exclusive video interview about preventive dental care. Please watch the video below and forward it to all of your friends and family.

By Fredrick D. Clark, D.D.S.

The battle is engaged. The combatants are tiny, but the war will be waged for decades. Unfortunately, it is a war, which will have many casualties. This is the war of the mouth. The enemy is PLAQUE, a colony or groups of numerous bacteria that live in the oral cavity. They are the culprits behind the many problems we experience with our mouths over the years. The battle begins with the eruption of the first tooth.

Plaque begins to attack the teeth and gums in our infancy and continues throughout childhood, teen years, adulthood and old age. We cannot see the enemy (plaque) until an appreciable amount builds up on the teeth and even then, it appears benign.

It does not hurt, in fact may even be unnoticeable, but it can lead to horrific consequences if left unchecked. Bad breath (halitosis), tooth decay (cavities), gingivitis (gum swelling, bleeding), periodontal disease (destruction of gum and bone) which causes tooth loss; all of these conditions are caused by the presence of plaque.

The teeth are just one part of a larger system, which includes the teeth and its supporting structures, the gums, the jawbones and the periodontal ligaments, (which hold the teeth to the bone). Collectively; this system is called the PERIODONTIUM.

Thus, all of the above mentioned conditions are diseases of the periodontium. The war I speak of is relentless and many of us lose the daily battles because it goes on painlessly. By the time one complains of a toothache, the damage is sometimes too extensive to save the tooth. Most people are familiar with cavities because they start at an early age in most children. There are a few things we can do to prevent cavities such as adequate brushing, daily flossing and most importantly, professional dental cleanings and checkups. This is a two-fold approach of (1), home care and (2), help from your Dental Professional in early detection and treatment.

I like to relate cavities to a concept most can understand; a cavity is like a cancer growing in which if left untreated will get larger and eventually destroy the tooth. Not only can it get larger but can cause immense pain, jaw swelling, abscesses, pus formation; and, the longer you wait the worse it gets. The results of many years of neglect is what causes people to require expensive dental care such as root canals, caps or crowns, extractions and dentures. Before it is too late, schedule an appointment with your dental professional; an ounce of prevention is worth a pound of cure. Learn how to win the battle of the mouth. You can keep your teeth for a lifetime; the key to keeping your teeth is early detection and treatment long before the problem becomes painful.

Dental care cannot be relegated to the out of sight, out of mind category if one wishes to retain their teeth. One of the primary reasons many of us do not get dental care is a lack of perceived need. Unfortunately the need may be present in spite of the absence of pain or apparent symptoms. Don’t lose the daily battles out of fear or apprehension, neglect or thinking that you know everything about your own teeth; you don’t. Only your Dentist knows for sure. Don’t loose the war of the mouth.

Dr. Fredrick Clark is an “Oral Physician” and dental child care advocate. Dr. Clark specializes in “scaredy cat” patients. He provides a relaxing and friendly office environment at his Prince George’s County, MD office located at 6188 Oxon Hill Road, Oxon Hill, MD. Please call the office at 301-567-9372.

The Facts About Welfare by Gary A. Johnson

March 2016

By Gary A. Johnson, Black Men In America.com Staff

Posted March 12, 2016

I was in the check-out line in the grocery store today. Let me set the scene. Friday evening during the 5:00 pm hour. In my view, there were not enough Cashier’s so the lines were long. There was a young black woman in front of me with an infant baby and a full cart of groceries. (I can hear some of you yelling at me now: “C’mon Gary, what does their race have to do with anything? You always see things through a racial prism). That is correct. Read the entire story and then decide if you want to put me on blast).

The check out process was slowed because the young woman was using a several vouchers. The Cashier had to stop periodically and process the vouchers one at a time after scanning certain items. Some of the scanned items had to be removed because they could not be purchased with a particular voucher. At one point our line did not move for minutes because of this voucher activity. There were two middle age black women behind me who were pissed! They starting making comments that could be heard by anyone within a 25-foot radius. This is some of what I heard from the two women in line behind me: “What the hell is the hold up?” “Looks like she got some vouchers.” “Damn, how long is it going to take to process this welfare queen?” “You see that purse? “That doesn’t look like welfare to me.” “I wonder how many more kids she has at home.” “I bet she’s driving a nice car.” “Those people are always gaming the system.”

Wow! I ignored the first couple of statements hoping they ladies would either stop talking or at least lower their voice. That didn’t happen. I was trying to figure out a way to add some calm to this situation without causing an incident. The last thing I needed on a Friday afternoon was a scuffle in the grocery store with three women over welfare.

The young woman heard the comments. She appeared to be upset that she could not get the Cashier to process the vouchers faster. The cashier had to scan the items and then insert the voucher into a machine and then the woman had to sign her name on the back of the voucher. None of this was electronic. This process was repeated five times. At one point the young woman turned to me and said, “I’m sorry.” I smiled and replied loudly, “Handle your business young lady, I’m not in a hurry.” I stared at the baby and was reminded that I have a granddaughter around the same age. That’s when I decided to strike up a conversation with the woman. I asked if that was her daughter. She replied, “Yes,” (with pride). I told her that her daughter was a “cutie pie” and very well-behaved. That young woman is somebody’s daughter or granddaughter. She’s someone who matters to someone.

The two women behind me were still sighing out loud and making comments about how the line is not moving because of this woman and her vouchers. For the record, at no point did I think the two women behind me were “bad people.” I thought they were grossly misinformed about the facts about people who receive welfare benefits.

Many people feel ashamed and scrutinized because of the myths and stereotypes that exist about people on welfare. Need-based assistance in the U.S. — such as Women, Infants and Children (WIC), the Supplemental Nutrition Assistance Program (SNAP, or food stamps) and Temporary Assistance for Needy Families (TANF) — is often subject to public scrutiny, causing those who receive it to feel shame. These stereotypes are so strong and have been around for so long that even black people have bought into them. These statements are not based on the facts.

Last year Gene Alday, a Republican member of the Mississippi state legislature, apologized for telling a reporter that all the African-Americans in his hometown of Walls, Mississippi, are unemployed and on food stamps. “I come from a town where all the blacks are getting food stamps and what I call ‘welfare crazy checks,'” Alday said to a reporter for The Clarion-Ledger, a Mississippi newspaper. “They don’t work.”

Let’s look at the data and analyze the FACTS.

Nationally, most of the people who receive benefits from the Supplemental Nutrition Assistance Program are white. According to 2013 data from the U.S. Department of Agriculture, which administers the program, 40.2 percent of SNAP recipients are white, 25.7 percent are black, 10.3 percent are Hispanic, 2.1 percent are Asian and 1.2 percent are Native American.

The SNAP program is one of the nation’s largest welfare programs. The U.S. Department of Agriculture (USDA) recently reported that the program has gone from 17 million recipients in 2000 to almost 47 million last year. Earlier this year, it was reported that one in five children in the U.S. now relies on food stamps for at least some meals each day.

About 7 months ago, more than 30 people were arrested for food stamp fraud in the North Country of Brushton, NY. All of the people arrested were white. Investigators reported that people used their food stamps to get food or alcohol at the Old Time Butcher Block store in Brushton.

Let me highlight what I believe are several common myths about welfare recipients and introduce some facts and data that I think will help us all gain a better understanding of the program.

Myth #1: Welfare recipients are often characterized as lazy, simply waiting for the next month’s benefits.

Fact: 73% of people receiving public benefits are members of working families. Even though welfare recipients are in the labor force, they aren’t earning enough money to support a family and provide food for their children and pay bills, such as rent and utilities.

Myth #2: Welfare recipients are mostly people of color.

Fact: 40% of SNAP recipients are white, making white people the largest racial group on food stamps. When it comes to TANF recipients, approximately 30% are white, 30% are Latino and 30% are black, with several other racial groups making up the remaining 10% of recipients.

Myth #3: Undocumented populations are stealing welfare benefits from citizens.

Fact: Undocumented populations are ineligible for all welfare programs, except emergency medical care. “It’s illegal to afford public benefits of the TANF or food stamp variety to undocumented immigrants … who have not been in this country for a situated amount of time as legal residents. For example, food stamps are only available to immigrants with legal status who have lived in the country for five years, are receiving disability-related assistance or are under 18 years old. Some programs also allow states to make their own guidelines for immigrant populations, leading to disparities in assistance from state to state.

Myth #4: People are getting rich off of welfare.

Fact: No one is getting rich off of welfare. Welfare benefits are modest. The average benefit of the SNAP program, formerly known as Food Stamps is $1.50 per meal. Can you adequately feed yourself on that small amount of money? Similar to SNAP, most other government assistance programs seek to provide only the barest minimum amount of help that an individual or family needs to survive.

Myth #5: Welfare doesn’t work.

Fact: Government assistance is extremely effective at helping people get out of—and stay out of—poverty. In 2013, food stamps helped lessen the burden of poverty for 4.8 million people.

Many people fall on hard times and receive welfare benefits until their situation improves. Some of those people are decorated war veterans, educators and hard working people who don’t earn enough money to support their families. Government assistance in the form of childcare resources have helped a single mother or father keep their family together during an illness. None of us knows when life will throw us a pitch that we can’t hit and we may need help from the government. Any one of us may need to rely on welfare at some point in our lives. Some people on welfare are hard-working and talented people who fell on hard times through no fault of their own. Realizing this is just one important step to building empathy and understanding for those who are less fortunate than us. I am blessed beyond measure. I am thankful for those blessings and do not take them for granted. The reality is that there are millions of people who truly need these government programs to help them get back on their feet. And you never know—someday, we might be one of “those people.”

Gary A. Johnson is the Founder of Gary A. Johnson Company & Associates, LLC, a management training and consulting company. The company manages a variety of Internet and digital media enterprises including Black Men In America.com, one of the most popular web sites on the Internet, Black Men In America.com Dating and the Black Men In America.com Syndicated Blog. In addition, the company manages Homework Help Page.com, an educational resource site for children, college students and parents.

To learn more about Gary click here.

10 Worst Mistakes People Make After Retirement

March 5, 2016

By Gary A. Johnson, Founder & Publisher – Black Men In America.com

“I’ve worked years for my money…now it’s time for money to work for me.” – Gary Johnson

Thanks to our new contributor Mr. Free Spirit, all of us at Black Men In America.com have a heightened sense of awareness about what it takes to live a “good life” after you retire. Money mistakes are a common learning experience from which we can all grow, but when you are already in your retirement phase, the results can be a little more catastrophic. It’s much easier to recover from mistakes when you are younger but retirees are depending on that nest egg and their ability to replenish savings is greatly diminished.

I listed the 10 Worst Mistakes People Make After Retirement. If you want more detail pertaining to a particular “mistake” simply click on the link to read more information:

- Not Changing Lifestyle After Retirement

- Failing to Move to More Conservative Investments

- Applying for Social Security Too Early

- Spending Too Much Money Too Soon

- Failure To Be Aware Of Frauds and Scams

- Cashing Out Pension Too Soon

- Not Being Effective Tax-Wise During Retirement

- Supporting Adult Working Children

- Being House-Rich but Cash-Poor

- Not Staying Active Socially and Physically

I also discovered a Senior Living Archives that you might find helpful. Between this archives section and our archives of Mr. Free Spirit you have a pool of relevant articles and tips on how to prepare for your retirement, maximize the quality of your life and how to get the most out of your money.

Here are a few articles worth reading.

Do you have any retirement related comments, advice or stories? If so, scroll down to the bottom of the page and share them in our “Comments” section.

Source: The Financial World.com

Couple counting money — Image by © Jose Luis Pelaez Inc/Blend Image/Blend Images/Corbis

Publicly Shaming Your Kid With A Bad Haircut: Good or Bad?

By Black Men In America.com Staff (Posted February 20, 2015)

Is giving your kid a “George Jefferson” or “Benjamin Button” old man haircut good a deterrent to bad behavior or psychologically damaging? Atlanta Barber Russell Frederick says he tested the unique disciplinary technique on his own son, Rushawn, last fall, and his grades “dramatically skyrocketed” after his old-man haircut. Three days a week, parents can take their misbehaving kids to A-1 Kutz and ask for the “Benjamin Button Special,” which Russell Frederick and his team of barbers are offering — free of charge — to parents who want to try a novel form of discipline.

But you don’t have to be bad to get a free haircut. Frederick runs a family-friendly establishment. Kids can play free video games onsite and top students who bring their honor roll report cards get free haircuts.

As for the potential negative impact such shaming tactics could have on a child’s long-term emotional development, Frederick isn’t convinced. “We’re raising a soft generation,” he said. “You can’t whoop them, then you wonder why these kids [are] running out here … getting shot by the police. Everybody sees that incident and says it starts at home. Well, how can it start at home when you won’t even let these parents discipline their kids and raise their kids properly?”

What do you think? Is this good or bad for young black boys?

Portions of this report came from The Washington Post and Creative Loafing of Atlanta.

How Do Black People Spend Their Money?

Originally posted on November 5, 2010. Updated December 31, 2014.

As we look at the year in review, this article has been the most read and commented article for 4 years running. Once I learned that this was the most popular and discussed article on the website, two questions immediately came to my mind:

- What does that say about the topic in terms of being relevant to our site visitors?

- Has anything changed?

How black people spend their money has been a hotly debated topic not only on this site, but in our office, at social events and in beauty and barber shops across America.

We’ve updated our original post with some information from an article written in September 2013, by Stacy M. Brown posted on the Washington Informer.com website titled, “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars.” In that article, Ms. Brown writes, “If black America counted as an independent country, its wealth would rank 11th in the world. However, African Americans continue to squander their vast spending power, relegating blacks to economic slavery instead of financial freedom, according to several consumer reports detailing the use of cash in the black community.”

We also incorporated 2014 data from the Nielsen Company. If history is any indication of future behavior, this updated article will be hotly debated in 2015. Let’s hope that we can make some progress in this area and close the wealth gap.

Happy New Year!

Gary Johnson, Founder & Publisher – Black Men In America.com

According to a recent study by the Nielsen Company, African Americans will have $1.1 trillion in collective buying power by 2015 (increasing to about $1.3 trillion by 2017), making black spending more relevant than ever as a consumer group.

According to Nielsen:

- Blacks are more aggressive consumers of media and they shop more frequently.

- Blacks watch more television (37%), make more shopping trips (eight), purchase more ethnic beauty and grooming products (nine times more), read more financial magazines (28%) and spend more than twice the time at personal hosted websites than any other group.

- Blacks make an average of 156 shopping trips per year, compared with 146 for the total market. Favoring smaller retail outlets, blacks shop more frequently at drug stores, convenience stores, and Dollar stores.

- Beauty supply stores are also popular within the black community, as they typically carry an abundance of ethnic hair and beauty aids reside that cater specifically to the unique needs of black hair textures.

While the numbers indicate that Black folks are an important part of the buying public, companies spend just three-percent (3%) of their advertising budgets marketing to black consumers. According to Cheryl Pearson McNeil, a Vice President at Nielsen, “The Black population is young, hip and highly influential. We are growing 64 percent faster than the general market,” she explains.

However, Noel King, a reporter for NPR’s Marketplace, cautions companies against trying to reach Black consumers without knowing our needs. “If you want to market to those groups, then you should know what particular group buys your stuff,” says King. “Blacks tend to spend more on electronics, utilities, groceries, footwear. They spend a lot less on new cars, alcohol, entertainment, health care, and pensions.”

Despite our collective buying power, statical data reflects that much of that money is spent outside of the Black community and not with Black-owned businesses.

Compare these numbers about “dollar circulation” reported by the NAACP:

“Currently, a dollar circulates in Asian communities for a month, in Jewish communities approximately 20 days and white communities 17 days. How long does a dollar circulate in the Black community? 6 hours! Black American buying power is at 1.1 Trillion; and yet only 2 cents of every dollar black spend in this country goes to black owned businesses.”

If the “dollar circulation” data does not get your attention, consider the following information from an article written by financial expert Ryan Mack:

55 percent of African Americans are unbanked or under-banked meaning they do not have a bank account or the appropriate bank account (Federal Deposit Corporation Survey)

- “About a quarter of all Hispanic (24 percent) and black (24 percent) households in 2009 had no assets other than a vehicle, compared with just 6 percent of white households. These percentages are little changed from 2005.” (Pew Research)

- “The median amount Black households reported saving on a monthly basis is $189, compared to $367 among White households…. [This is] the first time in a decade that African-American households have reported saving less than $200 per month.” (Ariel Investments 2010 Black Investor Survey)

- “Blacks on the average are six times more likely than Whites to buy a Mercedes, and the average income of a Black who buys a Jaguar is about one-third less than that of a White purchaser of the luxury vehicle.” Earl Graves, Black Enterprise Magazine

- Although Blacks make up 13-percent of the U.S. population, just seven-percent (7%) of small business are owned by Blacks. Access to capital, clientele, and other resources hinder many Black folks from starting business, despite a long history of entrepreneurship.

Highlights from “Big Spenders, Small Investors: Blacks Have Little to Show for Hard-Earned Dollars”:

- African Americans consistently outpace the total market population in overall growth, smart phone ownership, television viewing and annual shopping trips according to the new study, “Resilient, Receptive and Relevant: The African-American Consumer 2013 Report,” a collaborative effort by the Nielsen Company in New York and the National Newspaper Publishers Association (NNPA), located in Northwest Washington, D.C.

- Black buying power continues to increase, rising from its current $1.1 trillion level to a forecasted $1.3 trillion by 2017.

- Despite the strong economic outlook, Blacks continue to spend most of their money outside of the Black community and, according to Nielsen and NNPA, advertisers have repeatedly slighted the black media, spending only three percent, or $2.24 billion, of the $75 billion spent with all media last year.

- Each year, Blacks spend more than $47 billion on Lincoln automobiles, $3.7 billion on alcohol, $2.5 billion on Toyotas, $2 billion on athletic shoes, and $600 million each year on McDonald’s and other fast foods, according to Target Market News Inc., a Chicago-based marketing research group.